In 2017, the full implementation of the EU’s MiFID II regime gave buyside and sellside firms of all ilk access to regulatory post-trade data gathered by trade repositories and regulated trading venues. Many took the opportunity to glean new insight into the historically opaque fixed income market by combining this publicly available data with their own proprietary sources of trade data. However, some firms lacked the significant resources required to do so productively. Indeed, many struggled to extract anything very useful from this complex and voluminous data. In this article, GreySpark and Propellant discuss some of the specific issues faced by asset managers that a high quality source of fixed income data could address.

MiFID data is not immediately complete and timely – or even necessarily accurate, partly as a consequence of the deferrals regime, but also because cleansing, normalising and checking the data takes time and expertise. Enriching and transforming it into a useful, useable data set that can be queried, ingested and analysed requires significant resource and this is something that not all organisations are in a position to fund. In November 2022, ESMA itself was forced to temporarily suspend the publication of the results of its quarterly assessment of bond liquidity and the systematic internaliser regime for bonds due to “data quality issues”, which hints at potential unreliability of the raw data coming from the repositories and regulated venues.

The continued lack of any post-trade consolidated tape for fixed income markets in the EU hampers transparency. Even so, it is not clear to what extent the EU consolidated tape for fixed income will address the data issues. In the US, Finra’s Trade Reporting and Compliance Engine (TRACE) has been in place (in a few iterations) since 2006, but some US asset managers have intimated to GreySpark that it still does not cover all their needs and wants – and it seems likely that the EU solution will have similar limitations. This suggests that there will be as much of a need for additional fixed income data technology solutions for the buy side when the EU consolidated tape comes into play, as in the interim period.

Uses of Fixed Income Data

In preparation for this article, GreySpark spoke to a number of asset managers about the specific problems they faced around the availability, quality and useability of fixed income data and its use cases.

Pre-trade Analysis

The use case that may immediately spring to mind is pre-trade analysis, where traders and portfolio managers use historic data to inform their decisions on how and what they trade in order to achieve their portfolio aims and to ensure best execution for their clients.

This can involve the analysis of historic trades in specific instruments across a whole raft of parameters: the market as a whole; average daily volumes and absolute volumes traded; prices; market sentiment and data on where trades were made; as well as whether they were made electronically or via ‘voice’.

Fragmented availability of data can make even simple data points, such as prices, non-trivial to obtain and analyse, and others, such as volumes, very difficult. Even when all the data is available in a timely manner, being able to extrapolate these metrics could require significant analytical effort.

Several asset managers told GreySpark that obtaining volume data for their fixed income businesses was challenging and that, ultimately, they would hope to have a data solution that could be integrated with their order management systems, so that the data required –and only that data – would be available at their fingertips when making trading decisions.

Portfolio Risk

Portfolio liquidity is a critical measure for risk management, and the traded volume is an essential variable in its calculation. As this data is very difficult to calculate for fixed income securities, accurately discerning the potential speed and cost of liquidation of a portfolio containing fixed income assets can be difficult, if not impossible, in some circumstances.

Of course, it may be possible to make an estimate, given data from, say, a single exchange or platform but, without complete market data, this estimate may not be accurate.

GreySpark spoke to one European asset manager who stated that, prior to using the technology solution enabling analysis of the data provided by Propellant, the firm did not have access to accurate volume data, which meant that establishing portfolio risk profiles relied on estimates.

Post-trade Analysis

There is a clear need for market data to aid many post-trade analysis activities, particularly the generation of management information and benchmarking and strategy data.

Historically, it has not been easy for buy-side management to understand their own fixed income trading activity in the context of total market volumes, due to the opacity of the market and lack of available market data. This means that it has not always been possible for them to develop a good picture of their market share – both of particular securities and as a whole – and, thus, to get a feel for how much influence they might wield with sell-side organisations. This historic – and, to a large extent, continuing - lack of intel on their own performance means that it is hard for them to keep track of how aligned they are with market trends in, say, voice versus electronic trading.

Post-trade market analysis can also be valuable for supervision purposes. For instance, it can be used to track the performance of portfolio managers, traders and portfolios against the wider market. This is difficult to do without complete and timely data.

