Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

EMIR REFIT technical modifications on the horizon

📰Newsflash

📈Buyside

EMIR REFIT technical modifications on the horizon

On 29 April 2024, key technical modifications are coming to the EMIR REFIT regulation, which will require any UK or EU entities that partake in derivatives transactions to ensure compliance. Specifically, EMIR REFIT targets the reporting of derivatives transactions. The new standards will provide increased technical challenges and complexities in derivatives reporting. For example, the number of reportable fields in derivatives transaction reporting will increase from 129 to 203, requiring greater details about each transaction, such as the clearing threshold of a counterparty within a specific trade. This may call for a shift in trading strategies as market participants become accustomed to the new regulations. At the same time, the modifications will have a much broader scope than the original EMIR mandate, with implementation across the derivatives trading market covering both OTC and listed derivatives.

FCA unveils flexible research payment proposals for asset managers

The FCA has laid out plans to give UK asset managers greater freedom in how they purchase investment research, with the intention to promote competition and facilitate cross-border access to research. Gaining access to quality research is currently operationally complex for some asset managers, typically favouring larger asset managers with larger research networks. The current rules also restrict asset managers’ ability to buy investment research produced outside the UK. Now, the FCA has proposed giving asset managers greater freedom in how they pay for research, supporting their investment decisions. This greater choice should suit firms of varying business models and sizes, helping to promote competition. Specifically, the rules will allow the ‘bundling’ of payments for third-party research and trade execution and would exist alongside current research processes. The FCA hopes to implement final rules in the first half of 2024.

📉Sellside

Cyber attacks cost financial firms $12bn says IMF

According to a report by the International Monetary Fund (IMF), financial services firms have been hit with $12 billion in losses over the last two decades as a result of cyber-attacks. In addition, the number of incidents has more than doubled since the pandemic, while the scale of extreme losses has more than quadrupled since 2017 to $2.5bn. Cyber-attacks on financial services firms account for a fifth of the global total, with banks being the most exposed. JP Morgan revealed it suffers many as 45 billion cyber threats per day and is spending $15bn a year on technology to reduce the threat of cyber-attacks. As a result, the IMF is calling for more cross-border cooperation to manage the risks posed by cyber-attacks.

Citadel moves data and algorithm testing to the cloud

Market-maker Citadel Securities has moved the testing of algorithms that power millions of trades per day into the cloud in order to cope with large quantities of financial market data. Specifically, Citadel is utilising Google Cloud and will transfer storage of trading data from its own servers into Google Cloud. The move should help Citadel process droves of financial market data more quickly. Citadel was involved in roughly 25 per cent of US equities trades last year.

✴️Digital transformation

Hong Kong set to approve first crypto ETF

Hong Kong’s financial regulator is set to approve its first spot Bitcoin exchange-traded funds (ETFs). The move would make Hong Kong the first jurisdiction in the Asia-Pacific region to approve a crypto-backed ETF. According to a Reuters report, the Securities and Futures Commission (SFC) is set to grant approval later this month. So far there have been four applications from entities based in mainland China, including Harvest Fund Management, China Asset Management and Bosera Asset Management. The SFC has already granted approval to Harvest and CAM to provide virtual-asset related fund management services. By giving the go-ahead to the crypto ETF applications, Hong Kong would be following in the footsteps of the US, which granted approval for the first spot Bitcoin ETF in January 2024.

Tradeweb to Buy Money-Market Fund Portal ICD for $785 Million

Tradeweb Markets has reached an agreement to buy institutional investment technology provider Institutional Cash Distributors as it seeks growth beyond core business practices. Tradeweb will pay $785 million in its biggest acquisition yet. The deal will give Tradeweb access to one of the largest US institutional money-market fund portals that works with roughly 500 corporate treasury organisations.

📱Technology trends

Crypto trading concentration a 'considerable concern', EU watchdog says

A high concentration in crypto trading across a handful of exchanges is raising concerns from EU regulators about the impact of a system failure on the sector. Crypto exchange Binance accounts for roughly half of crypto market trading volumes. In fact, just 10 crypto exchanges process 90% of trading volumes. Of course, the European Union is rolling out the world’s first comprehensive set of crypto regulations, with the Markets-in-Crypto-Assets regulation becoming applicable from December 2024. Ahead of this, the European Securities and Markets Authority (ESMA) is conducting research into current crypto trends to help in-scope firms prepare for the new measures. ESMA is planning to discuss its findings in greater detail during a webinar on April 25, 2024.

UK fintech Gresham Technologies to be acquired by STG Partners for £147m

UK fintech Gresham Technologies is set to be acquired by Alliance Bidco, a limited company indirectly owned by US-based private equity firm STG Partners, in a deal worth £146.7 million. The two firms have agreed on a deal that includes a cash offer and a permitted dividend that collectively aggregate to 163.75GBp per share, representing a premium of 26.9% on Monday’s closing price. The acquisition is expected to close by the third quarter of 2024, subject to the approval of the firm’s shareholders. Following the acquisition of Gresham, Bidco intends to merge the fintech with its other portfolio company Alveo, which it acquired in January 2023. Alveo is a cloud-based data management, analytics, and Data-as-a-Service provider for the financial services industry. The goal of the acquisition is to create a capital markets data management specialist that offers clients greater scale and a range of solutions, especially within post trade services.

