Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

Top story

Bank regulators warn over operational resilience challenges

Newsflash

Buyside

FXPA warns of unintended FX settlement risks of T+1 and publishes guidance for buyside

The Foreign Exchange Professionals Association (FXPA) has warned of trade settlement risks for buyside firms in the transition to T+1 security trade settlement, which becomes effective in the US next year. Specifically, the FXPA has called for buyside firms to consider several aspects that could be impacted, such as trading relationships, credit, operational processes, funding, and settlement. The report from the FXPA, titled ‘Buy Side Guidance in Preparation for T+1 Settlement’ provides a framework of recommendations, and can be accessed here.

Strong interest in tokenisation among European asset owners, Funds Europe/Caceis research finds

More European asset owners are waking up to the benefits of tokenisation, a study by Funds Europe in partnership with asset servicing group Caceis has found, although some uncertainty around custody of assets remains. Just under half of European asset owners (42.3%) have a strategy to incorporate or utilise digital assets and tokenisation within their portfolios. The study found UK asset owners were the most prepared, with 56% having a tokenisation and digital assets strategy in place, followed by 53% of German and 40.5% of Dutch institutional investors. However, only one third of assets managers have spoken with custodians with regard to how they plan to incorporate the assets into their portfolios.

Sellside

Bank regulators warn over operational resilience challenges

Banks across the EU are failing to adequately meet guiding Principles on operational resilience and risk laid down by the Basel Committee in 2021. A regulatory assessment conducted earlier this year, which monitored banks' ability to withstand operational risk-related events that could cause significant operational failures or wide-scale disruptions in financial markets, found that the effectiveness and maturity of the measures across some banks are not up to the required standard. Given the 2025 deadline for the EU’s Digital Operational Resilience Act (DORA), struggling in-scope firms will need to come up with a solution if they are to maintain compliance. As stated, GreySpark will reveal how banks can do this in the coming days.

JPMorgan plans to expand Abu Dhabi presence

J.P. Morgan is planning to expand its United Arab Emirates (UAE) presence by offering deposit taking and payment processing to wholesale banking clients from the Abu Dhabi Global Market (ADGM) for the first time. The Financial Services Regulatory Authority (FSRA) has granted approval to J.P. Morgan Middle East in the ADGM to upgrade its licence to category one, allowing the firm to offer a wider breadth of services, covering payments and corporate Banking businesses, which is an extension on its current service offerings of corporate banking and securities/treasury services. This move from JP Morgan highlights the growing attractiveness of the MENA region to financial firms as they seek to realise its growth potential.

Digital transformation

South Korea preps 100,000 person-strong CBDC pilot

South Korea will start a pilot for a central bank digital currency (CBDC) involving 100,000 citizens in the fourth quarter of next year. The pilot program will be operated jointly by the Bank of Korea (BOK) and financial regulators the Financial Services Commission (FSC) and Financial Supervisory Service (FSS). The project will see 100,000 people – roughly 0.2% of the country's population – be able to purchase goods with tokens issued by commercial banks in the form of a CBDC. Use will be restricted to purchasing goods, with other applications, such as remittances, not permitted. Currently, several central banks across the world are in the process of rolling out CBDC projects, as they seek to digitise payments and leverage the benefits of distributed ledger technology. You can be reminded of our analysis on CBDCs here.

Stock trading app Robinhood to launch in UK

Online investment app Robinhood is set to launch its platform in the UK in early 2024. Features include the ability to choose from 6,000 U.S. stocks and 24-hour trading five days a week. Robinhood won’t offer U.K. stocks to begin with but will look to add them as it brings more products into the platform. Robinhood UK will not include derivates and options. Robinhood has obtained a licence with the Financial Conduct Authority (FCA).

Technology trends

Nasdaq unveils tech to scale global carbon markets

Exchange operator Nasdaq has launched technology that securely digitises the issuance, settlement, and custody of carbon credits. Carbon credits are permits that allow the owner to emit a certain amount of carbon dioxide and other greenhouse gases. Despite being a relatively young market, the carbon credit operating model is largely comprised of bilateral trading and is heavily reliant on manual interaction, providing limited ability to scale as the market develops. Nasdaq is aiming to allow market operators and registries to create standardised digital credits through the use of smart contract technology and distribute them with full auditability throughout the transaction lifecycle.

Majority of UK banks already piloting GenAI

Nearly three quarters of UK financial services firms are now piloting the use of generative AI for employee efficiency tools, according to a UK Finance survey. Respondents to the survey, which questioned 23 companies ranging from international to mid-size banks and non-banking FS firms stated that they do not expect to see a return on their investment for more advanced use cases for between three and five years, and identify the largest opportunities with generative AI in productivity improvement and operational effectiveness rather than customer-facing, revenue-related, use cases.

Regulatory developments

FCA sets out greenwashing rules

The Financial Conduct Authority (FCA) has moved to clamp down on greenwashing by putting in place sustainability disclosure requirements and an investment labels standard. The FCA first outlined plans for a package of measures to improve the trust and transparency of sustainable investment products and minimise greenwashing last year. Now, after receiving industry feedback, it has confirmed that the rules will come into effect next year. From the end of May 2024, an anti-greenwashing rule for all authorised firms will make sure sustainability-related claims are fair, clear and not misleading, giving transparency to investors on whether funds meet their investment needs.

US will be forced to curtail crypto if industry fails to act on illicit finance threats- official

This week, Deputy Treasury Secretary Wally Adeyemo warned that the US government could cut off cryptocurrency companies from the broader U.S. economy if they fail to block and report illicit money flows. Speaking at an event hosted by the Blockchain Association, Adeyemo stated that crypto companies need to do more to ‘curtail the flow of illicit finance’, and that the lack of action across the sector presents a risk to the U.S. This comes off the back of Binance chief Changpeng Zhao pleading guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement, and stepping down as CEO of the world's largest crypto exchange.

Chart of the week

China offers one of the biggest opportunities for wealth managers in the world today. It is home to between 6-7 million high net worth individuals with total wealth above USD $1 million, and 70,000 ultra high net worth individuals with total wealth above USD $30 million.

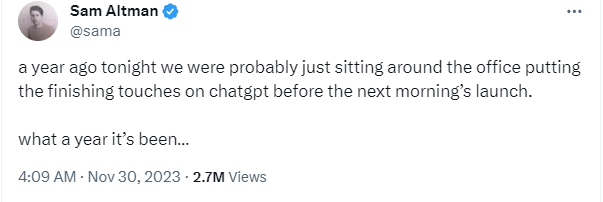

Tweet of the week

One year ago today, the world changed forever…

GreySpark insight

Not too much to say this week, other than it’s beginning to look a lot like Christmas in the GreySpark London office!