Hello everyone and welcome to the latest edition of GreySpark Insights.

We hope you all had an enjoyable festive period, and we wish you a happy and productive 2024.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

💥Top story

EU reaches provisional agreement on AI Act, paving way for landmark law

📰Newsflash

📈Buyside

BlackRock enters next phase of platform integration with Tradeweb

Tradeweb Markets has introduced the next phase of its platform integration with BlackRock’s Aladdin order execution management system (OEMS). The next stage of this partnership will provide Aladdin users trading US and European credit with access to enhanced liquidity via Tradeweb AllTrade, Tradeweb’s network of anonymous liquidity. In the first phase of the partnership, commencing in December 2022, Aladdin users gained access to real-time prices for around 25,000 corporate bonds using the service.Since its launch in 2017, Tradeweb AllTrade’s institutional all-to-all trading now represents 28% of RFQ electronic volume.

Private equity firms hold a record $2.59trn of ‘dry powder

According to S&P, capital waiting to be deployed in the private equity market, otherwise known as dry powder, rose 8% to a record $2.59trn in the past year. S&P said the mountain of unused capital in the industry comes after a slow year in dealmaking “with limited opportunities” for firms that have raised money from investors in recent years. However, with PE firms sitting on their hands for the last year or so, against a backdrop of high policy interest rates, PE firms may now be gearing up to unleash this capital, with the US Federal Reserve indicating three interest rate cuts next year.

📉Sellside

Bank of England makes history in becoming the first to see blockchain payment

Fnality, a blockchain-based wholesale payments firm, said this week that shareholders Lloyds Banking Group, Santander, and UBS had completed the "world's first" live transactions that digitally represent funds held at a central bank. Fnality seeks to bridge the gap between mainstream and digital finance to cut the time and cost of settling, managing collateral, and making real-time wholesale payments for financial market transactions on a global scale.

European Central Bank to run first cyber resilience stress tests

The ECB is set to conduct its first stress tests on cyber resilience to determine how well individual banks would respond to and recover from a cyber attack. The tests, conducted with 109 banks, simulate scenarios in which cyber attacks succeed in causing disruptions to banks’ business operations. Banks will then test their response and recovery measures, including activating emergency procedures and contingency plans and restoring normal operations. The exercise will assess how banks respond to and recover from a cyberattack, rather than their ability to prevent it.

✴️Digital transformation

BlackRock rolls out GenAI to staff and clients

BlackRock has announced the rollout of generative AI tools for January 2024 in a bid to embrace the new technology. The world’s largest investment manager has already begun using GenAI to support its in-house risk management systems (Aladdin and eFront), a leaked internal memo reveals. BlackRock are now planning to roll the GenAI feature out to clients, who will be able to use their large language model (LLM) to extract information from Aladdin.

EU reaches provisional agreement on AI Act, paving way for landmark law

Following a round of intense negotiations this week, lawmakers in Brussels have now reached a “provisional agreement” on the European Union’s proposed Artificial Intelligence Act (AI Act). The EU’s AI Act is anticipated to be the world’s first comprehensive set of rules to govern AI and could serve as a benchmark for other regions looking to pass similar laws. According to the press release, negotiators established obligations for “high-impact” general-purpose AI (GPAI) systems that meet certain benchmarks, like risk assessments, adversarial testing, incident reports, and more. It also mandates transparency by those systems that include creating technical documents and “detailed summaries about the content used for training.

📱Technology trends

SimCorp and Alloy partner to improve management of digital asset investments for clients

Deutsche Börse Group subsidiary SimCorp and infrastructure and technology provider for digital assets, Alloy, have entered a strategic partnership to assist SimCorp clients with managing digital asset investments.

The partnership will extend past standard digital asset broker connectivity, enabling mutual clients to manage digital assets holistically within SimCorp’s front-to-back investment management platform.

The solution will provide joint clients with one single source for traditional, alternative and digital asset classes.

HSBC to challenge Revolut and Wise with new forex app

HSBC has introduced an international payments app and debit card in an effort to challenge fintechs Revolut and Wise for a slice of the booming market for wealthy customers. On 3 January, 2024, HSBC released the new app, called Zing, for iOS and Android customers. The service, which will be open to non-HSBC customers, is set to launch in the UK and be rolled out in up to 200 countries in the coming months. HSBC noted that members could initially hold 10 different currencies in the app without point-of-sale conversion fees and make international transfers across more than 30 currencies.

🧑⚖️Regulatory developments

ESMA’s Call for Evidence (CfE) on the shortening of the settlement cycle, closed earlier today, 15 December, with the watchdog now considering a wide spectrum of outcomes following industry feedback. The CfE was designed to assess the costs and benefits of a possible reduction of the settlement cycle in the European Union (EU). It also assessed whether any regulation would be required to help ease the impact of the shift to T+1 on other jurisdictions outside Europe, such as the US. Following feedback received from the consultation period, ESMA has confirmed that it will consider all possibilities for a shortened settlement cycle, which includes both T+1 and a potential T+0.