One trader at an asset manager told GreySpark that as well as the availability of certain consolidated data, finding the resources needed to analyse and ‘sift through’ the data to find pertinent items or data sets could be a challenge. Being able to draw relevant post-trade metrics and calculations directly into their existing systems, negating the need for risky manual intervention, remains one of their main ambitions.

Other Use Cases

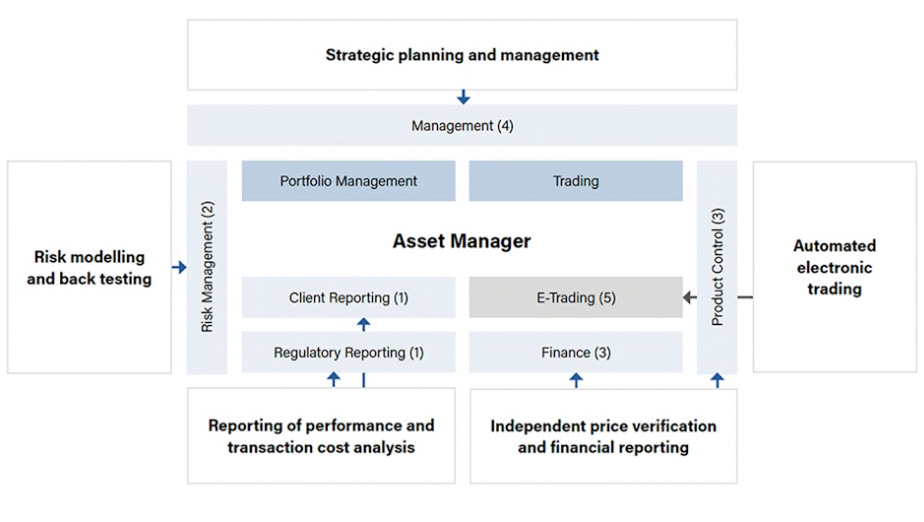

There are many other use cases for fixed income data and derived data in buy-side organisations, spanning functions and departments – it is not limited to trading and portfolio management teams.

To analyse and report to clients on an asset manager’s performance against the market, comprehensive market information is required and despite the current de-prioritisation of the MiFID II RTS 28 reporting requirement, some degree of reporting on transaction costs and best execution is also still undertaken by most organisations.

Historic trade data is extremely valuable to risk teams when undertaking various types of risk modelling – scenario analysis, stress testing, back-testing, what-if scenarios and similar.

Product control and finance teams utilise current and historic trade and price data for valuation control and independent price verification, which is critical to accurate financial reporting.

Strategic planning and management are greatly enhanced with reliable consistent data. If, for example, an asset manager is looking to expand into a new market, they need to be able to see volumes and liquidity in order to ascertain how quickly their money can be ‘put to work’.

Perhaps the biggest area of potential were timely, reliable fixed income data to be available is automated electronic trading. Without the data, this is not possible, even in simple scenarios. All of the asset managers to whom GreySpark spoke cited this as the ultimate goal, albeit one which, right now, still may be out of reach.

Potential Solutions Using Cleansed MiFID Data

In the absence of a consolidated tape in Europe, there is currently only a small number of providers offering this kind of complete solution to analyse fixed income data. While MiFID data is technically available, it is so difficult to utilise that only a few buy-side organisations are currently able to do so to any great extent.

As such, an offering which collects, checks, enriches, normalises and stores the complete data set for use and analysis would be extremely useful for all of the use cases discussed above. A solution that enables users to easily locate and analyse the data and draw out insights via API is clearly becoming ever more desirable as firms, in anticipation of the consolidated tape, see ever more use cases for the data.

Propellant Digital is an award-winning technology company specialising in Fixed Income data analytics. Its founders are trusted specialists in transparency and trading data, passionate about making bond, swap, and ETF markets more transparent.

Financial institutions face challenges in extracting value from growing volumes of European and US transparency data, and Propellant delivers practical, responsive technology that transforms this data into actionable insights. Propellant Digital helps global and regional banks, asset managers, quant hedge funds, trading venues, regulators, and industry associations to analyse transparency and trading data in near real-time. Its unique analytics cloud platform leverages the most extensive Fixed Income dataset, providing users with the insights they need to improve trading strategies, streamline workflows, and make informed trading decisions.