Weekly news up to 07/06/2024

Issue #38

Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

BlackRock, Citadel Securities-backed TXSE Group to launch Texas Stock Exchange

📰Newsflash

📈Buyside

BlackRock, Citadel Securities-backed TXSE Group to launch Texas Stock Exchange

TXSE Group, the parent company of the Texas Stock Exchange, has announced plans to launch the Texas Stock Exchange in Dallas, going up against established exchanges such as NASDAQ and NYSE in a bid to attract global companies. The exchange, which has raised about $120 million, plans to file registration documents with the U.S. Securities and Exchange Commission to start operating as a national securities exchange later this year. The exchange, which has received backing from BlackRock and Citadel Securities, will be a fully electronic national exchange that allows companies to list and trade on its platform.

Private equity bosses warn of lower returns

Private equity executives have issued warnings about the industry facing the prospect of years of lower returns as it seeks to sell off investments made during the ‘frenzy’ coronavirus pandemic years. After booming in late 2021 and 2022 and raising record cash levels against a backdrop of low policy interest rates, buyout groups now face challenges in exiting from trillions of dollars-worth of unsold companies, in order to return capital to institutional backers such as pension and endowment funds.

📉Sellside

BBVA to issue financial sector's first biodiversity bond

BBVA Colombia and International Finance Corporation (IFC) are set to issue the financial industry’s first biodiversity bond. BBVA Colombia plans to raise $50 million in the sale of the bonds, with the proceeds being used to finance projects focusing on reforestation, the regeneration of natural forests on degraded land, mangrove conservation or restoration, climate-smart agriculture, and wildlife habitat restoration. In addition to the investment, the transaction includes advisory services to set the eligibility criteria and indicators that aim to foster best practice in sustainable management of natural resources. Colombia is the world’s most biodiverse country per square kilometer. It is home to 14 percent of known plant species in the world, only surpassed by Brazil; and close to 4,500 bird species.

Swift to pilot AI in fight against fraud

Banking co-operative Swift has announced two AI-based experiments in collaboration with its member banks to explore how the technology could assist in combatting cross-border payments fraud and save the financial industry billions in fraud-related costs. The group, which includes BNY Mellon, Deutsche Bank, DNB, HSBC, Intesa Sanpaolo and Standard Bank, will test the use of secure data collaboration and regulated learning technologies to gather insights and identify potential fraud patterns in data. Fraud cost the financial industry USD 485 billion in 2023 alone and is now becoming a higher priority for financial regulators across several jurisdictions.

✴️Digital transformation

US Treasury seeks feedback on use of AI in financial services

The US Department of the Treasury is seeking public comment on the risks and opportunities posed by the use of AI in financial services. With financial firms investing billions of dollars into harnessing the power of AI, regulators have been scrambling to understand and guard against the potential risks associated with the technology. The Treasury has stated that it wants to increase its understanding of how AI is being used within the financial services sector and the associated opportunities and risks of adopting the technology. Comments to the Treasury can be submitted for 60 days.

Robinhood to buy crypto firm Bitstamp for $200m

Trading app Robinhood has agreed a $200 million cash deal to buy crypto exchange Bitstamp in an effort to expand outside of the US and accelerate its push into digital assets. Founded in 2011, UK-based Bitstamp has over 50 active licenses and registrations globally and will bring in customers across the EU, UK, US and Asia to Robinhood. Bitstamp’s core spot exchange, with over 85 tradable assets, and products such as staking and lending, will also help Robinhood move beyond the retail market and into the institutional space. Robinhood customers can currently buy and sell cryptoassets such as Bitcoin and Ethereum on its platform.

📱Technology trends

Bloomberg unveils enhancement to FX execution offering in wake of T+1

This week, Bloomberg Index Services Limited announced the launch of a specialist T+1 functionality from its Bloomberg FX Fixings (BFIX) data benchmark. Accelerating U.S. securities settlement to T+1 on May 28, 2024, raises the risk that transaction funding may not occur in time due to dependency on FX settlement processes involving trade matching, confirmation and payment, all to be completed within currency cut-off times. Using the BFIX value T+1 rates, users can send FX orders into their executing counterparts without being physically present in the designated time zone. Though sell-side banks offer this service via their forwards desk, the BFIX T+1 benchmark allows for a minimised impact on banks’ credit facilities when done at scale. The initial launch extends to 20 deliverable currencies globally, including USD, GBP, HKD, EUR, and JPY among others.

NYSE Equities technical issue triggers market uncertainty

On Monday 3 June, NYSE Equities confirmed that it was investigating a technical issue which had caused stocks to drop unexpectedly, subsequently drawing wide-ranging attention from the market. 40 stocks including Warren Buffett’s Berkshire Hathaway (BRK A), Canada’s Bank of Montreal (BMO), International restaurant chain, and Chipotle (CMG) experienced sudden price drops between 9.30am and 10.27am, sparking uncertainty. All impacted stocks reopened by 4.40pm with all systems operational.