🧑⚖️Regulatory developments

ESG: Australian regulator wins first greenwashing court case against Vanguard

A Federal Court in Australia has found Vanguard Investments Australia in breach of law due to misleading environmental, social, and governance (ESG) claims regarding its Vanguard Ethically Conscious Global Aggregate Bond Index Fund. According to reports, Vanguard violated the ASIC Act by disseminating false or misleading information about the ESG exclusionary screens of its bond index fund through various channels, including product disclosures, media releases and website statements. More than AU$1 billion is currently managed in the fund. The court has scheduled a hearing on 1 August 2024 to decide the penalty for Vanguard’s actions. Globally, regulators are starting to stamp down on greenwashing, with the introduction of standardised regulations for ESG ratings providers, who gauge the ESG credentials of a firm using rating systems. In fact, we covered this topic in closer detail earlier this week - find out more here.

ESAs to launch industry exercise ahead of next stage of DORA implementation

The European Supervisory Authorities (ESAs) will launch a voluntary exercise in May 2024 to help prepare the capital markets industry for the next stage of the Digital Operational Resilience Act (DORA) implementation. The exercise will help in-scope firms to collect registers of information of contractual arrangements on the use of ICT third-party service providers by financial entities, with the regulations applicable from 2025 and requiring firms to maintain information regarding their use of ICT third-party providers. Financial entities participating in the exercise will receive support from the ESAs to test the reporting process, address data quality issues, and improve internal processes.

📊Chart of the week

Source: GreySpark analysis

The term ‘ESG’ refers to a heightened consideration of non-financial factors in business, particularly environmental, social, and governance factors. It has become a key focus area for financial services firms in recent years amid tightening regulations, with the European Union, in particular, becoming the trailblazer for ESG regulation in the financial services industry. Broadly speaking, the concept emerged in the mid-00’s and became more mature towards the end of that decade. Over the last 10-15 years, the ESG mega-trend has emerged from being an ill-defined concept into a tide sweeping over capital markets. Over the past five years, the volume of ESG-labelled assets under management (AUM) has grown at a pace roughly four times that of the overall global AUM as the figure above shows.

The effect of this is that ESG-labelled AUM increased from 2021-2022, a period in which overall global AUM fell by more than 10%. This trend is unlikely to reverse, with fewer than 10% of asset managers not planning to integrate ESG into their investment processes and fewer than 5% of asset owners planning to do the same. If you would like to find out more about the current state of play in the capital markets ESG landscape, please check out our latest report here.

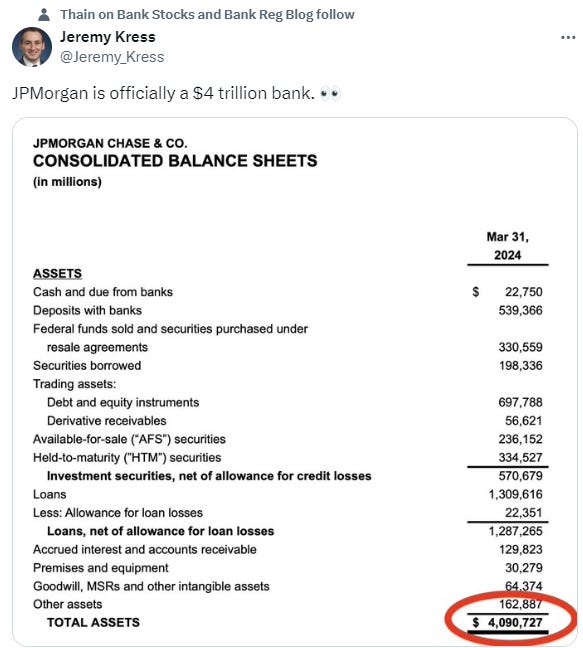

🐤Tweet of the week

JP Morgan has officially become a $4 trillion bank. This week, the investment bank announced profits of $13.42 billion for the three months ended 31 March, 2024, representing a six per cent increase on the same period in the previous year and a better return than analysts expected. The increase was mostly fuelled by an uptick in consumer banking profits with investment banking revenues largely remaining flat. In contrast, competitors Wells Fargo and Citigroup saw first quarter profits decline seven per cent and 27% respectively. In particular, Citigroup’s notable drop in profits can be attributed to higher expenses stemming from the bank’s ongoing restructuring plans.

📄GreySpark insight

The increasing digitalisation of capital markets has opened up new data channels, making it difficult for traditional analytics tools to extract actionable insights from the data and filter out the noise. As a result, firms may not provide the optimal data insights for their clients and fail to identify lucrative investment opportunities.

Looking at how AI-powered analytics can benefit sell-side firms:

AI-Powered Analytics: Advanced AI algorithms can analyse vast amounts of data, identifying patterns and trends that may not be apparent to human analysts. This can help sell-side firms make more informed investment decisions and improve their overall performance.

Real-Time Risk Monitoring: AI-powered risk management tools can analyse market data in real-time, identifying potential risks and enabling sell-side firms to take proactive measures to mitigate them.

Portfolio Optimisation: AI algorithms can optimise portfolios based on various factors such as risk tolerance, investment goals, and market conditions. This allows firms to create more effective investment strategies and achieve better returns for their clients.

Sentiment Analysis: Natural language processing (NLP) techniques can analyse news articles and social media posts to gauge market sentiment and predict future price movements.

Fraud Detection: AI can help detect fraudulent activities such as market manipulation, insider trading, and other illicit practices, protecting trading firms and their clients from financial losses.

Discover more here.