Short selling is a trading strategy where investors aim to make money when a security’s value falls. While traders may use short selling for speculative purposes, investors or portfolio managers can also use it to hedge against risks in long positions.

In the APAC region, short selling has recently been fraught with controversy and has attracted close regulatory scrutiny. In 2023, the Financial Services Commission (FSC), South Korea’s financial regulator, imposed a total penalty of KRW 26.5 bn (USD 20.4 million) on two global conglomerates for naked short selling.

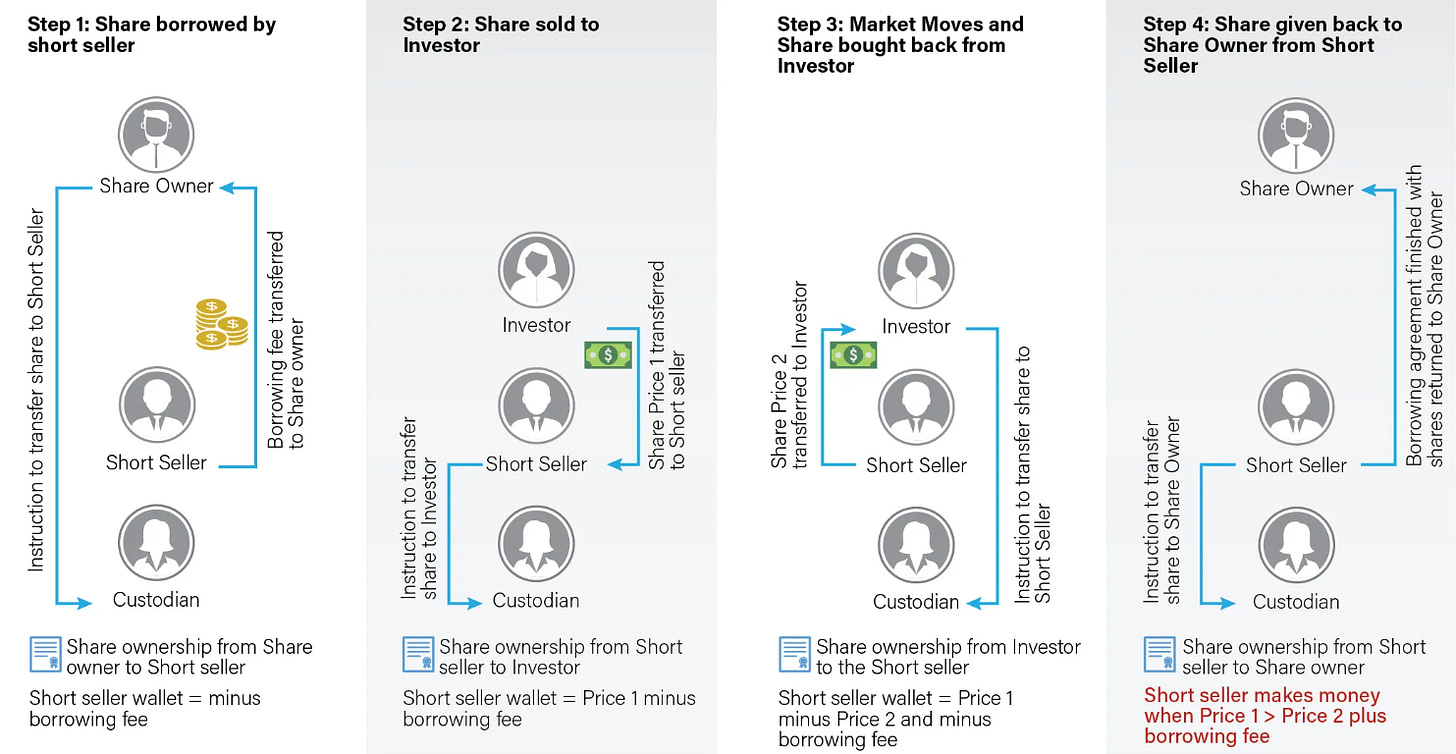

Source: GreySpark analysis, figure 1

In terms of the short selling process, the short seller borrows shares of a stock from their owner and sells them to a third party with the intention of buying them back at a lower price, before returning them to their owner. If, after the short seller has sold the borrowed stock, their price drops, the short seller purchases the shares at the reduced price, returns them to the lender and keeps the profit. If the stock price rises, the short seller can face significant losses. This is because the stock’s increasing value forces other short sellers to buy back shares to cover their short positions, driving the price they must buy back the stock at even higher.

