Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

Europe Passes World’s First Law Regulating AI

📰Newsflash

📈Buyside

Major asset managers and investment banks partake in landmark blockchain pilot

A landmark blockchain pilot for tokenised real-world assets involving 45 major organisations took place this week, using blockchain developer Digital Asset’s network infrastructure. The pilot included the successful execution of over 350 simulated transactions, proving how a network of interoperable applications can connect to enable secure, atomic tokenised securities transactions across the capital markets value chain. The pilot brought together firms from across the capital markets industry, including 15 asset managers, 13 banks, four custodians, three exchanges and could bring the industry closer to using tokenised securities at scale. Institutions with blockchain applications in production include Goldman Sachs, BNP Paribas and DTCC.

New research from EFAMA has found that roughly 40% of daily FX flows – representing between $50-70 billion - will no longer be able to settle through the Continuous Linked Settlement (CLS) platform. CLS handles roughly one million daily institutional FX transactions worth over $6.5 trillion. Following the transition to a T+1 trade settlement period in the US, effective in May 2024, more than a third of European asset managers will have to settle trades outside of CLS, which has a cut off time of 6pm Standard Eastern Time (EST). With firms trading up until market close of 4pm EST and having to settle these trades on trade date, there will be little to no time for firms to settle trades via CLS. This could lead to increase in operational and settlement risk. EFAMA suggested that regulators should take mitigating measures including requiring the extension of the official CLS cut-off time.

📉Sellside

JPMorgan plans major roll out of biometric payments

JPMorgan Chase is planning a roll out of biometric payments with US retailers by early next year, enabling shoppers to make purchases by scanning their palms or faces. Last year, JP Morgan signalled its intention to bring the technology to its merchant client base, partnering with biometrics specialist PopID to conduct a series of pilots. JP Morgan has stated that adoption will mainly be down to its merchants and that the perceived sense of caution toward biometric payments is overstated. Global biometric payments are expected to reach $5.8 trillion and three billion users by 2026.

Deutsche Bank joins Saphyre’s onboarding platform

Deutsche Bank has signed up to Saphyre’s platform for custody, broker trading, and buy-side accounts. Saphyre’s automated intelligence solution handles onboarding and maintenance of custody, broker trading, and buy-side accounts for financial firms, while synchronising data between each functionality in real-time. Its technology digitises all pre-trade data and activities across multiple counterparties, with its platform also maintaining memory of data and documents, resulting in an efficient trade settlement process. Deutsche Bank joins a growing list of sell-side firms using Saphyre’s services, including Citi, Northern Trust and Standard Chartered.

✴️Digital transformation

Only 6% of banks invested in generative AI

According to research from Cornerstone, only 6% of banks are currently invested in generative AI. In addition, more than one quarter of banks have stated that adoption of generative AI technologies is not currently on their radar, suggesting that their uptake of generative AI may be slower than expected. Right now, it seems banks have bigger fish to fry than generative AI deployment. The banking sector currently finds itself grappling with a strained macro economic environment, underpinned by rising costs and stubborn inflation, especially in the US, leading to significant reductions in headcounts and technology spend.

Institutional players back digital asset clearing house ClearToken

ClearToken, a London-based clearing house for global digital assets, has secured a $10 million funding round, receiving support from key financial institutions such as Nomura. ClearToken is seeking to become the industry’s first digital asset clearing house. ClearToken intends to be fully regulated in the UK and has initiated the process of obtaining clearing house recognition from the Bank of England, with the intention of launching CCP services within the next 12-18 months. ClearToken's infrastructure will aim to reduce counterparty risk for settlement, financing, and derivative transactions by centralising clearing and collateral for digital asset transactions.

📱Technology trends

FlexTrade Integrates with Coinbase Prime for Enhanced Digital Asset Trading

FlexTrade Systems, the multi-asset execution and order management systems provider, has announced its integration with Coinbase Prime, a prime broker platform for digital and crypto assets. The collaboration will allow FlexTrade’s clients to access a significant liquidity pool for digital assets through its FlexTRADER EMS and FlexONE OEMS. The move is part of FlexTrade’s ongoing efforts to expand its digital asset trading capabilities, providing institutional-grade trading, compliance, and analytics across the digital asset and cryptocurrency markets.

Broadridge launches new futures and options trading platform

Broadridge has launched a new global futures and options software-as-a-service (SaaS) platform, expanding its existing derivatives trading capabilities. The platform delivers new functionalities for global institutions operating in the futures and options markets, offering a distributed architecture that enables operations from any jurisdiction. Ray Tierney, president of Broadridge Trading and Connectivity Solutions, noted:

We strongly believe this fully hosted solution is a significant step change in order and execution management for the derivatives markets, helping firms simplify and optimise trading.

🧑⚖️Regulatory developments

Europe Passes World’s First Law Regulating AI

The European Union has made history this week, passing the world’s first comprehensive law regulating artificial intelligence. The EU AI Act is expected to officially become law by May or June 2024, pending formal approval from EU member countries. The complete set of regulations is expected to be in force by mid-2026, with rules for general-purpose AI systems like ChatGPT applying a year after the law takes effect. In particular, the legislation will seek to ban AI systems that carry “unacceptable risk,” including using biometric data to detect a person’s ethnicity. General purpose AI systems will have to draw up a policy showing that the content used for training their models respects European copyright law. Financial firms will broadly fall out of scope from high-risk AI models, which you can learn more about here.

