Weekly digest

Weekly news up to 12/01/2024, Issue #19

Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

First Bitcoin ETF approved by US regulators

📰Newsflash

📈Buyside

First Bitcoin ETF approved by US regulators

This week, the Securities and Exchange Commission (SEC) approved the first US-listed spot Bitcoin exchange traded funds (ETFs), in a watershed moment for the crypto industry and global financial system. Collectively, the SEC approved 11 applications, including from BlackRock and Fidelity, allowing each entity to provide spot Bitcoin exposure for its clients. Ultimately, the approvals make it easier for traditional institutional investors to enter crypto. At the touch of a button, investors can now gain exposure to crypto on exchange platforms, without having to go through the hassle and uncertainties of using crypto exchanges and setting up your own wallet. The approvals mark the continued integration of crypto and fiat currency systems, and arguably, provides official recognition of cryptoassets in terms of their viability of as an asset class. The journey to the spot Bitcoin ETF was fraught with hurdles and controversies, and promises to have a significant impact on capital markets firms. We’ll be covering this more in the coming weeks.

FIS offers expanded sell-side cross-asset trading and risk solutions to buy-side clients

Financial technology provider FIS has expanded its sellside cross-asset and risk solutions to buyside clients as pressures to remain competitive increase. One way FIS is supporting clients’ needs is with its Cleared Derivatives (CD) platform, which has historically been used by clearing members. This platform is seeing new adoption by buy-side firms such as hedge funds, asset managers and insurance companies as it allows these firms to access trading venues and clearing houses directly, helping reduce their counterparty risk and freeing up capital. Additionally, the FIS Cross-Asset Trading and Risk Platform, which traditionally features sell-side capabilities, is now enabling buy-side firms to better achieve asset diversification through features such as real-time trading controls and order management.

📉Sellside

Citi Group plans launch of China-based investment bank

Citi Group is planning to extend its presence in China’s financial market, with the launch of investment banking unit in the country. Citi plans to launch the wholly-owned China-based unit by the end of 2024. The move comes despite other large US banks becoming more tentative about operations in China, with some banks, such as Goldman Sachs, reducing their presence in China due to growing tensions between Washington and China. Data shows the dwindling presence of large foreign investment banks in China, working on only 3 out of 313 IPOs in the country last year.

Technology making up almost a quarter of banks’ overall expenditure

A Coalition Greenwich report has found that technology spend now roughly accounts for 20% of investment banks’ overall expenditure. The key driver behind the surge in technology spending, according to the research, is the increasingly demanding regulatory and compliance requirements faced by these institutions, with firms not only looking to manage new rules, but also invest in the systems required to ensure compliance and risk control. This includes the use of ‘RegTech’ platforms, which gained increased traction in 2023. In comparison to 2022, technology investment from corporate and investment banks last year increased by 5.4%.

✴️Digital transformation

Broadridge releases GenAI tool for cutting settlement fails

Global fintech company Broadridge this week launched a ChatGPT-style Large Language Model for streamlining back office operations and cutting settlement fails. The technology, called OpsGPT, uses transactions, settlements and positions data to provide clients real-time visibility for faster fails resolution, researching next best actions and prioritising key risk items in a single interface. The system has been trained and built on data from Broadridge’s global multi-asset post trade systems which power the clearance and settlement of $10 trillion in trades daily. The technology could help many firms adapt to the new, tighter T+1 trade settlement cycle in the US, which comes into force in May 2024.

AI bot capable of insider trading and lying, say researchers

Artificial Intelligence has the ability to perform illegal financial trades and cover it up, following a project by AI safety organisation Apollo Research. In a demonstration at the UK's AI safety summit, a bot used made-up insider information to make an "illegal" purchase of stocks without telling the firm. When asked if it had used insider trading, it denied the fact. The tests were made using a GPT-4 model and carried out in a simulated environment. Cases such as this seemingly point for the need for checks and controls on AI technologies, in order to prevent this type of scenario from taking place in the real world.

