Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

A glance at recent headlines could suggest that something is in the water;

Over the past 14 days, J.P. Morgan, BlackRock, and Barclays have all participated in a tokenised trade on JP Morgan's new Tokenised Collateral Network on Onyx;

Last month, Citigroup unveiled a tokenisation service for cash management and trade finance for institutional clients using blockchain technology and smart contracts;

Just two weeks ago, UBS announced it is piloting a tokenised money market fund on the Ethereum blockchain.

Financial institutions, mainly on the sellside, are possibly awakening to the potential of a new era of capital markets infrastructure — asset tokenisation.

In truth, the transition to asset tokenisation has been years in the making, with large financial institutions such as Deutsche bank and BNP Paribas already dipping their toes in the tokenised assets market, as this timeline below shows:

However, now more than ever before, financial institutions increasingly find themselves at an inflection point. With the growing influence of fintechs, and the rise to prominence of disruptive technologies such as AI and blockchain, financial institutions must continue to innovate to stay relevant to the times. Asset tokenisation arguably represents the perfect opportunity to do so.

On the surface, asset tokenisation may sound like a trend that’s native only to the cryptocurrency world. Although the provenance of the technology that underpins tokenised assets such as blockchain and smart contracts can be traced back to the crypto industry, asset tokenisation is not about crypto.

Asset tokenisation is about the creation of more efficient and inclusive securities markets — albeit, through leveraging the benefits given by blockchain, such as security, speed and traceability.

So, what actually is asset tokenisation?

Asset tokenisation involves representing the ownership rights of real-world assets (namely securities such as equities and bonds, real estate and collectibles) as digital tokens on a blockchain. Tokens can be bought, sold, and traded in a manner that is arguably more efficient and potentially more accessible than traditional markets. When understanding asset tokenisation, it’s helpful to look at an example.

Take a private equity fund. Private equity funds are historically illiquid and opaque, and out of reach from the everyday investor. These funds carry high minimum investment thresholds, typically upwards of $500,000, making them only really accessible by high net worth clients and institutions.

With tokenisation, a $10 million private equity fund could be divided into 100 tokens, with each redeemable token representing $100,000 worth of ownership of the fund. Through this process, also known as fractionalisation, market liquidity, democratisation and diversification improves, unlocking value that was previously inaccessible. What’s more, a previously bureaucratic settlement and exchange process becomes streamlined, due to speedy, cross border transfers offered via blockchain technology. Crucially, the immutable nature of the code that underpins blockchain technology means that each unit is tamper proof. Smart contracts automatically enforce fixed actions related to a particular tokenised asset; for instance, asset ownership is transferred to the investor upon payment for the asset. Additionally, the use of ‘middle men’ such as intermediaries may no longer be necessary, meaning lower costs of transactions.

At a high level, the asset tokenisation process is as follows:

In verifying ownership of the asset, collateralization data needs to be relayed ‘on-chain’ from off-chain bank accounts or vaults to ensure that the tokens are backed by an equivalent amount of collateral assets. In such cases, a third party, such as a licensed auditor, must verify that the corresponding value of the asset is being held off-chain, ensuring while also verifying the issuer.

Then, the issuer must outline the ‘tokenomics;’ for example, how many tokens are going to be created and what value each token denotes, before deciding what blockchain platform to issue the tokens on, i.e., public or permissionless blockchains. The Ethereum blockchain is often used to facilitate the creation exchange of tokenised assets. Alongside this, smart contracts underpinning the asset are integrated and audited, before the tokens are released on the secondary market via digital platforms and exchanges (typically crypto exchanges at this stage). Tokenised asset exchanges often integrate compliance and reporting tools to monitor transactions, ensure regulatory compliance, and generate audit reports. It’s customary for token issuers to undergo testing phases before release, with specialised vendors or consultancies helping to oversee the wider asset tokenisation process.

Any trades are then settled and stored via the specified blockchain network. For institutional investors, blockchain-oriented custody solutions with additional layers of security are required. At a high level, you can see the tokenised asset trade process between individuals below.

From a firm perspective, a model trade process for asset tokenisation can appear as follows:

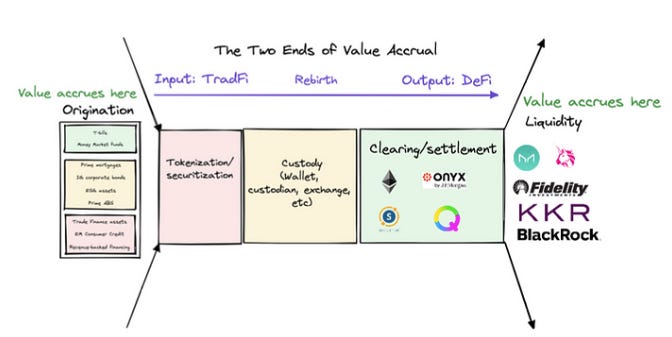

Here, a security (such as a private equity fund or money market fund) is tokenised, kept in custody via specialist digital wallets, a third-party custodian, or on an exchange, before blockchain networks execute and facilitates the transfer and settlement of the assets for the institution when necessary.

According to data from BCG, asset tokenisation has the potential to evolve into a $16.1 trillion industry by 2030, up from $310 billion in 2022.

Generally speaking, the asset tokenisation industry finds itself at a nascent stage in terms of development. Technology architectures and regulatory landscapes are continually evolving, however the existence of industry-wide frameworks in both regards are lacking.

With regard to regulation, the landscape is currently muddled. For example, in the US, the definitions of digital assets have been interpreted differently among different regulatory bodies such as the SEC and CFTC, thus reducing clarity and confidence toward this new asset class. As it stands, digital asset exchanges that offer security tokens must register with the SEC and comply with both the Securities Act and the Exchange Act, or obtain an exemption, although confusion undoubtedly remains.

In contrast, the EU has more of a defined regulatory framework for tokenisation. Under the terms of the new Markets in Crypto-Assets regulations, which are set to be implemented next year, securities (including tokenised security assets) are excluded from the framework, and instead are subject to existing MiFiD regulations.

In terms of the asset tokenisation trend as a whole, question marks still remain with regard to its interoperability, and how a cohesive tokenised asset trading environment could be achieved given technological and regulatory constraints and uncertainties across different jurisdictions. Additionally, the premise of fractionalising assets may only serve to alienate some financial institutions, because full control of their assets may be lost. The process of ‘tokenising’ a security can also be lengthy, taking roughly 3-6 months.

Nevertheless, the surging institutional interest towards tokenised assets suggests that something could be in the water. However, if those ripples are to turn to waves, a unified and interoperable tokenised asset environment is a must, which will only be possible through clear, established regulatory and technological frameworks.