Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

Top story

NASDAQ gets go ahead from SEC to develop first exchange AI-driven order type (see below)

Image from The Wall Street Journal

Newsflash

Buyside trends

European Buy-Side Traders Slash Algo Usage

Research from Bloomberg Intelligence found that European buy-side traders cut their use of algorithmic providers by 43 percent in 2023, driven by a notable decrease from small fund providers. JPMorgan was the most commonly used algorithmic trading desk in Europe, capturing 12 percent of market share: followed by Morgan Stanley (10 percent), Goldman Sachs (9 percent) and Bank of America (8 percent). Bloomberg Intelligence analyst Nicholas Phillips cited liquidity and regulatory issues as being the main reasons for reducing their use of algo trading providers.

FlexTrade integrates Tradefeedr’s FX pre-trade forecast data service to enhance buyside FX desks

FlexTrade Systems has joined up with FX data analytics provider Tradefeedr to provide a new offering that will likely improve buyside trading desks. Tradefeedr’s data analytics API aggregates and standardizes trading data, whether executed by algorithm or risk transfer methods like Request for Quote (RFQ). This approach allows clients to assess the performance of their execution algorithms in comparison to industry standards. It also fosters meaningful discussions with algorithm providers, aiding the identification of the best algorithms and execution styles that align with market conditions and risk profiles.

Sellside

JP Morgan working on blockchain based digital deposit token

According to Bloomberg, JP Morgan is looking into the use of a blockchain-based digital deposit token as a way of making cross-border payments and settlement faster. JP Morgan has already built most of the infrastructure needed for the project, but will not create the token unless it gets the go-ahead from US regulators. JP Morgan has been using a digital token called JPM Coin for several years, allowing corporate clients to move funds in dollars and euros from their different accounts within the banks. The new offering will be used to allow clients to send money to other banks, while also settling trades of tokenised securities.

Goldman Sachs becomes latest new member on Eurex listed FX futures business

Goldman Sachs is the latest sell-side institution to join derivatives exchange Eurex’s listed FX futures business as a trading and clearing member, helping to fulfill Eurex’s long term goal of becoming a “European FX liquidity hub.” Goldman will also act as liquidity provider for off-book transactions as part of the deal. According to Joseph Nehorai, global co-head of futures at Goldman Sachs, increasing capital costs in FX markets are creating a growing appetite for listed FX derivatives. FX derivatives allow buyside firms to enjoy the advantages of OTC trading and centrally cleared derivatives.

Deutsche Bank to offer crypto custody for clients

Deutsche Bank has partnered with crypto firm Taurus to provide custody services for institutional clients’ cryptocurrencies and tokenised assets. Deutsche Bank noted that crypto trading is not currently within its plans, despite expressing an interest toward it in a 2020 World Economic Forum. The bank stated it is proceeding "cautiously and in line with the spirit and the letter of the regulations governing this asset class."

Digital transformation

NASDAQ gets SEC nod for first exchange AI-driven order type

NASDAQ has revealed that it has won approval from the SEC to launch the first exchange AI-driven order type. The order type, known as midpoint extended life order (M-ELO), allows investors with longer-term horizons to trade with each other using a 10-milisecond waiting period. Thus approval of M-ELO would increase the frequency at which orders are matched, resulting in greater trading efficiencies.

The number of UK banks investing in technologies such as virtual and augmented reality is falling as the metaverse hype appears to be fading away. According to a survey by Censuswide, 12 months ago, more than half of UK banks were investing in these immersive technologies. However, this number has now fallen to 38 percent in 2023. The main reason for this is the prioritisation of other emerging technologies among banks, including cybersecurity, cloud technologies, and open banking APIs.

Technology trends

European fintech funding drops as investment discipline returns

European fintech funding dropped in the first half of 2023 as the industry grapples with a strained macroeconomic environment. European fintechs raised €4.6 billion in the first half of 2023 across 463 deals, down from €15.3 billion from 884 deals in H1 2022. In particular, the UK fintech industry has shown some resilience, accounting for over 50 percent of funding in H1 2023. M&A transactions decreased five percent between H1 2022 and H1 2023, with an 84 percent decline in transaction sizes.

Adyen lands UK banking authorisation from FCA and PRA

Dutch payments processor Adyen has received authorisation from the Prudential Regulation Authority and the Financial Conduct Authority (FCA) to launch banking services in the UK. The services that Adyen will provide to the UK market include bank accounts, virtual and physical cards, capital services and expense management tools, and is angled at platform businesses seeking to offer financial products to their SMB users.

Study of post-trade firms show pain points of legacy technology systems

A survey by NASDAQ found that one third of post-trade firms are operating with legacy platforms more than a decade old. Additionally, the results showed that 78 percent of investment budgets are dominated by maintaining and upgrading legacy technology, with more than a third of survey participants planning a major system overhaul in the next five years.