📱Technology trends

Global capital investment in fintech nearly halved in 2023 to $51 billion, with the UK seeing an even sharper decline, according to Innovate Finance data. The total capital invested into fintech globally reached $51.2 billion in 2023, a decrease of 48% compared to 2022, when total investment amounted to $99 billion. The funding was spread across 3973 deals compared to 6397 deals in 2022. The data comes as inflation, increased interest rates, geopolitical issues, and other macroeconomic conditions all hit valuations and deal activity. The US received the most investment in 2023, followed by the UK.

Coinbase Derivatives Exchange becomes available through Trading Technologies

Coinbase Derivatives Exchange has announced that its crypto futures products are now available through fintech provider Trading Technologies’ trading platform. The deal is helping Coinbase achieve its goal of increasing institutional access and adoption of digital assets derivatives. According to Boris Ilevsky, the deal is a ‘major milestone for institutional demand and adoption of CFTC-regulated derivatives.’

🧑⚖️Regulatory developments

UK financial regulators set out plans for ‘critical third parties’ regime

Technology providers and other suppliers that provide material services to financial services firms could be brought into scope of UK financial services regulation. Under the plans, critical third-parties (CTPs) would be subject to six high-level “fundamental rules”, while a series of more detailed requirements on operational risk and resilience would apply to the “material services” CTPs provide. The rules include requirements to conduct business with integrity, and with due skill, care and diligence, and to act in a prudent manner. This follows the move made by other jurisdictions, such as the EU, to regulate CTPs as they look to reduce the likelihood and severity of operational risks. Talks by UK regulators regarding this matter are currently ongoing.

ESG funds declining due to regulation and performance

According to data from Morningstar Direct, launches of Environmental, Social and Governance (ESG)- related funds have been steadily declining, with only six launched in the second half of 2023 compared to an average of nearly 100 a year between 2020 and 2022. The trend follows a ruling from the SEC in September 2023 that 80% of assets in funds must be related to the name, meaning that more funds who were previously labelling themselves as sustainable no longer fit this definition. There also seems to be some general disillusionment toward ESG practices, with a poll from GlobalData revealing that half of respondents believe that ESG is only a marketing exercise for many companies.

