Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

Asset management industry ‘under pressure’ as costs rocket

📰Newsflash

📈Buyside

Asset management industry ‘under pressure’ as costs rocket

According to Boston Consulting Group (BCG), the global asset management industry is coming “under pressure” this year after costs increased at more than twenty times the rate of revenues last year. In a new report, BCG found that total assets under management in the industry increased by 12 per cent to nearly $120 trillion last year, however rising costs ate into companies’ margins. While the revenues rose by 0.2 per cent in 2023, costs rose by 4.3 per cent for the year, triggering an 8.1 per cent decline in profits. Weak investor inflows have weighed heavily on revenue growth, with investors opting to put cash into lower cost passive funds.

Private equity and venture capital investment into the UK has crashed since 2021

According to a report from the British Private Equity and Venture Capital Association (BVCA), private equity and venture capital investment into UK businesses fell by over 30 per cent to £20.1bn in 2023. In 2021, UK private equity investment hit a record high of £36.8bn, almost double the 2023 number, thanks in part to the huge monetary stimulus injected into the economy during the pandemic. However, higher rates and tighter monetary supply over the past two years has caused less investment to flow into the riskier opportunities that private equity and venture capital offer. Nevertheless, the UK remains by far the biggest home for private capital in Europe. In 2023, it raised £8.2bn—a larger total than France, Germany, Sweden, and Switzerland combined and over half the amount raised in the US.

📉Sellside

Citi Makes Strategic Investment in Cicada

Citi has made a strategic minority investment in Cicada Technologies. Cicada is a US-based fintech platform that has built an innovative electronic alternative trading system (ATS) that helps global institutional buyside and sellside market participants trade fixed income securities. The ATS is registered with the SEC and the broker-dealer activities of Cicada Securities LLC are regulated by FINRA. The investment was made by Citi’s Markets Strategic Investments unit, which is responsible for the sourcing and execution of strategic investments relevant to Citi’s Markets franchise. Citi will also act as a liquidity-provider for the trading platform.

US FS giants explore multi-asset settlement using share ledger tech

A clutch of major US financial services firms - including Citi, JP Morgan, and Visa - are taking part in a Regulated Settlement Network (RSN) proof-of-concept (PoC) that will explore multi-asset settlement using shared ledger technology. Run by regulatory agency Sifma, the PoC will investigate how shared ledger technology can be used to settle tokenised commercial bank money, wholesale central bank money, US Treasury securities and other tokenised assets. The plan is to develop an interoperable network for multi-asset transactions that aim to operate on a 24/7, programmable shared ledger. Findings of the PoC will be published in due course.

✴️Digital transformation

KfW to issue blockchain-based digital bond

German bank KfW is preparing to issue its first blockchain-based digital bond in accordance with the German Electronic Securities Act. The blockchain-based transaction will be carried out by a consortium of financial institutions, including DZ Bank, Deutsche Bank, LBBW and Bankhaus Metzler. KfW has already issued a first digital bond in the form of a central register security and is now taking the next step with the issuance of a blockchain-based bond as it seeks to improve efficiency and scalability.

The world's biggest banks are hiring AI talent twice over

Large banking institutions are adding artificial intelligence-focused jobs at increasing speeds, despite industry-wide job cuts. At 50 of the world’s biggest banks, hiring for AI talent grew 9 per cent over the last six months — double the rate of growth in overall headcount at those banks during the same period, according to new data published by research firm Evident. JPMorgan Chase, Capital One, and Wells Fargo led the race, adding the largest amount of AI talent. JPMorgan has the greatest volume of AI talent, with nearly six times more AI staff than the average bank. It employs 11.5% of all existing AI talent within the banking industry. With layoffs at several major banks including at Citigroup, Barclays, Deutsche Bank, and Lloyds Bank already this year, the increase in the number of AI-centered positions highlights the importance financial institutions are placing on building up their capabilities in the space.

📱Technology trends

Revolut launches crypto exchange

This week, Revolut launched its ‘Revolut X’ cryptocurrency exchange, designed for professional investors. It is also available on desktop for all UK users with a Revolut retail account. Revolut X will compete with established exchanges by offering flat 0% maker fees and 0.09% taker fees regardless of trade volume. The exchange offers real-time trading of 100+ tokens with market and limit orders available.