Regulatory developments

Banks and investors step up opposition to EU derivatives plans

Asset managers, pension funds and brokers across Europe have stepped up their opposition to EU plans to move trillions of euros of derivatives out of London clearing houses, warning the move could negatively impact European companies and investors. Clearing houses are paramount in reducing market instability, sitting between counterparties on deals and preventing defaults from filtering through to the financial system. London currently manages roughly 90 percent of euro derivative positions, with the EU seeking to end reliance on the UK’s financial services after Brexit. However, eleven trade associations, representing banks and brokers handling large derivative trades, believe a move would make EU firms “less competitive” and subject them to restrictions not faced by others.

US banks say regulators broke law as fight over proposed capital rules escalates

On 12 September 2023, US banks accused the FED of violating federal laws, following the introduction of sweeping capital requirement restrictions, which you can be reminded of here. The protest group, representing banks such as JP Morgan, Goldman Sachs and Morgan Stanley said the capital requirement restrictions violates federal laws (the Administrative Procedure Act) because it lacked sufficient public data and analysis. The group said the authorities should freeze all work on the rules until they are properly re-proposed. The SEC has declined to comment.

SEC charges Virtu over alleged failure to safeguard institutional customers' trade

Market maker Virtu has been sued by US regulators for allegedly giving misleading statements and the misusing sensitive customer information. This week, the SEC said a database containing post-trade information obtained from customer orders in its institutional business was easily accessible using two widely-known passwords within the firm. Failure to safeguard such in information could lead to the mis-use or exploitation of data. The SEC is currently weighing up civil penalties for Virtu.

Chart of the week

Incredibly, AI stocks have driven all of the gains in the S&P 500 index this year. Without the inclusion of AI-centric stocks, the S&P 500 index would be flat for this year. The growing influence of AI, not only in capital markets but also across the global financial system, is one that can no longer be ignored.

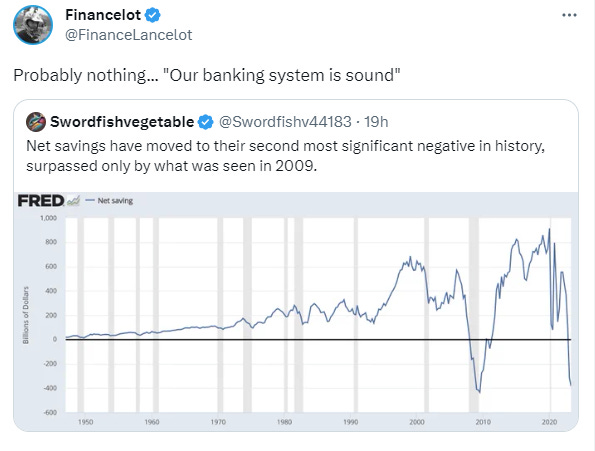

Tweet of the week

We can sense some sarcasm in this one, Financelot.

GreySpark insight

Artificial intelligence is rapidly ingraining into the capital market industry. With monolithic legacy systems still a feature of many CIBs, and an increasingly competitive landscape with the rise of fintechs, CIBs know that AI adoption is necessary for the future success. In fact, CIB trading franchise heads know that if they do not push their businesses to at least experiment with bought, built, or bought-and-built AI applications, then:

Their competitors will eventually succeed with AI implementations, thus eliminating any early-stage competitive advantage;

The institution’s relevance to changing client / customer base services channel demands and needs will decrease over time; and

Low-cost opportunities to improve trading business margins or to grow profitability through the development of new, client-facing service offerings will be lost.

Thus, it’s imperative that banks start optimising their AI adoption strategies. Discover more here.

What has caught our eye?

Tokenisation could improve bond liquidity and transparency

This piece by Global Trading takes a look at the possibilities to be had with the tokenisation of bond markets. Tokenisation refers to the process of issuing a digital representation of a traditional asset on a blockchain or distributed ledger. Tokens can represent tangible assets such as real estate, financial securities or non-tangible assets such as digital art. In fact, tokenisation of financial products currently finds itself at a major inflection point, with financial institutions exploring ways to leverage asset tokenisation. The Hong Kong Monetary Authority (HKMA) is currently investigating tokenisation in collaboration with the Bank of International Settlements (BIS).

This report by Fenergo takes a closer look at some of the ESG challenges currently being faced by financial intermediaries (FIs). Interestingly, the report found that only ten percent of FIs are fully prepared to meet their ESG obligations, with the main challenge meeting this obligations being a “lack of formal data standards.”

This report by the SEC recently disclosed new proposals that would address risks to investors from conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisers. The proposals provide a flavour for what AI capital market regulation could look like going forward, with much uncertainty remaining about how AI can be feasibly regulated across the industry.