SEC adopts landmark new clearing rules for US Treasury market

The Securities and Exchange Commission (SEC) has adopted major rule changes for the $26 trillion US Treasury market requiring more trades to be centrally cleared. The US watchdog is looking to bolster risk management practices for central counterparties in the US Treasury market and facilitate additional clearing of US treasury securities transactions through forcing some cash Treasury and repos to be centrally cleared.

The SEC stated that additional rule changes are designed to reduce the risks faced by a clearing agency and incentivise and facilitate additional central clearing in the US treasury market.

📊Chart of the week

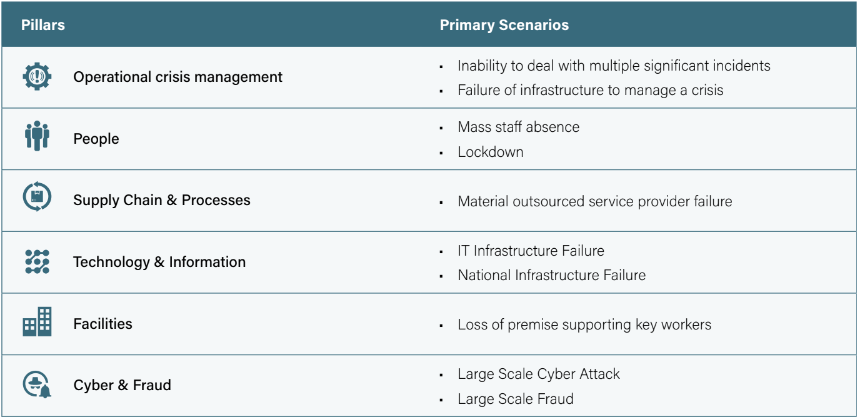

Categorised Examples of Primary Scenarios to be Tested

Source: GreySpark analysis

The table above shows typical scenario testing situations that financial institutions partake in across various business lines, in order to improve their operational resilience in the face of disruption.

🐤Tweet of the week

2023 saw the lowest total for global venture capital invested since 2017. After 18 months of mania across 2021/22, the pullback in VC funding was arguably expected, especially given a backdrop of high interest rates and geopolitical tensions, which inevitably impacted investor confidence.

Nevertheless, according to Pitchbook analyst Nalin Patel, the value of the average VC deal size had stayed comparatively steady. For example, median deal sizes for EU-based startups remained at new all-time-highs across all stages of VC in 2023. Additionally, with risk-on assets starting to become more favourable again, highlighted by the steep rise in technology company valuations and cryptoassets at the back end of 2023, and indications of falling policy interest rates, the signs are arguably pointing toward a better year for VC growth.

📄GreySpark insight

GreySpark Partners has observed ambiguities in the Digital Operational Resilience Act (DORA) regulations and an absence of ‘best practice’ guidelines for firms implementing a digital operational resiliency testing framework, ahead of its 2025 enforcement date. Specifically, DORA does not provide guidance on how much firms should aim to spend on cybersecurity, and there is a lack of clarity on the methods that firms should employ to adequately mitigate potential threats. Consequently, many firms are unsure of what a ‘good’ operational resiliency framework looks like, leaving them at risk of not achieving full DORA compliance ahead of the 2025 deadline.

Given that UK financial firms have been subject to operational resiliency regulations from the Prudential Regulatory Authority (PRA), Financial Conduct Authority (FCA) and Bank of England (BoE) since March 2022, EU financial firms may be able to glean learnings from the UK experience. GreySpark has observed that UK firms have found it difficult to fit operational resilience into a one-size-fits all framework since each firm faces its own unique challenges. Even so, they have often received less ongoing regulatory feedback and guidance than they would have preferred. This suggests that EU firms could potentially find their own regulators to be less prescriptive about what a firm’s compliance with DORA should look like. Nevertheless, firms are required to press ahead and, under the terms of DORA, they must run comprehensive scenario testing of their security and resilience and fully address any vulnerabilities identified by that testing. Specifically, DORA legislation requires firms to carry out business impact analyses based on ‘severe business disruption’ scenarios, and fully address all detected vulnerabilities. This is likely to increase supervisory pressure on firms to develop more sophisticated scenario testing methods, and to build redundancy and substitutability into the systems that support the Critical Important Functions (CIFs).

GreySpark’s opinion is that achieving the appropriate level of scenario testing sophistication and precision required under the terms of DORA is likely to only be possible through the use of AI technology. Traditional scenario testing methods, which can be clunky and error-prone, just will not cut the mustard. Additionally, further clarification on resilience testing requirements under DORA is due to be released in Q4 2024, so in-scope firms are essentially required to be compliant with legislation that has not yet been fully outlined.