For around a decade after the inception of Bitcoin, the traditional finance and cryptoasset worlds stayed separate from one another. On both sides, scepticism remained towards the opposing side. From financial institutions, scepticism stemmed from the lack of regulatory oversight, with the mysterious world of crypto, in their eyes at least, being as good as dirty money and a deeply taboo topic that sought to usurp the centralised nature of finance. From the retail side, the intention of crypto was to remove centralised involvement and take monetary control and influence away from the institutions.

However, since 2018, the traditional finance and cryptoasset worlds have been integrating at breakneck speed, altering modern day finance as we know it. Aside from advancements in education and regulatory frameworks outlined above, a realisation has come that the traditional finance and cryptoasset worlds may benefit from each other. From the institutional side, the application of blockchain technology (that originated in cryptoasset markets) to traditional securities can greatly improve trade efficiency, by increasing speed and enabling seamless cross-border settlement with the highly securitised cryptographic protection that blockchain provides. From the retail side, the arrival of institutional capital can help to deliver long term-value to holders, through greater returns on crypto investments, market liquidity, and through the development and maturation of crypto market infrastructures.

With the two worlds becoming increasingly intertwined, something of a Medici effect in capital markets has ensued; defined as when intersectionality between two trends leads to the most powerful innovations being created than in one trend alone.

GreySpark observes the impact of cryptoassets on traditional finance in 2024 in two ways:

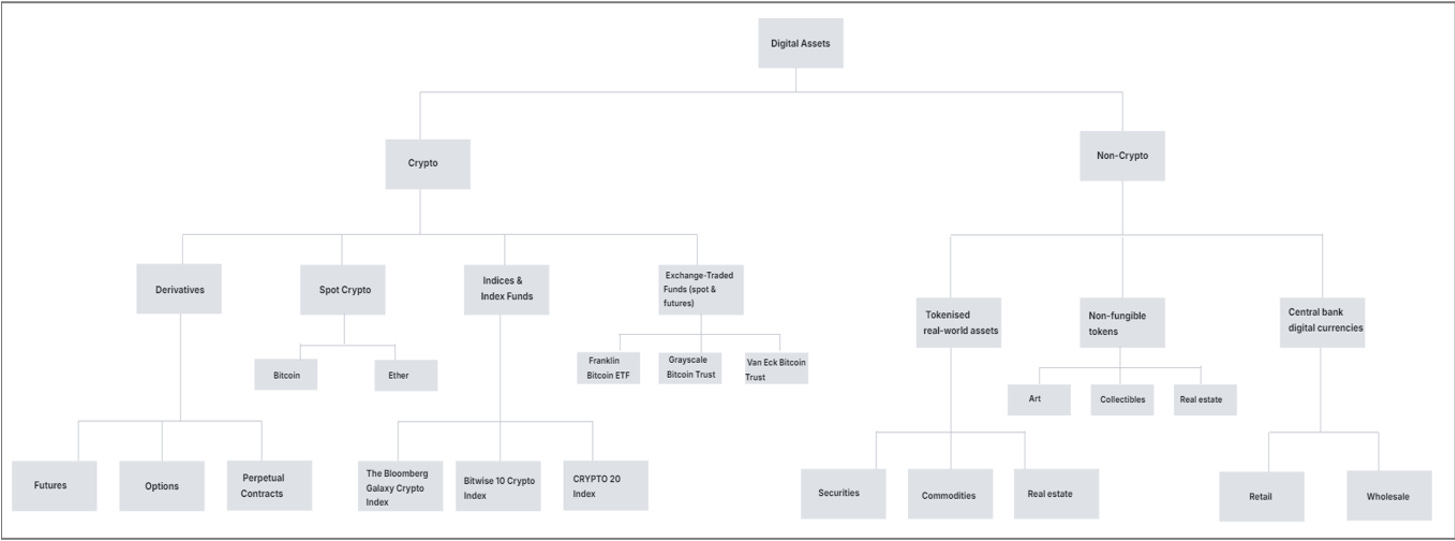

1. The emergence and proliferation of blockchain or distributed ledger-based digital assets. These include tokenised real-world assets (including securities, commodities and real estate), non-fungible tokens (NFTs), and central bank digital currencies (CBDCs), as defined in further detail below.

2. The replication of financial products found in traditional markets in the crypto world, including crypto-based derivatives, indices, index funds and Exchange-traded funds.

Source: GreySpark analysis

The figure above shows these similarities between the crypto world and traditional finance worlds. Perhaps an indicator of the growing legitimacy of the cryptoasset industry is the offering of crypto-centric products from reputable capital market firms. One such example is The Bloomberg Galaxy Crypto Index, which is a benchmark designed to measure the performance of the largest cryptocurrencies traded in USD. In addition, the emergence of specialist cryptoasset investment firms is leading to new product innovations. One example is Bitwise Asset Management’s Bitwise 10 Crypto Index Fund, which tracks an index of the ten most highly valued cryptocurrencies. It has a minimum investment threshold of $25,000. Bitwise’s index fund is an example of how leaning on investment strategies seen in the traditional finance world is improving confidence towards digital (and crypto) assets at an institutional level.

To be clear, while all cryptoassets are digital assets, not all digital assets are cryptoassets.

Broadly speaking, digital assets are a virtual representation of an underlying product, asset or item that owners can recognise to have value. Like in crypto markets, a core component of digital assets in traditional markets is the use of blockchain-based digital ledgers to record asset ownership and transactions. This structure enables the transfer of digital assets without the need for a central party or intermediary.

Other than cryptoassets, there are three main types of digital assets, which are:

· Non-fungible tokens: Are non-interchangeable digital assets that produce a blockchain record intrinsically connected to a real-world object such as art, digital content or media. The most expensive NFT ever sold is ‘The Merge’, a digital piece of artwork which fetched $91.8 million.

· Tokenised real-world assets: Are digital tokens on a blockchain that represent a traditional financial or physical asset, such as securities, commodities and real estate.

· Central Bank Digital Currencies: CBDCs are a new type of digital money underpinned by blockchain or distributed ledger technology issued by a country’s central bank. CBDCs differ from traditional fiat currency in the sense that they are liability of the central bank, rather than being created and held on the balance sheets of commercial banks. There are two types of CBDC: retail and wholesale. Retail CBDCs have wider use, being issued for the general public and tailored to facilitate smaller transactions between people and businesses. On the other hand, wholesale CBDCs are optimised for financial institutions who hold reserve deposits with a central bank and are used to facilitate large cross-border settlement asset in the interbank market. Only three countries have fully launched a CBDC (Jamaica, Nigeria and The Bahamas), with more than 100 CBDC projects currently in pilot stages. However, the long term potential of CBDCs is currently uncertain.

With digital assets still in their infancy as an asset class, much excitement and uncertainty around how their integration into the global financial system remains.

Standby for further information on the institutional adoption of digital assets, when we release our ‘Trends in Digital Assets’ report later this quarter.

For further information, please do not hesitate to contact us at london@greyspark.com with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective.