The Subtle Difference Between High Frequency and Algorithmic Trading

HFT v Algo

Electronic trading or E-trading, has evolved progressively since its inception in the 1980s and now consists of several subsets, including algorithmic and high-frequency trading. Even so, this covers a multitude of different subsets, including including direct connectivity and application programming interfaces (APIs), multi-dealer platforms (MDPs) and single-dealer platforms (SDPs). Specifically, high frequency trading (HFT) and algorithmic trading are conflated, however there are subtle but important differences.

Algorithmic trading uses mathematical models to make and implement trading decisions. For instance, an algorithms could seek to execute an order at the optimal time, or price, resulting in the lowest possible impact on prices or maximising profit. Complex algorithms are often suitable for large block trades. Algorithms execute orders using automated and pre-programmed trading instructions to account for variables such as price, volume and timing. Within large financial institutions, algorithmic trading systems are popular due to the sizeable trading volumes they can handle. In fact, you can take a look at our recent Substack article about algorithmic trading here.

In comparison, high-frequency trading (HFT) is a subset of both e-trading and algorithmic trading that processes and executes large numbers of trade orders at high speeds. Through the use of complex algorithms, computerised trading systems analyse market conditions and then execute trades. The motivation for banks and hedge funds to engage in HFT may also come from financial incentives offered by exchanges to firms that bring liquidity to the market.

It is often difficult to articulate the distinction between HFT and algorithmic trading. Though they share some characteristics, especially in terms of the technology used and market data inputs, algorithmic trading is an execution tool aimed at building and disposing of a position; there is a genuine investment decision behind it aside from exploiting price imbalances or short-term market making opportunities, unlike with HFT. Smart order routing (SOR) and basic execution algorithms like volume weighted average price (VWAP) are not HFT methods. These tools automate the execution of large orders with the aim of minimising market impact.

In contrast, HFT is largely characterised by the speed of execution of those orders. GreySpark defines HFT as computerised and automatic trading characterised by order submission rates (orders per second) that are much higher than what is humanly possible. HFT is mainly conducted by principal traders in hedge funds and to a lesser degree, by trading desks in large investment banks.

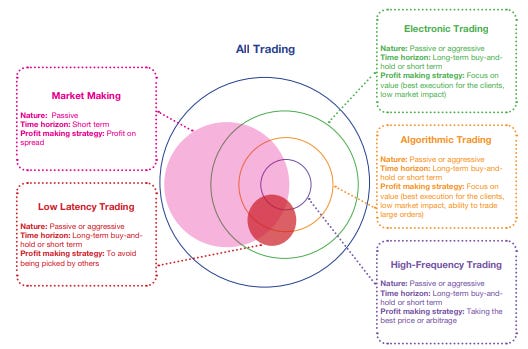

In fact, below, we can see how algorithmic and HFT fit into the wider trading ecosystem, along with low latency trading and market making. Low latency is a prerequisite in many markets for gaining access to good pricing, which is a necessary but not sufficient condition to label a strategy as HFT. Market making is a stand-alone model that uses a high degree of automation to provide two way quotes on securities to traders, with the market maker profiting on spreads.

Source: GreySpark

Algorithmic trading and HFT come with their own pros and cons. HFT may provide more opportunities for profit for the trader due to the large amount of executions that are taking place. Using HFT strategies, traders can capitalise on even the slightest movement of an asset’s price. However, as a consequence HFT can, in some instances, bring higher market volatility than pure algorithmic trading.

In the past, HFT has often been blamed for negative events such as flash crashes, with the infamous 2010 Dow Jones Industrial Average index 1000-point price drop a prime example. However, due to the technical nature of HFT, it is difficult to accurately assert that this trading style is always entirely responsible for adverse market conditions.

Nevertheless, this has not prevented HTF from being used as a scapegoat for market adversities by market participants and being brought into regulatory scope. In fact, HFT was regulated under the terms of MiFID II in 2018. Trading firms engaging in high-frequency trading techniques, defined as a trading scenario where a specific trader sends at least two messages per second for a single instrument on any trading venue, or at least four messages per second in respect to all instruments being traded on a venue, must be authorised as an investment firm.

In contrast, algorithmic trading is generally perceived as being more efficient and ‘safer’ than HFT, because it is less likely to exacerbate price movements in the way that HFT does and may therefore, provide a more accurate picture of what an asset’s true price is. However, although algorithms still execute trades with speed and precision, it is slower nature in comparison to HFT and could give less trading opportunities. With algorithms growing in popularity and accounting for nearly 40% of trade volumes in the capital market industry in 2023, it is vital that financial firms understand the implications of using specific algorithmic-based strategies, which includes algorithmic trading itself and HFT.