Know your client (KYC) refers to the processes used by financial institutions to verify a customer’s identity and help protect against practices such as fraud, corruption, money laundering and terrorist financing.

As the global financial system has become increasingly interconnected and digitised, with growing ties between financial institutions and corporate companies across different jurisdictions, the need for robust and digitised KYC protocols has materialised.

Historically, face-to-face (FTF) meetings between prospective clients and financial institutions have been necessary during client onboarding to authenticate documentation and verify identities. However, these in-person meetings are no longer necessary, where suitable processes and technology are in place to replace them. Not only will the end-to-end process for account opening be completed more quickly, but it will facilitate additional cross-border business for firms in those regions that permit it.

Below shows the main drivers of increased NTFTF KYC in 2024.

Digital Transformation in Banking - With most banking & financial activities moving online, customers expect to open accounts, and access services without needing to visit a physical branch. Also, Neobanks (digital-first banks operate without physical branches, making NFTF KYC a necessity).

Unlocking of Cost Efficiencies - NFTF KYC reduces the costs associated with physical branches, document handling, and manual verification processes. This makes it a cost-effective solution, especially for FIs looking to scale quickly.

Regulatory Flexibility - Globally, most regulators have altered their guidelines to accommodate NFTF KYC – providing frameworks to allow for secure, remote identity verification. These can include video KYC (v-KYC), digital identity verification, and biometric checks.

Technological Advances - New technologies have made NFTF KYC more secure and efficient. These technologies include AI-based facial recognition, machine learning for document verification, and digital identity verification platforms.

Lasting Impact of the Pandemic - The pandemic accelerated the adoption of remote KYC procedures, as in-person interactions became restricted. Through adopting NFTF KYC, FIs adapted quickly to ensure business continuity while remaining compliant.

With non face-to face (NFTF) KYC becoming increasingly popular, the Financial Action Task Force (FATF), a prominent international standard-setting body focused on money laundering, has this decade laid out a series of updated recommendations for financial institutions to consider when onboarding clients without interpersonal contact.

As such, a standard framework for non face-to face (NFTF) KYC has emerged across the globe, which is typically the provision of secure, remote identity verification. These typically include video KYC, digital identity verification (including contact information and government-issued documentation) and biometric checks.

In fact, Hong Kong’s financial services regulator, the Securities and Futures Commission (SFC) and Singapore’s Monetary Authority of Singapore (MAS) have trailblazed the response to the FATF recommendations by setting out closely aligned requirements that they believe financial institutions should follow to onboard clients using a NFTF approach.

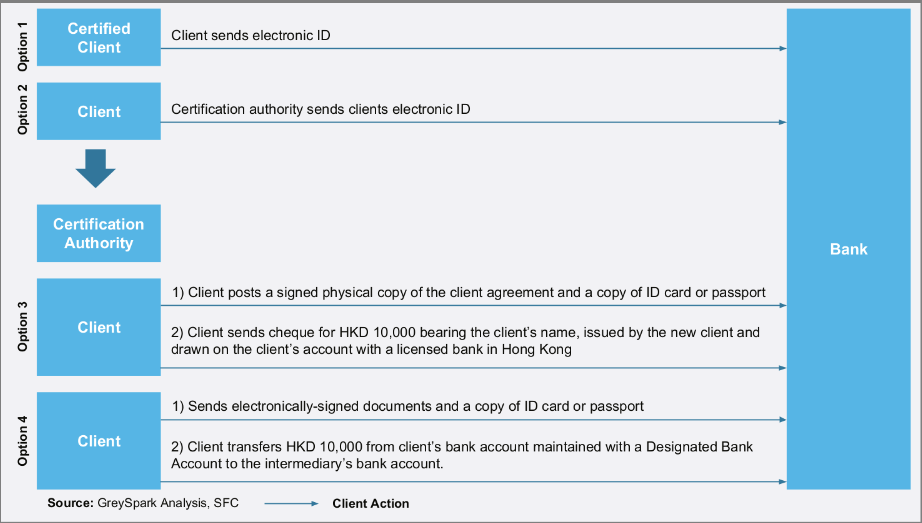

Figure 1: Four Acceptable Methods for the NFTF Client Onboarding of HK Residents

As Mandated by the SFC*

Source: GreySpark analysis

Option 1 - Client signs the agreement, witnessed and certified by an approved individual (e.g., branch manager of the onboarding FI).

Option 2 - Certification authority (e.g., DocuSign) electronically verifies and certifies the client's identity and documents. Authority may be based overseas but must be approved by the regulator.

Option 3 - Client mails a signed agreement and identity documents, plus a cheque for HKD 10,000 from their Hong Kong bank account.

Option 4 - Client electronically signs the agreement and transfers HKD 10,000 from their own Designated Bank Account** in Hong Kong.

However, globally, ensuring efficiency in KYC processes continues to be an achilles heel for financial institutions.

GreySpark observes several pain points:

On average, it takes between 31-60 days for banks (globally) to conduct a KYC review for a single corporate client.

The average cost of completing a single KYC review for a corporate is $2,200.

Currently, the average increase in year-on-year cost of conducting a KYC review in the capital markets industry is 17 per cent.

This data underlines the importance of utilising more efficient and digitised KYC processes.

One such example is Singapore’s MyInfo platform, which is a specialist digital identity platform built to streamline KYC checks via automation.

Specifically, MyInfo is a government-maintained platform, storing personal data from various public agencies for use by private sector entities. Singapore financial institutions (SFIs) can use MyInfo to identify and verify Singapore citizens and residents. MyInfo allows SFIs to verify key details such as a customer's name, unique ID number, date of birth, nationality, and residential address.

In fact, according to data from Fenergo, investing in a third-party KYC solution can give banking analysts a 30 per cent increase in productivity, while also providing a 20 per cent reduction in costs over the lifetime of a KYC platform investment.

This poses the age-old question of whether firms should ‘buy’ or ‘build’ a KYC platform themselves. The table below weighs up the argument for both options.

Source: GreySpark analysis

Opting to buy a third-party solution allows FIs to implement quickly with lower upfront costs, benefitting from ready-made compliance, fraud detection, workflows & STP, that meet regulatory standards. This approach can streamline onboarding processes and avoid the resource-intensive maintenance of an in-house system.

Developing a KYC solution in-house provides FIs a customized system, tailored to specific operation and strategic needs. While more flexible, it requires substantial time & cost investment for development, integration, & ongoing updates top adapt to regulatory changes. Building in-house can offer a competitive edge through unique functionalities but demands strong expertise and long-term commitment.

Either way, financial institutions must ensure that their KYC processes in an increasingly digitsed world are optimised in order to ensure both operational efficiency and compliance.

For further information, please do not hesitate to contact us at london@greyspark.com with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective.