Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

Fintech retakes top spot for UK startup investment

📰Newsflash

📈Buyside

Hedge funds told to strengthen liquidity preparedness for margin and collateral calls

The Financial Stability Board (FSB) has released a consultation report highlighting the need for policy adjustments to address liquidity pressures in the non-bank financial intermediaries (NBFI) sector - which includes hedge funds - during periods of heightened margin and collateral calls and market stress. The FSB has outlined eight policy recommendations aimed at strengthening liquidity ‘preparedness’ of non-bank market participants due to their significant exposure to margin and collateral calls. Collectively, these recommendations focus on enhancing liquidity risk management practices and governance, liquidity stress testing and collateral management practices. The FSB is now seeking feedback on the consultation report and the outlined recommendations, with submissions welcome until 18 June, 2024.

Asset managers most bullish in over two years, says BofA survey

A survey from Bank of America has revealed that investor sentiment, globally, from asset managers is at its highest level in two years. The survey found a record allocation to commodities, with equity allocations at a 27-month high. Cash holdings from asset managers fell from 4.4 per cent in March 2024 to 4.2 per cent in April 2024. Across the period, holdings in bonds fell by 20 percentage points, the highest monthly decrease since July 2023. Collectively, this points to a growing ‘risk-on’ sentiment among asset managers.

📉Sellside

BoE forecasting held back by out-of-date technology

The Bank of England (BoE) has been heavily criticised by a former chairman of the US Federal Reserve for relying on outdated technology for its economic forecasts. An independent review found “material under-investment” in forecasting tools, the proliferation of “makeshift fixes”, and “complicated and unwieldy” systems. The BoE is currently piloting the use of artificial intelligence for specialist use cases across several parts of the business, and is also developing a cloud-based data and analytics platform.

Investment Banks Cut Asia Jobs Amid Deal Slump

Several investment banks across the Asia-Pacific region are cutting job roles following a slump in dealmaking and weak investor sentiment. Morgan Stanley is cutting 13 per cent of its investment banking team in APAC, with HSBC cutting 30 investment banking positions in APAC. In addition, according to market data, Hong Kong’s stock exchange only saw 12 companies raise HK$4.7 billion ($600 million) in the first quarter of 2024, marking a 30 percent year-on-year drop and a 15-year low.

✴️Digital transformation

Germany’s largest federal bank to offer crypto custody services

Germany’s largest federal bank, the Landesbank Baden-Württemberg, will start offering cryptocurrency custody solutions in the second half of 2024. The bank will start offering crypto custody services to institutional clients in partnership with the Austria-based Bitpanda cryptocurrency exchange. The Landesbank Baden-Württemberg will use Bitpanda’s institutional custody solution for its offering. Bitpanda Custody is a crypto custody platform with decentralised finance capabilities, registered with the United Kingdom’s Financial Conduct Authority. The partnership will be enable the bank to tap into Bitpanda's digital asset platform, custody services and relevant licenses.

oneZero integrates New Change FX benchmark data feeds into its analytics suite

Trading technology provider oneZero has partnered with New Change FX to integrate its benchmark data feeds in a bid to boost its client trading performance. New Change FX’s feeds will be incorporated into oneZero’s suite of data analytics, adding a new stream of independent FX reference data. Clients will have the option to enhance trading performance by using the New Change FX reference data in their reporting. Last December, oneZero added Cboe FX and State Street to its network of liquidity providers and venues. As part of the move, the two firms were granted access to more than 200 FX brokerages in the oneZero network.

📱Technology trends

Nasdaq unveils new Swedish small cap index future offering

Nasdaq has launched futures on the OMX Sweden Small Cap 30 ESG Responsible Index, as it seeks to enhance its product offering in the Nordic region. The solution is aimed at asset managers, retail investors and Exchange-Traded Product issuers. According to Nasdaq, it will make it possible for investors to gain exposure in the Swedish small cap market and simplify investment strategies through consolidating a diversified portfolio of small cap stocks into a single instrument. At the same time, the screening criteria allows investors to make decisions which are aligned with ESG outcomes.

Fintech retakes top spot for UK startup investment

The UK’s fintech sector is once again the UK’s highest-funded startup sector, after climate technology secured the most funding in 2023. In the first quarter of 2024, UK fintech companies raised $1.4bn across 73 rounds, with Monzo’s cash raise of £340 million the most notable development. Fintech has historically been one of the UK’s leading technology sectors. However, last year climate tech startups accounted for nearly a third of all investment raised. The increased fintech startup activity is a positive sign for the UK’s wider fintech industry, with UK fintech investment declining 34 per cent in 2023 in comparison to 2022.

