Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

Top story

DTCC buys blockchain outfit Securrency (see more below)

Newsflash

Buyside

FXPA adds Fidelity International as new buy-side member

The FXPA has confirmed that Fidelity International has joined as the association’s newest buy-side member. The FXPA represents the collective interests of professional foreign exchange industry participants around the world, specifically working to create a more transparent, liquid and competitive global currency market. Fidelity cites FXPA’s recent focus on the FX implications for buy-side traders given next year’s planned move to T+1 settlement for US and Canadian equities as its main reason to join the FXPA.

Onramp launches bitcoin asset management platform built on multi-institution custody

Software company Onramp has launched a global bitcoin asset management platform built on multi-institution custody. The solution has been launched to provide institutions, financial intermediaries and high net worth individuals with a custodial solution that leverages the potential of bitcoin while minimising counterparty risks. According to Onramp, institutions and individuals face a dilemma when deciding how to gain access to and safely store bitcoin. Onramp’s platform helps alleviate these issues and highlights the growing integration of crypto services among traditional finance systems.

Sellside

BNP Paribas launches fintech for marketplace payments

BNP Paribas, in partnership with Startup Studio 321, has launched a standalone fintech for orchestrating marketplace payments. Operating through a full service plug-in API, the new venture, otherwise known as ‘Panto’, is targeting European B2C e-commerce players. At a later stage, the fintech could extend to the European B2B and C2C markets, with international sellers. BNP is seeking to improve the ‘platformisation’ of commerce, with the platform sent to launch in the first half of 2024.

Eurex expands its crypto derivatives suite with Options on FTSE Bitcoin Index Futures

After becoming the first exchange in Europe to offer bitcoin index futures in April 2023, Eurex has expanding its crypto offering with the launch of options on FTSE Bitcoin Index Futures. This is another major milestone in Eurex’s ambition to offer secure access to cryptocurrencies in a regulated market environment. According to Eurex, new contracts are listed as options on futures in EUR and USD, with the respective bitcoin index future as underlying, equivalent to 1 bitcoin. Both options and futures expire at the same time (17:00 CET) on the last Friday of the month. Alongside monthly and quarterly maturities, weekly expiring contracts will also be available to trade. The service offering will launch on 23 October 2023.

Digital transformation

DTCC buys blockchain outfit Securrency

The Depository Trust & Clearing Corporation (DTCC) has agreed to buy blockchain-based fintech Securrency, with the financial terms remaining undisclosed. DTCC said in a statement that the "acquisition will position the clearinghouse to provide global leadership in bridging best-in-class industry practices with advanced digital technology to encourage adoption of digital assets." The deal could also open the door to tokenising assets among clearing and trade settlement processes — a topic that GreySpark recently covered. Following the deal, Securrency will become a fully-owned subsidiary of DTCC and will operate under the name DTCC Digital Assets.

A Bitcoin ETF is a near certainty by January as SEC caves

The SEC’s battle to stop a bitcoin ETF from coming to market has taken a huge blow, with the SEC running out of time to appeal a key court ruling. Up until now, the SEC has vigorously contested the implementation of a specialist bitcoin ETF, although it appears likely that the SEC has had a change of heart, if not a lack of resources to keep contesting the ruling. This makes it all but certain that a bitcoin ETF will hit the markets in a relatively short time, with crypto analysts at Bloomberg giving odds of 90% that a product will debut by January 2024. This could lay the platform for further institutional flows into the crypto market.

Technology trends

Broadridge’s LTX offers enterprise clients custom generative AI solutions through launch of BondGPT+

Broadridge Financial Solutions subsidiary LTX has launched an enterprise version of its BondGPT application, named BondGPT+, offering new capabilities for clients. The new offering incorporates Broadridge technology and OpenAI GPT-4 to quickly answer complex bond-related questions alongside helping users identify corporate bonds on the LTX platform. The offering also allows clients to integrate third-party data sets, and integrate clients’ enterprise applications into existing work flows. The solution is testament to how generative AI continues to evolve across different asset classes.

Bloomberg launches front-office pricing offering to aid with real-time trading decisions

Bloomberg has launched a new front-office solution which uses a machine learning model capable of handling vast amounts of data to produce frequent pricing for real-time trading decisions. The solution, called Intraday BVAL Front Office, is separate to Bloomberg’s existing evaluated pricing service, BVAL. According to Bloomberg, the solution delivers prices as fast as every 15 seconds and can capture a new bond issue moments after the security is available for secondary trading.

Regulatory developments

EU Commission postpones sustainable reporting standards by two years

The European Commission announced plans to delay key aspects of its Corporate Sustainable Reporting Directive (CSRD), including the adoption of requirements for companies to provide sector-specific sustainability disclosures and for sustainability reporting from companies outside of the EU. Specifically, the European Sustainability Reporting Standards (ESRS) sets out the rules and requirements for companies to report on sustainability-related impacts, opportunities and risks under the EU’s upcoming CSRD, which remains on track to begin applying from the beginning of 2024. In ESRS, there are two sets of draft rules, the first of which sets agnostic sustainability reporting requirements, while the second sets sector specific rules. The latter’s adoption date is set to be postponed by two years to June 2026.