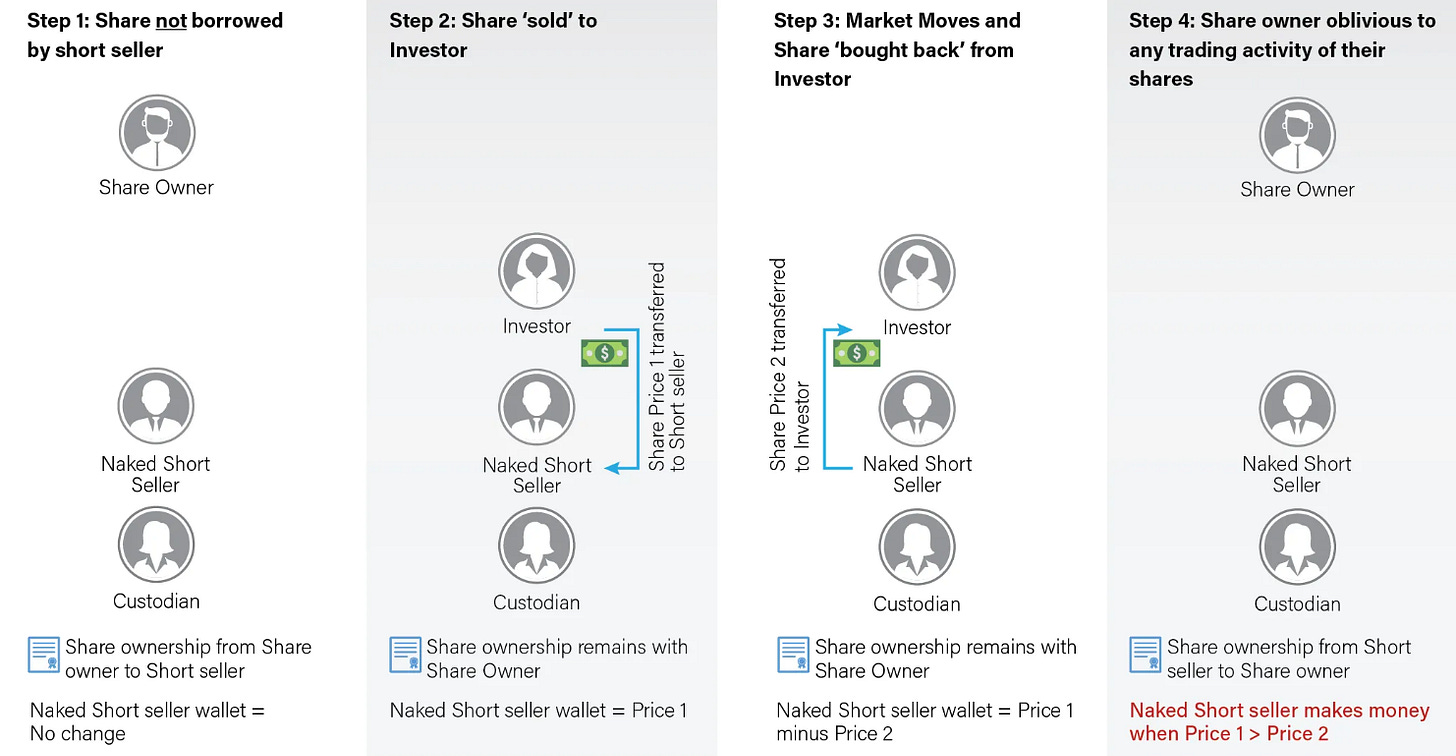

In contrast, naked short selling is the unauthorised sale of shares without owning, borrowing or securing the right to borrow them.