🧑⚖️Regulatory developments

Expanded SEC clearing rules will see daily DTCC Treasury activity increase by $4 trillion

According to an industry survey of 83 sellside institutions, newly expanded clearing rules from the US Securities and Exchange Commission (SEC) will see daily Treasury clearing activity on the Depository Trust & Clearing Corporation (DTCC) increase by more than $4 trillion when they take effect. First announced in December last year, the SEC’s new rules are designed to enhance risk management practices for central counterparties in the US Treasury market and facilitate additional clearing of securities transactions in this area of the market. Under the new rules covered clearing agencies in the US Treasury market are required to adopt policies that ensure their members submit certain specified secondary market transactions for clearing. Adjustments are expected to be made by the end of March 2025.

Affirmation rates reach nearly 95% on double-settlement day at DTCC

Affirmation rates came in at 94.55 per cent on the second day of T+1 in the US, which also happened to be the double settlement day, whereby trades from prior to the switch were also settling on T+2. The rate increased from 92.76 per cent on the first day of T+1. According to the data from DTCC, the CTM Allocations Rate by 7PM ET also rose above 99 per cent. Aside from a minor issue within the DTC’s night cycle processing on the first day of T+1, the transition to T+1 settlement in the US has so far been relatively seamless.

📊Chart of the week

Globally, the past ten years saw an average of $3.5 trillion per year in acquisition activity, and in 2022, an average year, 50,000 deals were completed. However, deal volume is not correlated with success, as 90 per cent of M&A transactions fail long-term due to poor implementation and post-deal strategy complications. Despite the synergies, banks have often been a lower priority for fintech boards and executives looking to exit compared to the public markets, private equity and enterprise technology. Overall, out of all fintech transactions in the market, bank-fintech acquisitions account for less than 1 per cent of deals. Out of the approximately 500 whole-company acquisitions undertaken by the top 50 US and top 15 International and Canadian banks since 2013, only 94 or less than 20% were fintech acquisitions.

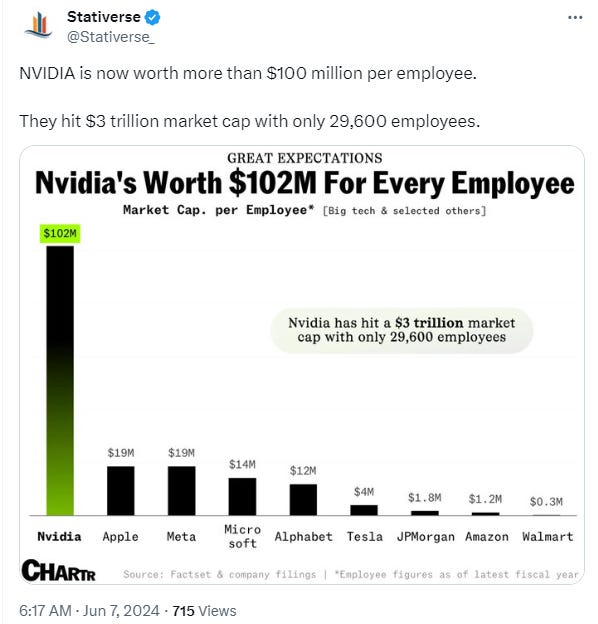

🐤Tweet of the week

This week, the market capitalisation of AI powerhouse Nvidia surpassed $3 trillion, surpassing Apple as the second largest company in the world. Just two years ago, Nvidia had a market capitalisation of just $400 billion. What is even more staggering is that as a company, Nvidia is worth more than $100 million per employee, with a headcount of 29,600, more than five times higher than the market capitalisation per employee of its closest rival, Apple. Regardless of whether you think Nvidia’s share price may be overbought or not, it is clear that the AI narrative is showing little sign of relenting.

📄GreySpark insight

Whether high-touch or low-touch, developing technology solutions entirely in-house has become increasingly challenging for most banks, particularly those beyond the largest Tier 1 institutions. The main challenge banks are experiencing is the very high costs associated with developing and maintaining technology from scratch, coupled with a lack of in-house skill and expertise creating these platforms. Many banks find these costs unaffordable and face budgetary limitations, forcing them to prioritise “run-the-bank” activities over technology modernisation.

Consequently, cost pressures and the need for the best quality trading systems are driving more banks to abandon their in-house strategy in favour of third-party solutions provided by technology and fintech companies. This move allows banks to reduce expenditure while leveraging the expertise and efficiency offered by technology trading providers. Figure 4 shows the waves of technology that have rippled across the Tier 1 and Tier 2 trading firms as regulatory changes took effect. Between 2007 and 2012, banks began their first wave of equipment adoption, primarily led by Tier 1 institutions in response to regulatory changes such as MiFID and RegNMS. These regulations introduced new structures demanding best execution, client information, surveillance, limits, monitoring, controls, and regulatory reporting transparency. Tier 1 banks built in- house platforms to capitalise on the growing trend of Low Touch trading. Meanwhile, Tier 2 firms, facing budget limitations, continued to rely on their High Touch systems, which provides a less efficient and tailored service.

From 2012 to 2017, during the second wave of trading automation, Tier II firms were forced to set up LT platforms at a time of great budget constraints, relying on their existing HT systems to offer a sub-standard service. The most recent period from 2017 till now sees the completion of the third wave of equipment. Legacy in-house platforms operated by Tier I and the ‘bastardised’ HT platforms operated by Tier II are being replaced by fit-for-purpose platforms specifically designed for Low Touch, overwhelmingly sourced from vendors, and augmented using the Buy & Build approach.

Discover more here.