Institutional Demand Driving Crypto to New Heights

What could this mean for capital markets firms?

GreySpark analyst Elliott Playle looks at the key talking points in the crypto market at the moment, including why institutional demand for crypto assets is surging.

When the price of Bitcoin starts to hit the front pages of national news broadcasters, it can typically mean two things. One, the furore and excitement around Bitcoin is at an all-time high. And two, it might be time to take some profit on your Bitcoin holdings if you have been holding throughout the bear market. Given that the price of Bitcoin tanked roughly 15% after this high was eclipsed, it seems like investors did exactly that.

Nevertheless, Bitcoin surpassing its all-time high shows that much of the sentiment we saw back in 2021 has returned, and then some. What started as an unknown, peer-to-peer payment system between private individuals, in a supposed ‘screw-you’ to the centralised nature of banks, has expanded and integrated into the global financial system, with most of the world’s systemically important financial institutions now having dipped their toes in the crypto space, as the table below shows.

During the last crypto cycle, any movement by large financial institutions (FIs) into the crypto space would be met with a degree of surprise and caution. This article published by the Bank of England in 2021 is a prime example, citing the application of cryptocurrencies as a ‘financial stability concern’ following increased news flow. It is no longer out of the ordinary to see a bank move into the crypto space and offer services such as custody or trading.

Putting our capital markets hat on, current data shows that the record-high price of Bitcoin is, to a large extent, being driven by institutional demand.

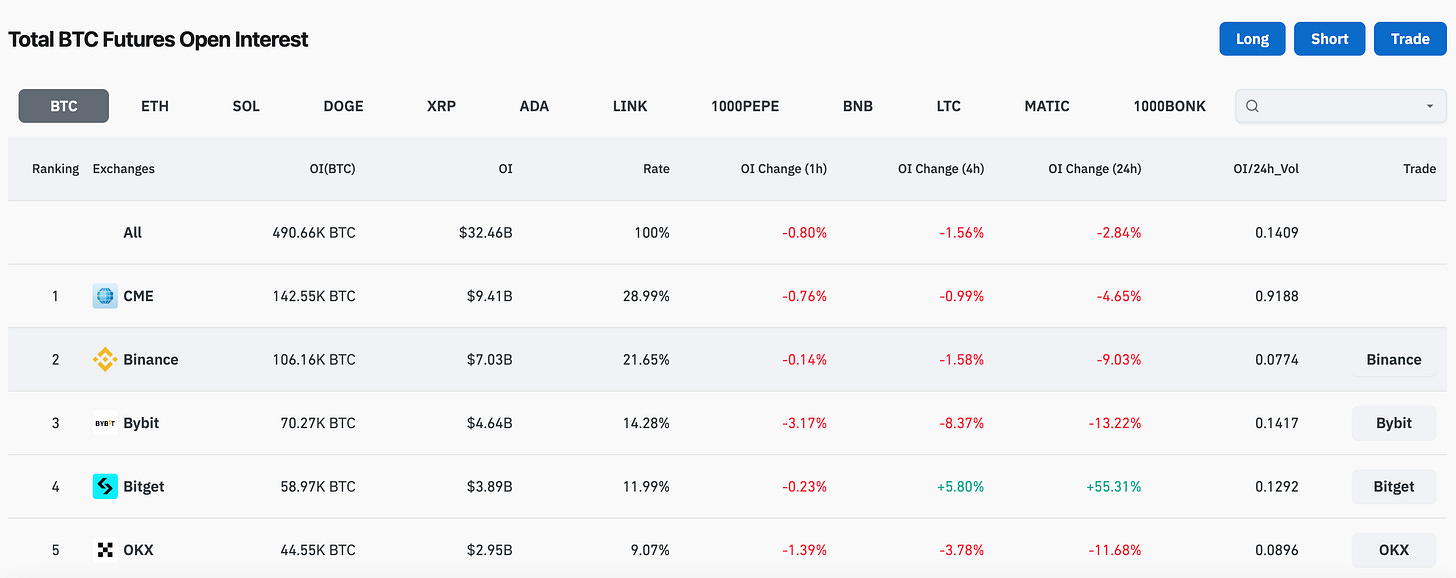

Data from the Chicago Mercantile Exchange, the world’s largest derivatives marketplace and predominantly used by financial institutions to make trades, shows it is is leading the way for Bitcoin futures open interest (the total number of outstanding Bitcoin futures or options contracts in the market). It is a measure of the amount of money invested in Bitcoin derivatives at any given time, but more importantly, gives an indication as to the current sentiment toward Bitcoin.

The CME currently accounts for roughly 29% of Bitcoin open interest, which underlines the strong institutional interest toward Bitcoin. This time three years ago, that figure was only 19%. This in itself suggests a healthy growth in institutional demand for Bitcoin.

The move by the Securities and Exchange Commission (SEC) to approve 11 spot Bitcoin Exchange-Traded Funds (ETFs) in the US earlier this year has fuelled this upsurge in institutional interest, with asset managers including BlackRock and Fidelity finally given the infrastructure rails and regulatory safety net to indulge in crypto. In fact, 28 February 2024 saw a record day of inflows into the US spot Bitcoin ETFs, amassing $673 million of net inflows in total. Other factors such as the Bitcoin halving, which cuts the rate at which new Bitcoin is released into circulation by half, is constricting supply and ramping up demand. The halving is estimated to take place next month.

However, there is an even bigger development at the intersection of the crypto and traditional finance worlds, that could have even larger ramifications for the capital market space than the US spot Bitcoin ETF approval.

On 5 March 2024, Deutsche Börse Group, one of the world’s largest exchange organisations, announced the launch of a regulated spot trading platform, called Deutsche Börse Digital Exchange (DBDX), targeted at institutional clients. As well as crypto trading, the platform provides a secure ecosystem for settlement and custody of crypto assets. Interestingly, trading on the DBDX will take place on a Request for Quote (RFQ) basis, followed by multilateral trading, drawing parallels to traditional finance systems. As GreySpark highlighted in its 21 September 2023 post, cash FX and crypto trading bear some similarities, especially with the use of smart order routing, prime brokerage, and now RFQ. Familiarity in operational models could go a long way in increasing confidence toward crypto as an asset class.

The significance of this move from Deutsche Börse cannot be downplayed. The move from asset managers to provide spot Bitcoin ETFs to its institutional clients is one thing. A move from a specialist global exchange operator like Deutsche Börse to provide spot Bitcoin trading to its institutional clients is another. Currently, more than 25 exchanges and marketplaces use Deutsche Börse’s technology and outsource IT operations with them.

I envisage a domino effect of crypto spot trading provision by Deutsche Börse’s exchange partners, which could culminate in many other major centralised security exchanges offering crypto services in some way. In addition, the provision of a spot crypto trading platform for institutional clients by a multinational such as Deutsche Börse will make crypto accessibility easier than ever before to FIs, who could enjoy using a reliable, one-stop shop for crypto trading and assets that is not concealed by the mystery of stand-alone or decentralised crypto exchanges and networks.

Institutional trust and confidence toward crypto assets is at an all time high, much like Bitcoin’s price. A fad this is not: financial firms will have to stay relevant to the crypto trend if they are to remain aligned to the wider capital markets industry in future.