Fed proposes expanded operating hours for FedWire and NSS

The US Federal Reserve Board is seeking feedback on a proposal to start operating its two largest payments services seven days a week. Currently, both the Fedwire Funds Service and the National Settlement Service (NSS) operate Monday to Friday. The services are offered to depository institutions with Federal Reserve Bank master accounts that settle for participants in clearinghouses, financial exchanges and other clearing and settlement arrangements. Under the proposal, both services would operate on every day of the year. The Fed says the move would support the safety and efficiency of the US payment system and help to position the nation's payment and settlement infrastructure for the future.

🧑⚖️Regulatory developments

FCA defends 'name and shame' proposals after backlash

The Financial Conduct Authority (FCA) has revealed that it was not expecting such a strong reaction to its plans to “name and shame" firms it is investigating for financial wrongdoing, after facing backlash from government officials, including Chancellor Jeremy Hunt. Specifically, the FCA stated it was considering announcing when it has opened enforcement investigations into financial firms, which it currently only does in very limited cases. It would mean "naming and shaming" the companies being probed, regardless of whether or not it decides there has been misconduct or a breach of its rules. The FCA has defended the proposals and stressed that they were still being deliberated.

DTIF expands digital token identifier for crypto derivatives regulatory reporting

The regulatory reporting of cryptoasset derivatives trades reached a key milestone this week, with an expansion of the Digital Token Identifier (DTI) scope. DTI is the global ISO standard for identifying cryptoassets in the EU. As of 29 April this year, crypto-derivatives falling under the EU’s European Market Infrastructure Regulation (Emir) need to use a DTI as part of their trade reporting processes. The scope of the DTIs is now being expanded, and is being included as an underlier to two derivative identifiers - the Unique Product Identifier (UPI) and the International Securities Identification Number for OTC derivatives (OTC ISIN). The UPI is a G20-mandated identifier for derivatives reporting, helping regulators identify the build-up of systemic risks in OTC derivatives markets globally. The OTC ISN is an identifier used to detect and investigate market abuse. Including DTIs as underliers to both the UPI and the OTC ISIN will allow for greater transparency in the crypto derivative trading market, supporting public authorities in identifying digital asset risk, globally.

