Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

JPMorgan rolls out Generative AI 'research analyst' to staff

📰Newsflash

📈Buyside

BNP Paribas in talks to buy AXA’s asset management arm

French insurer AXA has entered into exclusive talks to sell its investment management arm to BNP Paribas for €5.1 billion in a deal that would create one of the largest industry players in Europe. For BNP, the acquisition would significantly boost its asset management arm as the industry races to achieve economies of scale and lower costs. The combined entity would have total assets under management of roughly €1.5 trillion. BNP stated that it expects the transaction to close in mid-2025.

FCA to offer partly ‘rebundled’ research to support UK buy-side

The UK’s financial conduct authority (FCA) has introduced a new payment option for research, following an industry consultation that took place earlier this year. Under the new proposed payment option, UK buyside firms will be able to facilitate joint payments for third-party research and execution services, provided they meet certain requirements. The new payment option is not mandatory. From 1 August onwards, the FCA has suggested that firms must ensure they comply with requirements if they wish to use the new option.

📉Sellside

JPMorgan rolls out Generative AI 'research analyst' to staff

JPMorgan has rolled out an in-house developed generative AI chatbot to staff, likening it to having a research analyst at the desk. Called LLM suite, the bot is designed to assist with writing, idea generation and summarising documents. The bot is already at the desks of roughly 50,000 staff, with the next phase of the rollout targeting its asset and wealth management division. JP Morgan is pioneering the deployment of generative AI technology in the capital markets industry, employing over 200 AI researchers and more than 2000 AI machine learning experts and data scientists.

BofE and BIS develop tech to monitor stablecoin reserves

The Bank of England and the BIS Innovation Hub have developed a system that gives financial supervisors near real time data about stablecoins' liabilities and their reserve assets. Specifically, it allows supervisors to get a single view of stablecoin liabilities across multiple coins and blockchains and the corresponding reserves. The trial covered Tether, USDC, Binance USD, True USD and the Pax Dollar. Currently, supervisers have access to the same stablecoin information as the public, with information being scattered across different intermediaries. The tool will help to standardise stablecoin data and pull it into a single database in which the supervisor can obtain a holistic view of the data.

✴️Digital transformation

UBS and CIBC execute intraday FX swap transaction on Finteum DLT platform

UBS and CIBC have executed a world-first intraday FX swap transaction on the DLT-based platform Finteum. The EUR/USD intraday FX swap, negotiated using the Finteum Platform and executed on the TP ICAP UK MTF, was completed within minutes. Both legs of the swap were settled by the banks at pre-agreed times on the same business day. This new type of trade promises to create more efficient and shorter term interbank markets, significantly reducing banks’ requirements for intraday liquidity. Finteum claims it is one of the first interbank venues to offer FX swaps and repo alongside each other in the same platform, providing huge efficiencies for bank treasury teams who are typically faced with clunky structural processes when dealing in swaps.

FTC investigates 'surveillance pricing' based on customer data

The Federal Trade Commission is investigating how companies including Mastercard and JPMorgan Chase use AI and personal data for services that allow firms to set different prices for different people. The FTC has issued orders seeking information from eight firms (Mastercard, Revionics, Bloomreach, JPMorgan Chase, Task Software, PROS, Accenture, and McKinsey & Co.) that offer so-called "surveillance pricing" products and services that incorporate data about consumers’ characteristics and behaviour. The FTC stated that it wants to improve its understanding of the "opaque market" that sees algorithms and AI used along with personal information - such as location, demographics, credit history, and browsing or shopping history — to categorise people and set a targeted price for a product or service.

📱Technology trends

SIX Swiss Exchange resumes trading following four hours down

After four hours of suspended trading, SIX Swiss Exchange resumed trading at 1.30pm BST on 31 July, 2024, following technical issues with its SIX MDDX Multi-Dimensional Data fluX (SIX MDDX) data feed. The cause of the disruption is still being identified. This is the second disruption that SIX Swiss Exchange has faced in just over a year - in June 2023, the exchange experienced its worst outage in just over a decade, where trading was halted for three hours following issues with equities and options trading. The outage comes amid increased regulatory pressure on trading venues to strengthen processes following several high profile outages in recent times, including from the London Stock Exchange, Euronext and Deutsche Boerse.

