Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

As highlighted in our recent ‘ESG regulatory rundown’ article, the ESG regulatory landscape is constantly evolving and advancing to help create a more sustainable world. This is especially evident among global capital markets, with different jurisdictions enforcing their own iterations of ESG regulatory standards.

The EU has arguably the most comprehensive set of capital market ESG regulations in the world, and hence, is one of the main focus areas for GreySpark when it comes to observing ESG regulatory developments across capital markets. As a reminder, three of the most important ESG regulations currently facing financial firms in the EU are the EU Taxonomy, the Corporate Sustainability Reporting Directive (CSRD), and the Sustainable Finance Disclosure Regulation (SFDR), with these policies supporting the wider European Green Deal.

GreySpark observes that there are still some challenges and pain points facing financial firms in their adaptation to new ESG regulations, with uncertainties about how to incorporate the new standards into their business practices and remain compliant. Over the coming weeks, GreySpark will assess these pain points in close detail, while also providing overviews of specific ESG regulations in capital markets.

What better place to start, than with SFDR. Bear with us, it’s going to get a little granular!

The SFDR implementation period effectively ended in June 2023, with its main goal to increase transparency among financial firms, and prevent wrongdoing such as greenwashing.

SFDR requires relevant ‘Financial Markets Participants’ (FMPs) to disclose how they have considered and included ESG factors into their investment decision making processes, when creating financial products. In this instance, FMPs refer to the manufacturers and providers of UCITS funds, Alternative Investment Funds (AIFs) and Portfolio Management Services. The disclosures will be made against these specific financial products where they are mentioned: most notably on websites, in prospectuses, and in periodic reports (i.e quarterly and annual reports). FMPs are also obligated to report on their wider firm-level sustainability practices.

FMPs with less than 500 employees are not obligated to comply with SFDR (if they explain their reasoning in writing). What’s more, as World Favor points out, although SFDR is inherently an EU regulation, funds outside of Europe that are marketed in Europe also fall under the disclosure requirements.

Two significant designations that have materialised from SFDR are Article 6, 8 and 9 funds, and Principal Adverse Impact Indicators (PAIs).

SFDR requires financial market participants to classify their investment funds as Article 6, 8 or 9 to investors. The classifications give an indication of the degree of sustainability of a fund;

Article 6 Funds are those that are without a sustainability scope. Financial firms must disclose the extent to which sustainability risks have been integrated into their investment decision making processes, although ‘none at all’ is a legitimate answer. Article 6 Funds are not considered ESG funds.

Article 8 Funds are those which promote environmental or social characteristics, or a combination of both, provided that the companies in which the investments are made follow good governance practices. These funds are also known as ‘light green’ funds, as they are ESG funds, however they are not funds which are dedicated to the further development of ESG.

Article 9 Funds are those for which sustainability is an objective rather than a characteristic. These are nicknamed ‘dark green’ funds, because ESG is more of a core principle for them, in comparison to Article 8 Funds.

Investments promoted as ESG, however, are required to classify as being either an Article 8 or 9 fund, depending on which classification requirements their financial products meet.

In addition, FMPs must report on their Principal Adverse Impacts (PAI) on both a firm- and a product level (SFDR has two levels of disclosure). The PAIs consists of a list of sustainability ‘indicators’— which have to be taken into account in the businesses' investment policies and decisions.

Whereas most ESG disclosures are focussed on the positive aspects of an investment with defined goals, PAIs take more of a glass half-empty approach, and are focussed on specific ESG ‘negatives’. The PAI itself would be recorded as the proportion of the investment product which is involved in the terms of that ‘ESG negative’, i.e., ‘What proportion of the fund’s AUM is invested in companies involved in the manufacture of controversial weapons’.

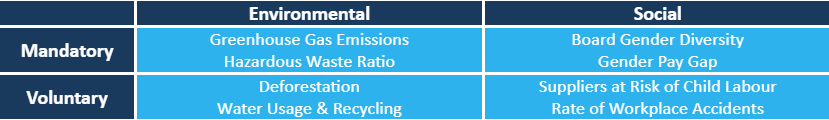

There are 14 mandatory PAIs (eight environmental and six social), which must be reported on, as well as a larger set of voluntary indicators that only apply to certain investment types i.e., in sovereigns and supranationals, or real estate assets, or in investee companies. Examples are listed below:

Source: GreySpark analysis

Specifically, FinDatEx supports the development and use of standardised templates. In the case of SFDR (among other regulations) the ‘European ESG template’ provided by FinDatEx provides a list of data requirements and metrics that each financial firm can consider under each PAI. Use of the template is not compulsory but it is used by a range of commercially significant firms— for an example of how it is used, under ‘Greenhouse Gas emissions’ one of the metrics is ‘greenhouse gas intensity of investee companies.’ The FinDatEx template can be accessed here.

Now, more than ever, it is vital for financial firms to stay aligned to ESG regulatory standards, as ESG compliance begins to take up a larger part of business operations. Failing to do so could have significant financial and reputational consequences going forward.

If you have any questions regarding SFDR, or how it may impact you, please reach out to us here.