📊Chart of the week

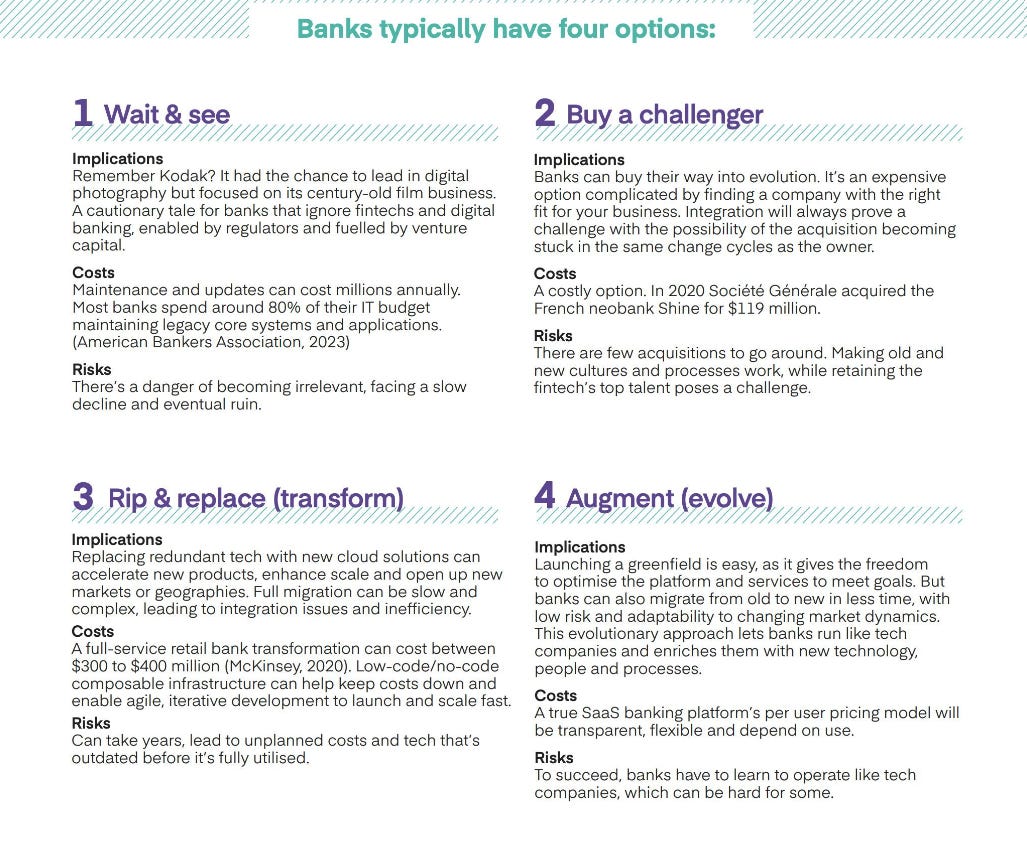

When it comes to improving their core banking systems, banks are typically faced with four options. Given the increasing digitisation of the capital markets industry and macroeconomic pressures, banks are now more than ever before, faced with the balancing act of accelerating their digital transformations to stay ahead of the competition while keeping costs to a minimum, with many banks in the midst of a record year for job cuts with growing pressures on margins.

With the enforcement of several key pieces of legislation such as US T+1 trade settlement, Basel Implementation and the Digital Operational Resilience Act on the horizon, banks may simply not get away with relying on legacy systems to the extent they have done before, or holding off investment in new technologies, with more automated and data-centric workflows a pre-requisite to maintain compliance and competitiveness. As such, option 1, which suggests to ‘wait and see’ may simply not be a feasible option at the moment, with elements of options two, three and four likely required.

Right now, it pays to be nimble for banks, who should ideally have an understanding of where bottlenecks and inefficiency gaps within their current systems lie, while coming up with realistic and feasible ways to plug them given cost and time pressures.

One strategy for banks might be to build a modern architecture around a legacy system while progressively reducing the dependency to innovate on the old systems. This can be achieved by plugging-in a modern middle-ware platform that acts as an interface between the old and the new, leading the bank to ‘augment’ and enhance its digital capabilities while minimising risk and minimal disruption to the baseline behaviour of the legacy infrastructure. This integration results in added flexibility, faster implementation and cost efficiencies. Additionally, it also helps banks reduce their risk of investing in a major and costly infrastructure change.

🐤Tweet of the week

It is just another action-packed week in the world of crypto, with several key developments once again highlighting its unstoppable integration into the global financial system.

In particular, the European Securities and Markets Authority (ESMA) revealed it is reviewing whether to allow Bitcoin into the EU UCITS funds, which are worth roughly $12 trillion. If Bitcoin is approved for UCITS, it would mean that fund managers could allocate small portfolios to Bitcoin within the framework.

In addition, BlackRock, the world’s largest asset manager with roughly $10 trillion in assets under management, hinted that it is in ‘diligence conversations’ with wealth funds, pension funds and endowments regarding its spot Bitcoin ETF. Robert Mitchnick, head of digital assets for BlackRock, anticipates that financial institutions such as those mentioned above will start trading in spot Bitcoin ETFs over the coming months.

Finally, as the chart above shows, the M2 money supply, which is an estimate of all cash held and short-term bank deposits across the United States, turned positive for the first time since November 2022. Increasing money supply is usually an indicator for investors to turn their focus to assets that outperform in high inflationary periods, with Bitcoin historically outperforming traditional financial markets when global M2 supply rises.

📄GreySpark insight

One of the most promising applications of DLT is in the tokenisation of assets. Essentially, this involves a creating a digital token to represent a real-world asset. The ownership of this token is stored on a digital ledger, and any change of ownership is recorded to the ledger. This could eliminate much of the friction in the system by removing paper-based ownership of share certificates and bring significant efficiencies in transaction processing.

An underlying characteristic of the technology is that information stored on distributed ledgers is immutable, creating a single source of truth. Whereas previously fund managers would need to access duplicated data sets held in multiple locations by different counterparties, DLT gives firms a central reference point for critical business information with full audit trails.

The benefits of transparent and trusted information via DLT includes gaining better insights into operations and investments, allowing for improved decision-making and efficiencies to be realised. In turn, this allows managers to report more accurate and detailed information to their own end investors and regulators. Similarly, investors also have instant access to key fund data across multiple managers and jurisdictions. At the fund administrator level, providers will be able to facilitate visibility, transparency and trust by collaborating directly with clients around an immutable single source of truth.

Participants could then push for full tokenisation of private market funds and their underlying assets. Tokens can also be used to create fractionalised, smaller, tradeable digital representations of private market funds and their holdings. Smart contracts can enable tokenisation by administering lifecycle management. Furthermore, tokenisation could facilitate greater democratisation and liquidity in an asset class that has been fundamentally illiquid, by enabling access to a broader set of investors.

Discover more here.