Deutsche Börse invests in capital markets fintech Primary Portal

Primary Portal, a digital platform that aggregates and digitises equity capital market processes for banks and asset managers, has completed the first stage of its £7.5 million Series A funding round led by the venture capital arm of Deutsche Börse. With over 90 banks and 400 institutional investors using the platform, Primary Portal is digitising the still largely labour-intensive and error-prone equity issuance space by creating the infrastructure that makes capital markets systems interoperable. Through digitising communications and workflows, Primary Portal allows for efficient connectivity between asset managers and banks in equity issuances, improving the process for companies to raise capital.

🧑⚖️Regulatory developments

FCA vows to reduce burdens on firms

The rules governing financial services could be streamlined to reduce burdens on businesses, following a review launched by the FCA. The move comes after the introduction of consumer duty, which makes sure that businesses deliver good outcomes for consumers when they buy financial products and services. The FCA is calling on the industry to help identify existing financial services rules, which could be removed or simplified if they overlap with the Duty. Reducing complexity of the FCA’s rulebook could lower costs for firms, encourage innovation and boost growth, thereby improving international competitiveness.

FCA establishes plan to strengthen UK capital markets

The FCA has laid out a series of measures designed to help strengthen the UK’s capital markets global competitiveness. Under the proposals, companies will still be required to publish a prospectus when first admitting securities to public markets. However, a prospectus would not be required when a company raises further capital except in limited circumstances. Together with other existing disclosure obligations, these proposals will make sure investors get the information they need while significantly reducing the costs associated with further capital raises for companies. The FCA is also consulting on proposals for a new activity of operating a public offer platform. These platforms will offer an alternative route for companies to raise capital outside public markets including from retail investors.

