Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

Top story

BlackRock expands crypto strategy with Ethereum ETF application

Newsflash

Buyside

Hedge fund investors pull $80 billion from industry in 2023

The hedge fund industry experienced a net outflow of $80 billion in the year to 18 October 2023, with battered private credit assets becoming more favourable in comparison to other fundraising routes. However, according to family office investor Michael Oliver Weinberg, money flowing out of hedge funds is a sign of the industry reaching maturity. Weinberg stated:

“Future growth will likely come from private wealth offsetting negative growth from institutional investors. "Even then, for tax paying private wealth, hedge funds are typically less tax efficient than strategies such as private equity, so this is an inherent 'brake' on the growth in the industry.”

US lawmakers unveil bill requiring private equity firms to reveal China investment

This week, two US senators introduced a bipartisan deal that would require private equity firms to make public how much capital they invest in China and other countries of concern, providing greater transparency to investors. The US has sought to crack down on U.S. investment in China over fears U.S. dollars are aiding Beijing's technological advances to modernise its military. US private equity firms have injected more than $80 billion into China between 2018 and 2022.

Sellside

HSBC to roll out custody platform for tokenized securities

HSBC is further entrenching itself into the digital assets market, after it announced the launch of an institutional grade custody services. Set for go-live in 2024, the custody service will complement HSBC Orion, the bank’s platform for issuing digital assets, as well as a recently introduced offering for tokenized physical gold, which we referred to in last week’s update. The platform will utilise technology from Swiss crypto custody firm Metaco. HSBC reiterates that the custody platform will not harbour cryptocurrencies, but rather, tokenised securities issued on third party platforms, such tokenized bonds or tokenized structured products.

Bond-market crash leaves big banks with $650 billion of unrealized losses

Jitters of the Silicon Valley Bank collapse continue to reverberate around global capital markets, with data from Moody’s revealing that US banks are sitting on roughly $650 billion in unrealised losses on US Treasury bonds. Treasury bond yields have soared this year, recently spiking above 5% for the first time in 16 years. Due to the inverse relationships between bond prices and yields, the price of treasury bonds have subsequently been falling, raising concerns that investors will offload their investments and possibly create another market frenzy. The Bank of America has been one of the worst affected banks from the fall in bond prices, having disclosed a $130 billion ‘hole’ in its balance sheet last month.

Digital transformation

Bank of England analyst warns of bias in AI models

Bank of England analyst Kathleen Blake has warned that some AI models used in the capital market space may contain bias. Blake noted:

“This (AI) is often the result of biases embedded in training data but can also be a result of the structure of the underlying model. There is a risk of AI algorithms learning to copy patterns of discriminatory decision-making.”

AI bias is an anomaly in the output of machine learning algorithms, due to the prejudiced assumptions made during the algorithm development. In implementing AI, it’s essential that financial intermediaries adopt robust AI deployment strategies, in terms of data collection, monitoring and bias identification training.

According to a survey by Coalition Greenwich of 60 C-suite executives in the capital markets industry, nearly a third of respondents still use manual processes to cleanse data ‘half of the time.’ This is to achieve the most efficient straight-through processing rate, because they wouldn’t have to rely on third-party vendors. However, the figures are in some way concerning, especially with the switch to T+1 trade settlement in the US on the horizon. The new settlement cycle encourages more automated workflows as businesses have to grapple with more complex and agile data. Continued reliance on manual processes could therefore suggest that a significant portion of the capital markets space is not prepared for the transition to US T+1 trade settlement.

Technology trends

BlackRock expands crypto strategy with Ethereum ETF application

BlackRock CEO Larry Fink once referred to Bitcoin as an ‘index of money laundering.’ Several years on, it appears that he has changed his tune. In June 2023, BlackRock applied for permission from the SEC to launch a Bitcoin spot ETF. Now, BlackRock has turned it’s attention to the world’s second largest cryptocurrency by valuation; Ethereum. This week, in a filing via the NASDAQ exchange, BlackRock has revealed plans to create an ETF that hold’s Ethereum’s Ether token (ETH), called iShares Ethereum Trust. No crypto ETF has yet received formal approval from the SEC, although it’s anticipated that the SEC will give it’s first approval to the 12 pending crypto ETF applications in the coming months.

FCA and Bank of England publish proposals for regulating stablecoins

The Financial Conduct Authority (FCA) and the Bank of England have outlined plans to regulate stablecoins, asking for feedback from industry players and the general public. Stablecoins are a type of digital asset that are pegged to the value of a stable reserve asset (i.e. the US dollar) using algorithms, and are redeemable on a one-for-one basis. It is envisaged that stablecoins will be used in the retail payments landscape in future, because of their ability to make payments faster and cheaper through the use of blockchain technology.

Regulatory developments

UK set to unveil regulatory regime for ESG ratings industry

The UK government is planning to regulate agencies that evaluate the environmental, social and governance (ESG) performance of companies. In this sense, rating agencies are specialist companies that assess firms against these benchmarks for the interest of investors. However, there is currently a lot of ambiguity, opacity and disparity among ESG rating systems. As a result, the ESG ratings are at times subjective and arguably not a true reflection of an in-scope firm’s ESG credentials. As a result, UK regulators are pressing ahead in ‘regulating the raters’ with formal proposals set to be unveiled next year.

Morgan Stanley's wealth management arm under scrutiny by Federal Reserve

The US Federal Reserve is looking into Morgan Stanley’s wealth management arm, following concerns of deficiencies in the bank’s due diligence practices of new customers. Following a standard examination a ‘few years’ ago, regulators discovered that Morgan Stanley’s screening of foreign clients and their source of funds was inadequate, leading to pressure from the Fed to improve its controls and processes.

