Institutional Crypto Trading Volumes on the Rise

Why the institutionalisation of crypto is growing

When Bitcoin was created by the pseudonymous Satoshi Nakamoto in January 2009, and the first Bitcoin exchange opened in 2010, the trading of Bitcoin, and its many imitators, lay entirely in the hands of retail investors.

Created with the purpose of escaping the centralisation and control of financial intermediaries, one of the main developments in capital markets in 2024 has ironically been the growing institutionalisation and maturation of the crypto industry.

In particular, the approval and subsequent launch of 11 spot Bitcoin Exchange-Traded Funds (ETFs) in the US in January 2024 opened the floodgates to wider investor inflows, by enabling easy access to crypto via regulated securities exchanges without having to go through the complexities of obtaining crypto from specialist and somewhat inconspicuous crypto exchanges. To date, net inflows across the 11 ETFs have totalled $53.56 billion, representing approximately 4.4 per cent of Bitcoin’s market capitalisation. More than that, though, the ETF approvals arguably marked the formal recognition and acceptance of the viability of cryptocurrency as an asset class.

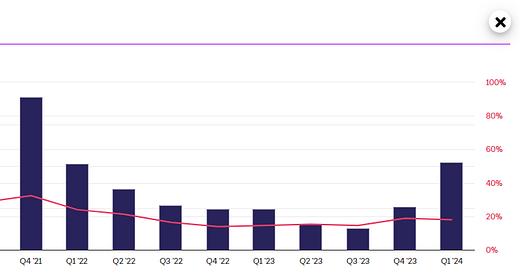

The increasing institutionalisation of the cryptoasset market can be seen in the graphic below.

As you can see, on Coinbase, one of the world’s largest cryptoasset exchanges, retail cryptoasset trading volumes, as a percentage of total volumes, have fallen significantly, at the expense of growing institutional trading volumes. Between Q1 2018 and Q1 2024, retail market share has fallen from roughly 80 per cent to 18 per cent, with the value of the total in those two periods rising from $56 billion to $312 billion.

There are several reasons for the growing institutionalisation of the crypto market, including:

Client Demand: Exuberance from investors and the perceived opportunities for quick returns on capital, among much else, has led to a rise in client demand for cryptoassets. A 2023 survey from KPMG found that 80 per cent of financial services respondents cited rising client demand as a major factor in their expansion of cryptoasset services. On top of this, the number of crypto investors, globally, has increased from 1 million in 2013 to more than 300 million users today;

Macroeconomic Factors: The crypto bull run of 2021 was underpinned by a significant risk-on sentiment, where low policy interest rates in the COVID era encouraged investors to seek riskier, higher-yielding assets such as equities and cryptoassets rather than fixed income products. Cryptoassets have also been touted for their ability to store value and hedge against inflationary and geopolitical pressures, although these claims are yet to be fully proven;

Education and Awareness: Cryptoassets have gained a bad reputation among some market participants, due to their inherent risk, volatility, and decentralisation. Anonymity, a lack of standardised regulatory control and insufficient investor safeguards (i.e., recourse if a user’s cryptoassets get hacked or go missing when transferred between different blockchains) have understandably led to low levels of trust and confidence toward crypto at an institutional level. However, growing investor interest has helped to drive increased education and awareness about cryptoassets and their key use cases at an institutional level, as they seek to meet the changing demands of their customers and stay relevant to this growing trend.

Regulatory Progression: Globally, crypto regulatory frameworks have typically struggled to classify cryptoassets, leading to a vacuum of uncertainty, ambiguity and games of wait-and-see among national regulators. However, the European Union has bucked this trend and is spearheading the crypto regulatory landscape with the enforcement of the landmark Markets-in-crypto-assets Regulation (MiCA) in June 2023, becoming the first comprehensive regulatory regime tailored specifically to cryptoassets trading. The framework will support market integrity and financial stability by regulating the provision and manipulation of cryptoassets and extending KYC and AML coverage to cryptoassets. This has helped to instil institutional confidence towards cryptoassets.

Infrastructural Development: Institutional market infrastructure is maturing, with infrastructures and products typically seen in the fiat-based securities world being replicated in the cryptoasset realm. On top of the aforementioned spot Bitcoin ETFs, Bitcoin and Ether now have regulated futures products on the Chicago Mercantile Exchange (CME). Specialist institutional OTC market places, exchanges, clearing houses, custodians and platforms are now prominent. Leading centralised exchanges Binance and Coinbase have developed their own proprietary institutional trading platforms, combining and sourcing liquidity from their own retail-heavy centralised exchanges amid market fragmentation. Another is Falcon X, which allows institutions to execute $1 billion + Bitcoin orders with low slippage and execution cost.

However, although institutional interest toward cryptoasset has grown notably this decade, the industry still finds itself in the early stages of a long maturation journey, where although they are developing, current regulatory frameworks and infrastructures are still not conducive to widespread institutional cryptoasset adoption.

As this maturation progresses, we will continue to report on the latest trends, so subscribe below to receive our regular updates.