🧑⚖️Regulatory developments

European taskforce calls for T+1 alignment

A group representing buy and sell-side firms and market infrastructure providers across Europe has called on the UK, Switzerland and the EU to coordinate plans to shorten the settlement cycle for securities trades. In a statement, the taskforce welcomed the UK’s plan, which stated that if the EU commits to T+1 in a timeline that aligned with its own, then simultaneous adoption could be considered. The alignment of dates will reduce the complexity of implementation projects for firms active across multiple jurisdictions, and minimise scoping issues related to instruments listed, traded and settled across Europe. Collectively, this should help to improve trade efficiency and make for a smoother, interoperable trading environment.

Finastra launches small business data collection module for DFA 1071 compliance

Financial software provider Finastra has announced the launch of its Small Business Data Collection module, which enables banks to easily comply with the Equal Credit Opportunity Act (ECOA) small business data collection requirements, mandated by the Dodd-Frank Act. Specifically, the solution streamlines data collection, validation, storage, report generation, and the annual filing process, saving financial institutions time and effort while ensuring accuracy and regulatory compliance. The solution is a cloud-native solution that integrates seamlessly with Finastra’s suite of retail lending products, including LaserPro, CreditQuest, DecisionPro, and Originate.

📊Chart of the week

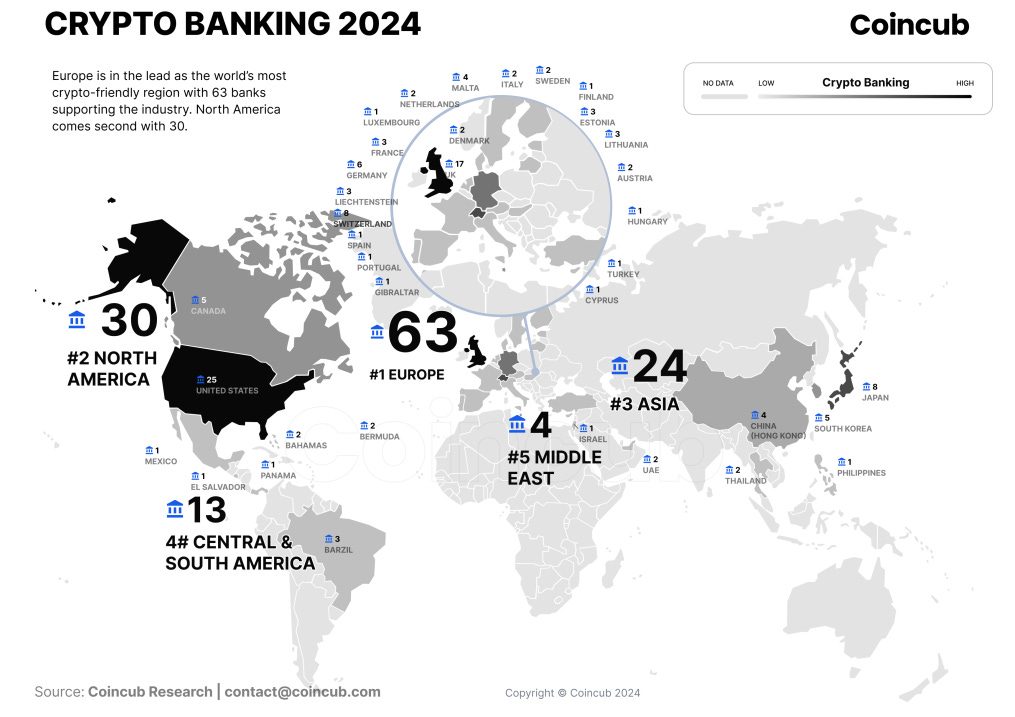

The map above shows the geography of crypto banking in 2024. Crypto banking is defined collectively as the specialist provision of banking services for cryptoassets and the integration of cryptoasset offerings in traditional banking services. Banks’ offerings include enabling fiat-to-crypto conversions, seamless integration with cryptocurrency exchanges, and linking traditional accounts with crypto wallets. Fintech firms’ specialist cryptoasset offerings typically include custodial wallets and payment and transaction solutions using cryptoassets.