📊Chart of the week

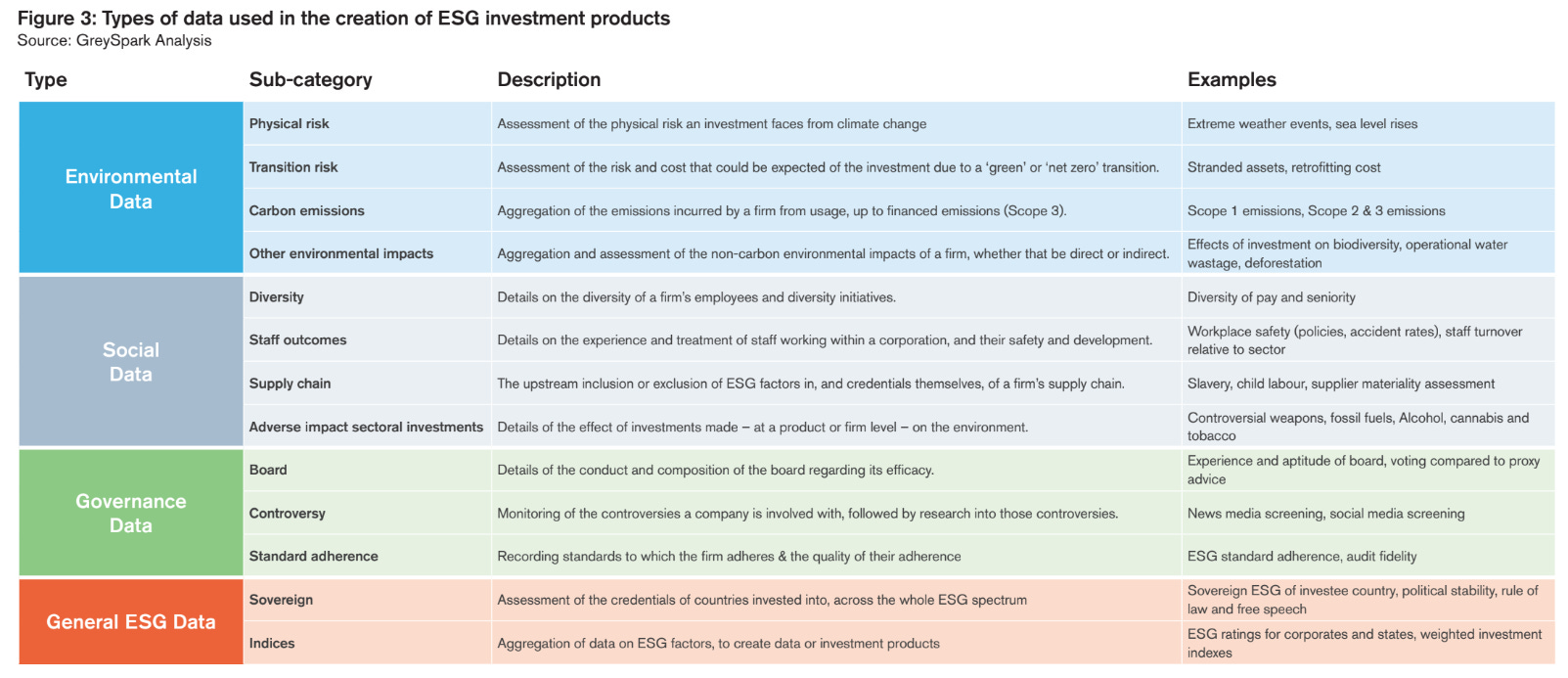

Source: GreySpark analysis

ESG data provides information about the environmental, social, and governance (ESG) attributes of a company or investment. ESG data is typically used by investors, analysts, companies, policymakers, and other stakeholders to understand and make informed decisions about business effectiveness, risk, and sustainability.

As the model above shows, ESG data can be broadly categorised into the following areas:

Environmental data: This includes data on a company's energy usage, carbon emissions, water usage, and waste management practices.

Social data: This includes data on a company's labor practices, human rights policies, community engagement, and diversity and inclusion initiatives.

Governance data: This includes data on a company's board composition, executive pay, anti-corruption policies, and other metrics.

Financial data: This includes the financial performance and stability of the company, which may be used alongside other ESG data to calculate intensity ratios and other ESG KPIs.

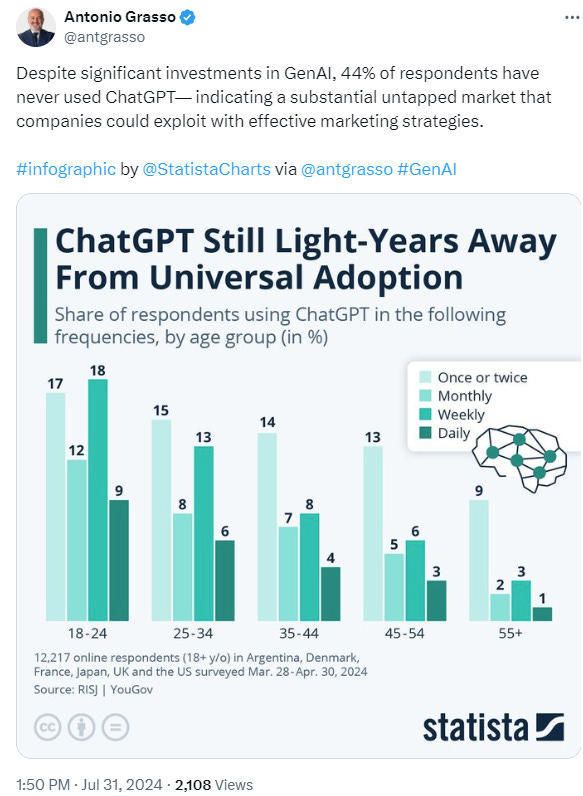

🐤Tweet of the week

Source: Antonio Grasso via ‘X’

📄GreySpark insight

Whether high-touch or low-touch, developing technology solutions entirely in-house has become increasingly challenging for most banks, particularly those beyond the largest Tier 1 institutions. The main challenge banks are experiencing is the very high costs associated with developing and maintaining technology from scratch, coupled with a lack of in-house skill and expertise creating these platforms. Many banks find these costs unaffordable and face budgetary limitations, forcing them to prioritise “run-the-bank” activities over technology modernisation.

Consequently, cost pressures and the need for the best quality trading systems are driving more banks to abandon their in-house strategy in favour of third-party solutions provided by technology and fintech companies. This move allows banks to reduce expenditure while leveraging the expertise and efficiency offered by technology trading providers.

Discover more here.