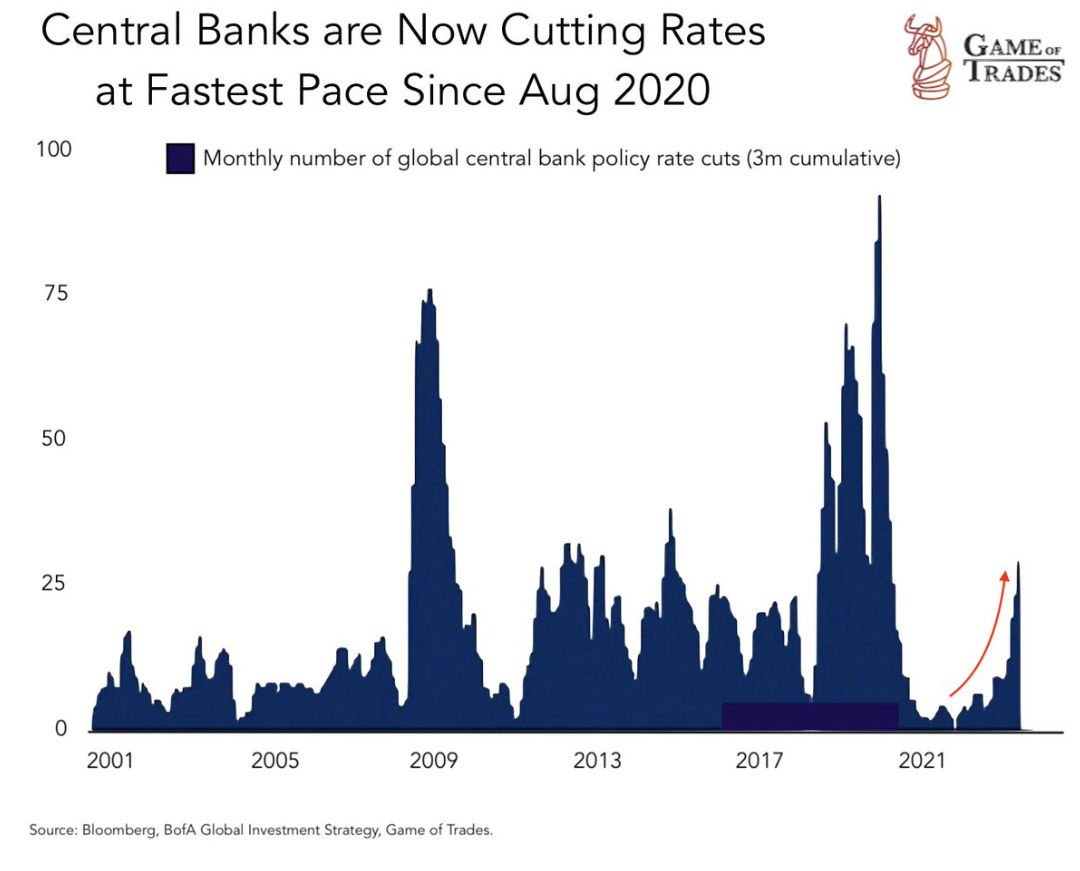

Chart of the week

Source: Bloomberg, via Game of Trades on ‘X’

Tweet of the week

GreySpark insight

Dilemmas facing transformation teams embarking on the digitalisation of risk management include:

How much of the risk management process to digitalise – Taking on a project to digitalise too much of the process may create much needed substantial change, but it comes not only with a greater risk of the project failing, but also with the risk that the resulting benefits may be small compared to the time and money spent.

Which solution to choose – Many vendors market governance, risk and compliance (GRC) products as a one-size-fits-all platform. However, the differences from business-to-business can mean that most firms that implement an out of the box solution without undertaking additional bespoke development must make significant compromises on the requirements for their digitalisation project.

Often, the most benefit can be realised by taking an iterative approach to digital transformation. A tight cycle of scope design, conceptual design, prototype, test and measure, is the basis of the most successful transformation projects.

Discover more here.

What has caught our eye?

European RegTech seed deals to break new record

This piece from RegTech analyst shows the remarkable growth in European RegTech activity, despite the current macroeconomic environment. European RegTech seed deal activity is on track to set a new record in 2023, reaching 38 deals. This is a healthy 46% increase on the figure from 2022. The UK was the most active RegTech country, with nine seed deals between Q1-Q3 2023.

Fintech Acquisitions: Vital Context for Board Members

This piece from Finxtech provides some food for thought over what banks should consider when acquiring a fintech company. Sure, healthy growth potential and a niche, innovative product are key drivers of a deal. However, a good product may not necessarily make the acquiree a match made in heaven for the acquirer. In particular, cultural clashes can hamper progress, with a lack of understanding, on the part of fintechs, of the practices needed to operate in a highly regulated industry also a key problem.

What should European Banks prioritise in their payments modernisation journeys?

European banks have a particularly challenging task ahead of them. Not only has the EU recently explored open banking and API enablement initiatives, its progress toward real-time and cross-border payments makes modernisation of legacy systems ever more complex. The European Payments Council’s (EPC) SEPA rulebook changes for 2023 present an especially difficult hurdle for banks to manage in the coming 12 months, as banks of all sizes prepare themselves for the migration to the ISO 20022 standard. This piece by Finextra looks at the current European banking landscape to consider how banks in the region are approaching their modernisation journeys in the current climate.