The number of banks or financial firms providing cryptoasset banking services is rapidly increasing, led by Europe with 64 banks, followed by North America with 30 banks, Asia with 24 banks, and South and Central America with 13 banks. The EU’s Market in Crypto-assets regulations, the world’s first comprehensive crypto regulatory framework, is allowing the EU to harbour a cohesive, harmonised crypto environment while instilling trust and confidence toward crypto as an asset class. As such, it is not surprising to see the EU emerging as a hub for crypto banking, with financial institutions feeling compelled to undertake operations here against a backdrop of regulatory stability.

One may have though that the US, one of the largest capital markets in the world, would be front-running the cryptoasset banking space. However, the US is still facing regulatory huddles in this regard. As well as having a fragmented regulatory landscape, with cryptoassets being regulated across several different regulatory bodies such as the Securities and Exchange Commission and The Commodity Futures Trading Commission, the SEC prohibits US banks to provide cryptoasset custody. However, lawmakers among the US senate are now seeking to reverse this rule, with discussions currently ongoing. A removal of this rule could help the US compete more closely with Europe’s crypto banking environment.

🐤Tweet of the week

Source: ‘X’

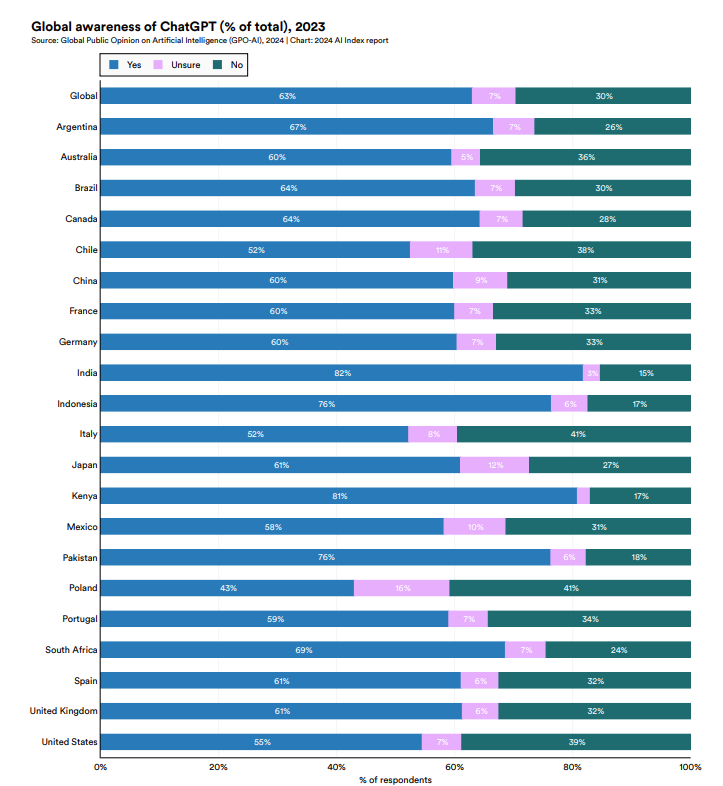

The tweet above from David Jimenez Maireles provides an insightful report about the state of artificial intelligence in 2024. As well as highlighting the high number of AI patents originating from the Asia-Pacific region, which is largely thanks to China’s rapid technological progression in the space, the report also shows global awareness of OpenAI’s ChatGPT model, one of the world’s leading generative AI models. Among global respondents, 63% claim awareness of ChatGPT. Countries with the highest awareness rates include India (82%), Kenya (81%), Indonesia (76%), and Pakistan (76%). Poland reported the lowest awareness, at 43%. You can view our report on the use of generative AI technologies in the capital markets industry here.

📄GreySpark insight

Application of Generative AI in Investment Banks

Generative AI has the potential to revolutionise investment banking specifically, but there are also more generic advantages that could benefit banking as much as they do other sectors. For instance, Generative AI can help banks to:

Reduce costs: Generative AI can be used to automate a wide range of tasks and activities currently performed by humans, and this can lead to efficiency gains and cost savings, giving humans the capacity to spend more time on tasks that create more value. For example, AI-powered chatbots can manage simple customer inquiries and provide support quickly and efficiently, leaving the human staff free to work on the more complex cases. Additionally, AI systems can be used to identify inefficiencies and streamline processes.

Improve efficiency: Processing large amounts of data quickly and accurately, Generative AI can better support human decision making. There is far less criticism of this use case than some, as most people would agree that identifying patterns and anomalies in data is something that technology can do far more quickly and accurately than humans.

Provide new insights and opportunities: A less well explored use case, Generative AI models can be used to create synthetic data to train machine learning algorithms. These models can quickly and efficiently identify patterns and increase the reliability of market trend predictions.

Discover more here.