Banks must disclose crypto asset exposures says Basel Committee

Global banks will be forced to disclose their exposure to crypto assets under new regulatory rules proposed by the Basel Committee on Banking Supervision.

The international regulatory body has proposed a standardised disclosure table and set of templates for banks' crypto-asset exposures with a proposed implementation date of 1 January 2025.

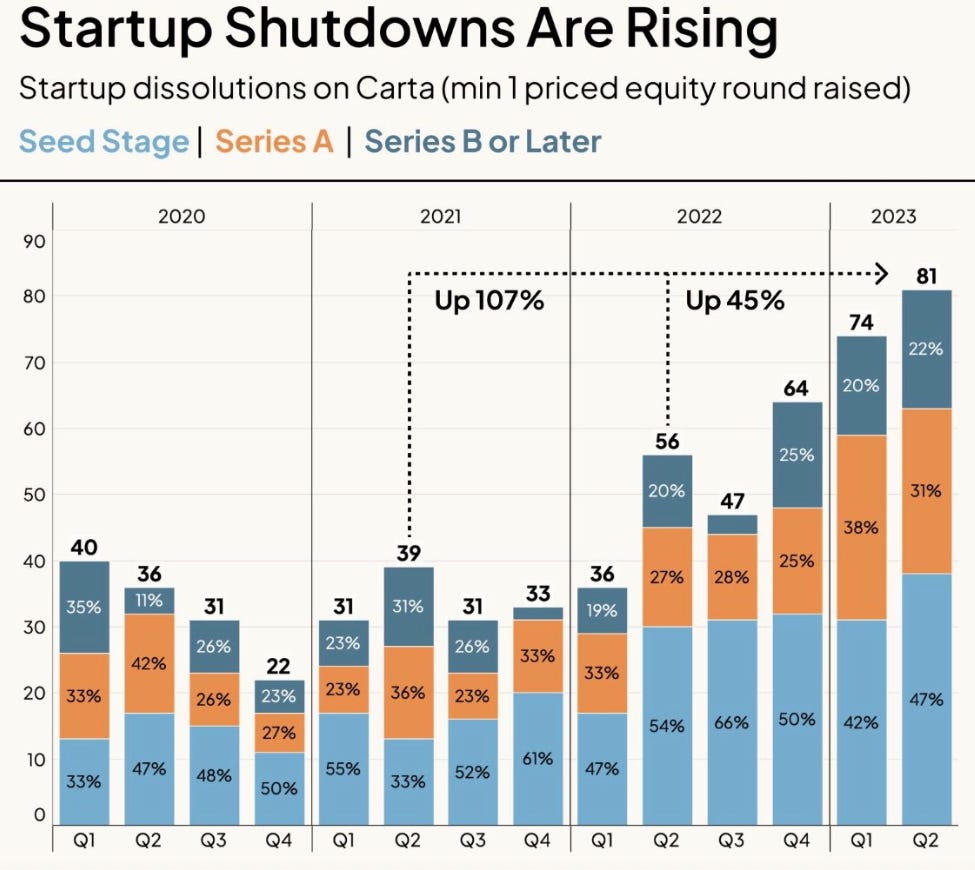

Chart of the week

Startups are running out of cash, with investors in the US slashing their startup funding by almost 50% in the year to 30 June 2023. Has a startup mass extinction event begun?

Tweet of the week

GreySpark insight

While many investment firms have already settled on their self-assessment and controls review processes and the approach they will take to risk-based analysis in the electronic trading risk management space, few have mature GRC tools and processes in place or sufficiently staffed lines-of-defence with the required authority and skillsets. Many firms are finding that they are expending too much effort in the administration of the processes for risk control self-assessment (RCSA), and that they do not reap enough value from their controls-work to benefit front-line businesses.

So, while investment firms face growing and evolving risks, staff find the risk assessment process too onerous. A potential remedy for this disquieting situation is the introduction of advanced technologies at an earlier stage in the maturity curve, to process data and deliver insights that are of value to the business as well as to GRC teams at an earlier stage. How and when precisely the AI-enabled tools could be applied, and the benefits that could be gleaned, can be illustrated by exploring their potential application in the context of real-world historical engagements.

Discover more here.

What has caught our eye?

Why Operational Resilience is Important in the Context of T+1

As the US market prepares for an industry-wide transition to T+1 settlement, organisations will need to reassess their operational strategy, resilience frameworks, and impact tolerance levels. FIX Global takes a look at some of the nuances involved in adjusting their operational resilience in the face of this major structural shift in capital markets.

The tokenisation of assets and potential implications for financial markets

This report by OECD takes a deep dive into the asset tokenisation trend, and the potential implications it can have for financial markets. In particular, it assesses the benefits, risks, and the underlying technologies behind asset tokenisation. If you want to really understand more about this topic, then this report is for you!

Broker-dealers in the modern post-trade financial landscape

Alessandro Cavallari and Steve Gutowski of Societe Generale Securities Services discuss the evolving post-trade landscape, emphasising brokers' need for technological adaptability and strategic partnerships with settlement agents. With an increasingly competitive and digitised landscape, it is vital that broker-dealers continue to stay ahead of the curve, and offer solutions that legacy technologies can’t match.

Have your say

We’d love to hear from you. What topics would you like to see us cover in the coming weeks? Comment down below.