The S&P 500’s year-to-date (YTD) performance could make you believe that the market is performing well, especially considering the backdrop of tight lending conditions, stubborn inflation, and slowing economic growth. With the S&P 500 climbing more than 12% this year, it seems on the surface that the index is having a solid year.

However, there are concerns that perhaps the world’s largest index (by market capitalisation) is not as healthy as it seems, and its current valuation may be a little artificial. Across the market, there are concerns that the S&P 500 index is overvalued and could be in a ‘bubble’, similar to that of the late 90’s and pre-dot-com crash. Despite an overall positive return, the median share price, YTD, is down roughly 1.3% on the same period in the previous year, with more stocks in the index being negative than positive. So – why is the S&P still returning a positive YTD figure?

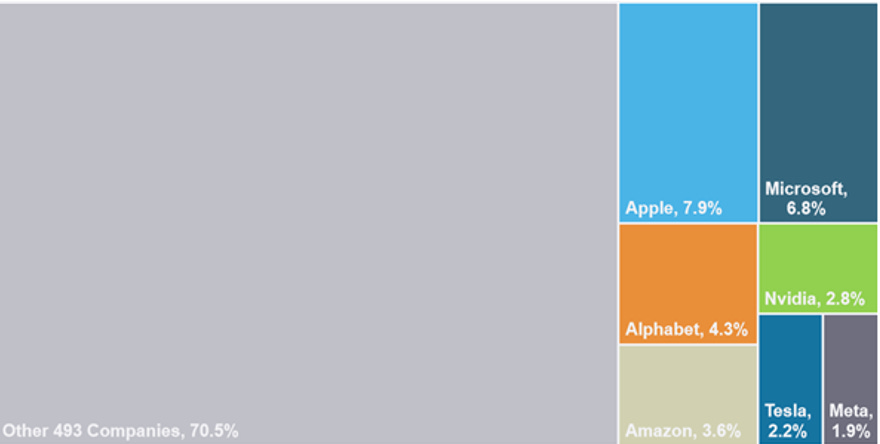

Shares of S&P 500

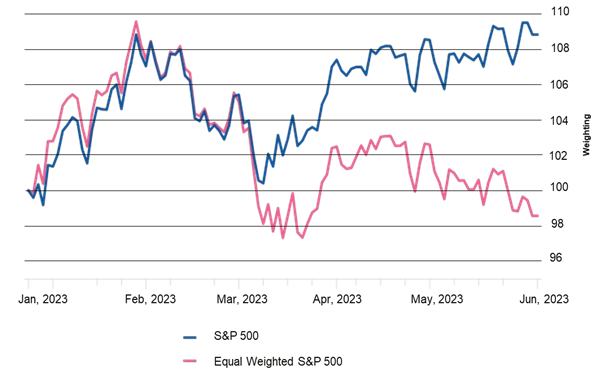

Six technology companies have largely been propping up the S&P 500, driving nearly all recent gains for the index. Alphabet, Nvidia, Amazon, Apple, Meta, and Microsoft - have collectively generated 88% of the index’s $3.8tn gain in market capitalisation up to June 2023. As the S&P 500 benchmark is weighted by market capitalisation, larger companies take up a greater concentration of the index. As illustrated above, we can see that the S&P 500’s largest five companies represent over 25% of the index’s value – with Apple, Microsoft and Alphabet’s net income totalling about 14% of aggregated profit earned by the entire S&P 500 over the period. If you were to remove the top six technology shares' contribution, the S&P has lost roughly $280 billion in market capitalisation up to June 2023. This considerable difference in performance can be visualised when comparing the regular benchmark index against the S&P equal weighted.

S&P Benchmark versus Equal Weighted Index

Source: Bloomberg Intelligence

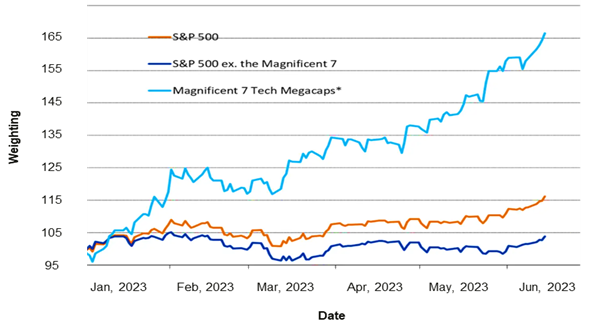

The unprecedented growth in these technology stocks can be attributed to the excitement over ‘generative AI’ in which all six aforementioned firms are heavily invested in. Many anticipate that AI will be the key disruptor in many industries, particularly as its commercial application and use increase. Business leaders within financial services are exploring how AI can transform existing business models, activities and operations.

Generative AI is poised to be a $1.3 trillion market by 2032

Source: Bloomberg Intelligence

Bloomberg Intelligence recently estimated that the generative AI market will expand at a compound annual growth rate of 42%, predicting generative AI to be a $1.3tn market by 2032 as outlined above.

Change due to AI is already noticeable in financial firms, no more so than the widespread growth of algorithmic and automated trading. Electronic Trading has completely altered the way traders carry out their daily activities. This shift from traditional trading floor voice businesses to those reliant on E-trading systems and algorithms is evident, with 85% of the total notional traded on the global equities market coming via electronic trading, and around 25% of global volumes are trading decisions that are fully automated based on defined strategies and models in 2022. This trend will likely continue through 2023 and beyond as the demand to move away from manual trading systems and incorporate new, more sophisticated trading workflows.

Financial firms have and are continuing to implement relevant frameworks, policies, and controls to navigate through the transition to AI, which encompasses not only the trading arm of the business but transcends vertically through the lines of defence and the wider business, from back to front office.

As GreySpark observes, in investment bank front offices, there is a surface-level observation that AI-enabled algorithmic trading strategies enhance the ability of cross-asset or multi-asset trading desks to generate alpha for buyside clients, and that the clients’ returns generated from these trading strategies are more robust than the outcomes of traditional trading strategies. The deeper reality, however, is that the value-add of AI-like applications in front-office environments comes through their use in combining patchy pre- and at-trade communications and market data such that a coherent picture is presented to a trader in near real-time of the most relevant data – both structured and unstructured – that can be applied in human-operated investment decision-making processes.

In the middle office, there is a strong use case for AI applications utilising optical character recognition (OCR) for key information extraction from documents, or sophisticated pattern matching algorithms for extracting insights from vast amounts of data. This can go a long way in pushing the operational functions of the front-office and the middle-office closer together, possibly using new forms of centralised ledger systems capable of combining large, siloed data into a simplified user interface.

In the back office, AI can be responsible for marginal improvement gains in the efficiency or streamlining of operational functions in areas such as accounting, AML, records maintenance and settlements, helping to improve client retention. However, the extent to which those use cases can continually drive improvement in the overall client experience remains unknown, with the installation of AI bringing costs and potential cutbacks to human resources.

Nevertheless, as highlighted by the data above, the AI trend is seemingly an unstoppable one, and one that looks set to form a greater part of financial firms’ technology stacks for years to come.