When naked short selling occurs, the custodian does not transfer ownership of any shares and the investor never owns the shares they have ‘purchased’, as shown in Figure 2 below. It is considered illegal in many jurisdictions due to the substantial risk and potential to cause significant market disruption. This practice poses a particularly high risk due to the prospect of unlimited losses. The illegality of naked short selling is rooted in various crucial concerns:

Source: GreySpark analysis, figure 2

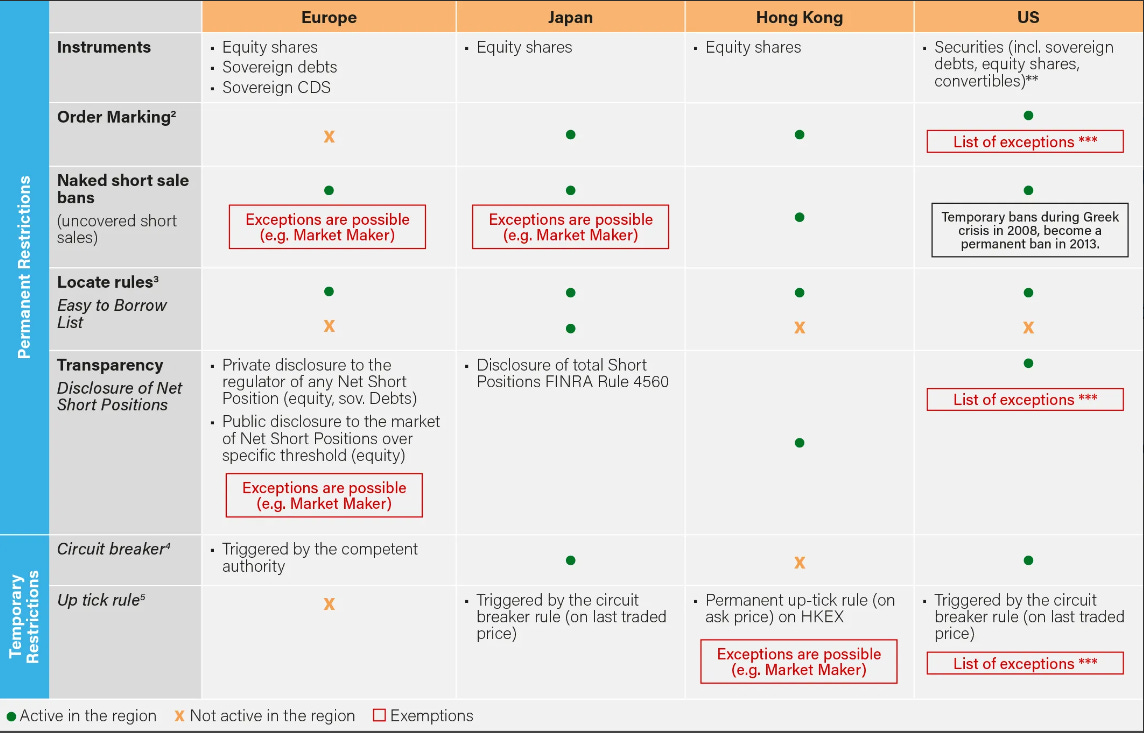

Naked short selling is banned by most exchanges – with certain exceptions that apply to market makers. Nonetheless, regulations for short selling vary around the world. Figure 3 provides an overview of short-selling regulations globally and compares their key characteristics.

Source: SFC, FSA, SEC, FCA and GreySpark analysis

Order Marking identifies trades as short sales for transparency and regulatory compliance purposes. This helps to ensure that the market accurately reflects the nature of the trades being executed.

Locate Rules require a broker-dealer to have reasonable grounds to believe that the security can be borrowed so that it can be delivered on the delivery date before effecting a short sale order.

Circuit Breaker Rule is designed to allow a temporary halt or restriction of short sales of an asset when the price drops sharply. The aim is to prevent excessive market volatility.

Uptick Rule requires short sales to be executed only at a price higher than the last different price or at an increment above the last trade. The aim is to prevent excessive downward pressure on the stock price.

Multinational financial intermediaries face significant challenges due to the regulatory complexity of short-selling rules across different jurisdictions, as depicted in Figure 3. Ensuring compliance with these diverse regulations requires a deep understanding of the individual jurisdiction’s specific requirements, such as disclosure rules, uptick rules and restrictions on stock eligibility for short selling.

A comprehensive framework for regulatory compliance includes the implementation of robust trading platforms that adhere to specific rules, such as the up-tick rule. The framework should be combined with a governance structure that ensures the continual monitoring and updating of exchange rulebooks. Specialised staff are essential for monitoring and adhering to various regulations. These staff members should be responsible for ensuring that internal procedures are continually reviewed, updated in the rulebooks and effectively integrated into the system.

GreySpark has designed a model which will allow firms to prevent and identify instances of naked short selling, which we will look at more closely over the coming days.

For more information, please head over to our website.