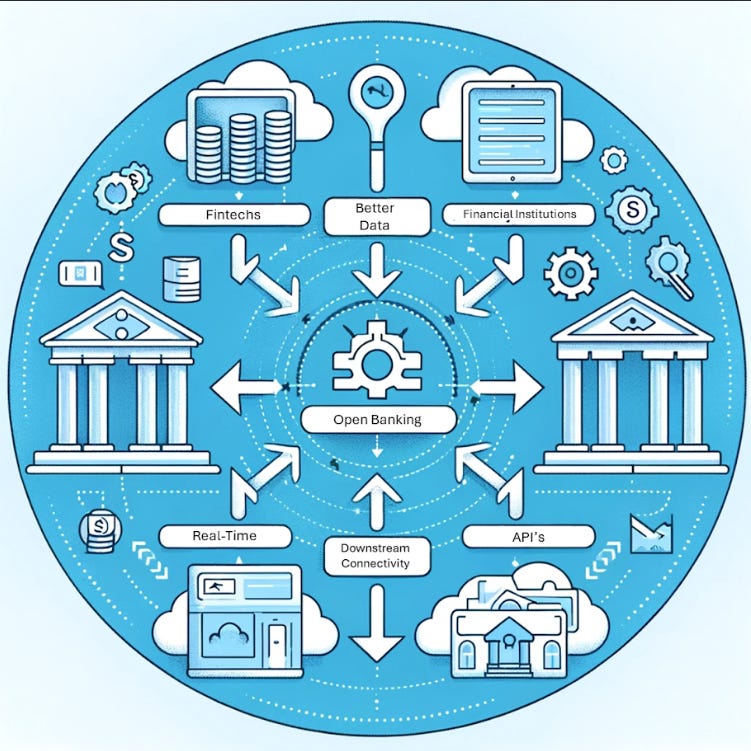

Open Banking is revolutionising the financial services and capital markets industries. By allowing third-party developers to access financial data in traditional banking systems through application programming interfaces (APIs), open banking enhances transparency, competition, and innovation, while also helping to improve trading strategies, risk management, and create more personalised financial services.

At the core of open banking are APIs, which facilitate secure and standardised data sharing between financial institutions and third-party developers. These APIs enable access to critical market data, real-time trading information, and customer investment profiles, allowing for more sophisticated and timely decision-making in capital markets. By integrating APIs, capital market technology and trading platforms can offer seamless access to a broader range of financial instruments, execute trades faster, and provide enhanced analytics and reporting capabilities.

Impact on Capital Markets

Open banking significantly impacts both buyside and sellside firms. For buyside firms, it provides enhanced access to market data, enabling more informed trading decisions and sophisticated investment strategies. Sellside firms benefit from streamlined processes and improved customer interactions through more efficient data management and transaction capabilities. For example, investment firms can use real-time financial data to optimise portfolio management and execute trades more effectively.

Buyside

For buyside firms, open banking facilitates enhanced access to real-time market data and liquidity, enabling more informed trading decisions. APIs allow investment managers to integrate various data sources directly into their trading platforms, providing a consolidated view of market conditions and investment opportunities. For instance, portfolio managers can use open banking APIs to pull data from multiple brokerage accounts, aggregate it, and perform complex analytics to optimise asset allocation and risk management strategies.

Additionally, open banking enables automated trading strategies. Quantitative traders can leverage high-frequency trading (HFT) algorithms that automatically execute trades based on pre-defined criteria. The ability to access and process vast amounts of financial data in real-time -through an API - allows for more better execution, lower latency and improved market responsiveness.

Buyside use case: A hedge fund leverages open banking APIs to integrate market data, trading signals, and portfolio management tools into a unified platform. This integration allows the fund to execute trades based on real-time analytics and optimise portfolio performance dynamically.

Sellside

On the sellside, investment banks and brokerage firms can benefit from enhanced client interactions and more efficient execution services. By utilising open banking APIs, these firms can offer their clients real-time access to trading data, personalised investment recommendations, and seamless transaction capabilities. For example, a brokerage firm can integrate client portfolio data with market data to provide tailored trade ideas and risk assessments, enhancing the client advisory process.

Sellside use case: An investment bank uses open banking APIs to offer a client-facing platform that provides real-time market analysis, trade execution, and personalised investment advice. This enhances client engagement and streamlines the advisory process.

Fintech Innovations and Open Banking

Fintech firms are at the forefront of the Open Banking transformation, developing cutting-edge solutions that cater to both buyside and sellside firms.

For instance, fintech companies like TrueLayer and Yapily provide open banking infrastructure that facilitates the aggregation and analysis of data from multiple sources. This capability is particularly beneficial for buyside firms, which can leverage these technologies to improve portfolio management and optimise trading strategies through a comprehensive view of market conditions. Similarly, sellside firms benefit from enhanced client engagement and streamlined trading operations, enabled by real-time insights and personalised services offered through these advanced API solutions.

In addition, open banking significantly enhances retail payment systems by enabling more efficient and secure transactions. Through the use of open banking APIs, consumers can make direct payments from their bank accounts, bypassing traditional card networks and reducing transaction fees. This facilitates faster and more cost-effective retail payments, benefiting both consumers and merchants.

A record 9.7 million open banking payments were made in June 2023, an increase of 88 per cent on the same month in 2022. The value of open banking transactions reached $57 billion in 2023. According to Statista, the value of open banking transactions will increase to $330 billion by 2027.

Open banking is a transformative force in the capital markets sector, driving enhanced transparency, competition, and innovation. By using APIs, financial institutions and fintech firms are revolutionising data sharing and integration, which in turn improves trading strategies, risk management, and improved client/customer services. Open banking is set to further transform capital markets, fostering an environment of greater efficiency and innovation, ultimately providing opportunities for all players in the sector.