Fed fines JPMorgan $98.2 million for failing to monitor market misconduct

This week, the US Federal Reserve issued JPMorgan Chase with roughly $350 million in fines and civil penalties for gaps in its trading venue coverage and inadequate data controls implemented across its trade surveillance platforms. Specifically, JP Morgan was found to have failed to surveil “billions of instances of trading activity” across roughly 30 trading venues globally. The enforcement action requires JP Morgan to review and take corrective action to address the firm’s “inadequate monitoring practices.”

📊Chart of the week

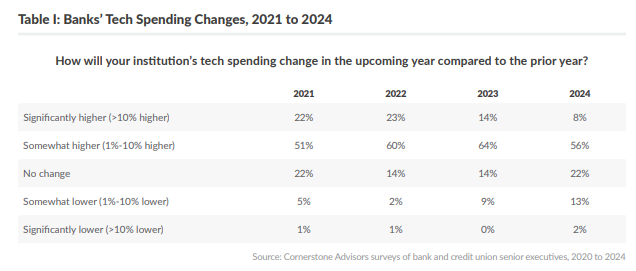

According to a survey of 359 respondents from global banking institutions in the $250 million to $50 billion asset range, most banks are bracing for cuts in technology spending in 2024, as the banking industry continues to grapple with inflation, declining bank fees and systemic shocks. 15% of banks are set to reduce technology spend in some way in 2024, nearly double the figure for 2023.

The reductions in technology spend could have significant ramifications on several fronts. It could mean that the uptake of new technologies such as generative AI is slower than first expected, as stated in our 13 March, 2024 post. Banks may also have to become more selective in their technology spending and explore ways in which to maximise efficiency from existing inputs.

Additionally, the reduced technology spending could lead to less demand for vendors’ technology products, squeezing vendor margins and creating a more competitive vendor environment. Renegotiations of vendor contracts may also become more commonplace in order to reduce costs, potentially putting strain on vendor relationships.

🐤Tweet of the week

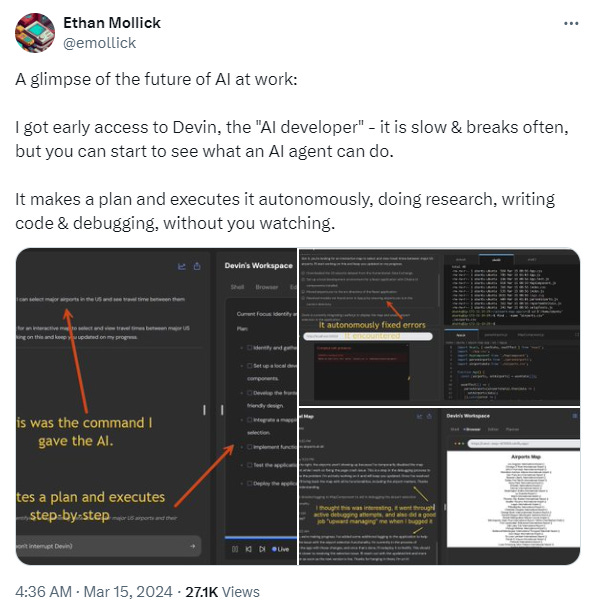

US-based startup Cognition has launched Devin AI, an artificial intelligence software, which alters the way code is debugged, written and deployed. Devin AI is a first of its kind and has the ability to take a simple command and turn it into a functioning website or software programme. It is essentially an entirely automated software engineer.

Devin AI does not just complete and suggest code, it can also manage the whole process of creating and releasing whole software applications, which large language models (LLMs) like Google's Gemini or OpenAI's ChatGPT are unable to do.

Devin works autonomously with its own code editor, command line and browser. It systematically puts software into practice by segmenting work into manageable steps and can plan and execute complex engineering projects that would normally involve thousands of human decisions. Watch this space.

📄GreySpark insight

🕰️

The clock is ticking towards the DORA enforcement deadline of 17 January 2025. Financial institutions in the EU should be actively preparing for the new regulations, which demand forensic monitoring of the resilience of their business systems and the implementation of stringent scenario testing frameworks. Digital resilience and operational risk are at the forefront of these preparations. However, new evidence suggests that several EU financial firms are lagging behind in readiness for the enforcement deadline. This lack of preparedness could lead to significant reputational and financial consequences.

GreySpark Partners has observed ambiguities in the DORA regulations and an absence of ‘best practice’ guidelines for firms implementing a digital operational resiliency testing framework. DORA does not provide guidance on how much firms should aim to spend on cybersecurity, and there is a lack of clarity on the methods that firms should employ to adequately mitigate potential threats. Consequently, many firms are unsure of what a ‘good’ operational resiliency framework looks like, leaving them at risk of not achieving full DORA compliance ahead of the 2025 deadline.

Discover more here.