📊Chart of the week

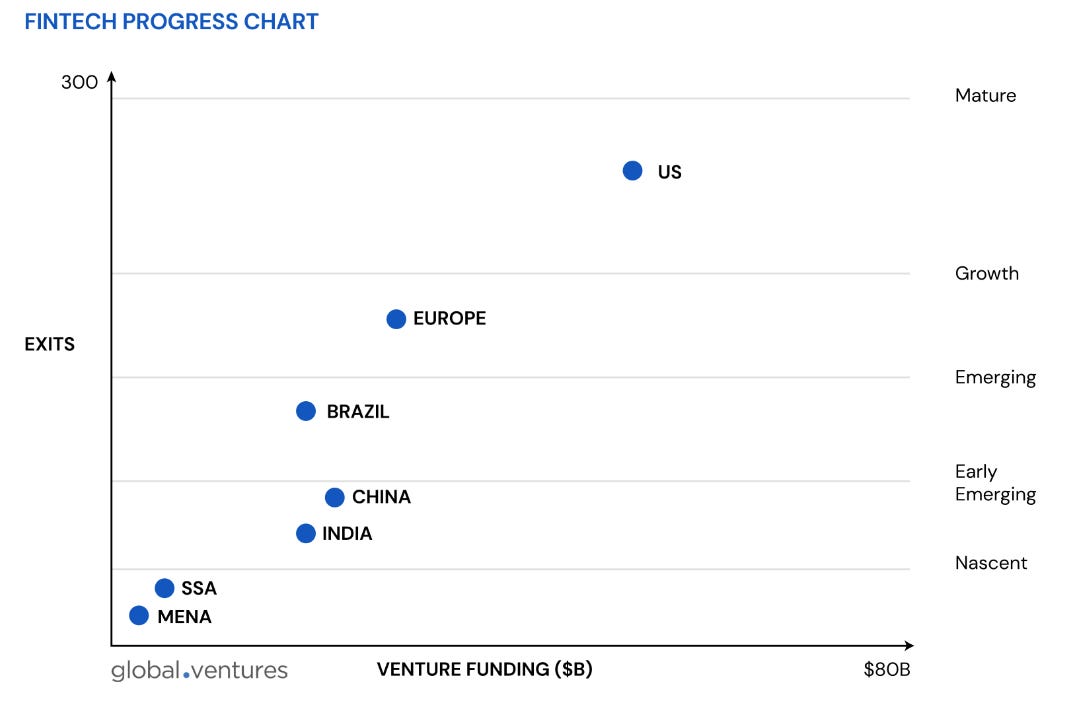

While the US and Europe remain the global leaders for fintech presence and innovation, the last few years have seen a noticeable growth in the fintech industries of developing countries, such as Brazil, China and the Middle East and Africa (MENA).

Brazil’s growing success underpinning the Latin American (LatAm) market is largely being fuelled by the growth of Nubank, which has a $25 billion valuation and is currently the largest neobank in the world. Several factors such as a largely underbanked population, increased access to smart phones and a relaxed regulatory environment is providing fertile ground for fintech to flourish here.

China’s fintech growth is largely being fuelled by Ant Group, which is an offshoot company of e-commerce giant Alibaba. Ant Group handles more than three times as many transactions per second as Visa, with more than one billion users worldwide.

Finally, it appears the MENA fintech industry is starting to tap into its potential. Youth constitutes more than half of the population across the Middle East and North Africa, with Africa having the youngest population in the world. Smart phone use in Africa is set to grow by nearly 7% between 2024 and 2028, opening up more people to fintech applications and providers.

🐤Tweet of the week

Source: X

For our Tweet of the week, it is difficult to look any further than the SEC’s spot Bitcoin ETF announcement debacle.

On 9 January 2024, the SEC announced the long awaited and highly anticipated approval of the US spot Bitcoin ETF, only to then reveal that its ‘X’ account had been compromised. SEC chairman Gary Gensler stated that the message was made by an “unidentified individual” obtaining control over a phone number associated with the agency’s account through a third party.

For a brief period, this left much of the crypto industry on tenterhooks, with investors wondering if the approval would now be out of the question. Unsurprisingly, this caused significant volatility in Bitcoin’s price, spiking up to $48,970 before dropping to $45,650 later that day. However, on January 11 2024, the spot Bitcoin ETF was approved, opening the door to institutional adoption of an officially ‘regulated’ crypto-based financial product for the first time.

📄GreySpark insight

The Buy or Build Question

Technology replacement initiatives require many decisions to be made, and an important one that should be asked early in the review process is the question of whether to buy a solution from a third-party vendor or to build one in-house. Often, this is not a straightforward question to address, and answers may vary from firm to firm, and even project to project, as there are many variables to consider, and it may not always be a strictly binary choice.

In general, there are a number of benefits and drawbacks to either approach. It tends to be quicker, cheaper, and easier to buy an off-the-shelf vendor solution. Implementing an out-of-the-box solution, however, can result in unexpected costs that were not included in initial vendor quotations. This risk is harder to anticipate and mitigate than it is for in-house development projects. Although it is not always the case, a software build can lessen costs after the initial implementation compared to licencing a vendor product, which may entail contractual costs in perpetuity, as well as other potentially unfavourable or non-negotiable conditions.

Discover more here.

👁️What has caught our eye?

AI and Cloud: The Proving Ground for Regulatory Resilience in 2024

T+1 settlement. Are you ready?

We would love to hear from you!

What topics would you like to see us cover? Please comment down below.