The concept of distributed ledger technology (DLT) is not exactly new but after a brief burst of hype in 2016, it is now integrating further into the capital markets industry. In part, this is fuelled by the rise to prominence of cryptoassets and tokenised securities, which are underpinned by DLT.

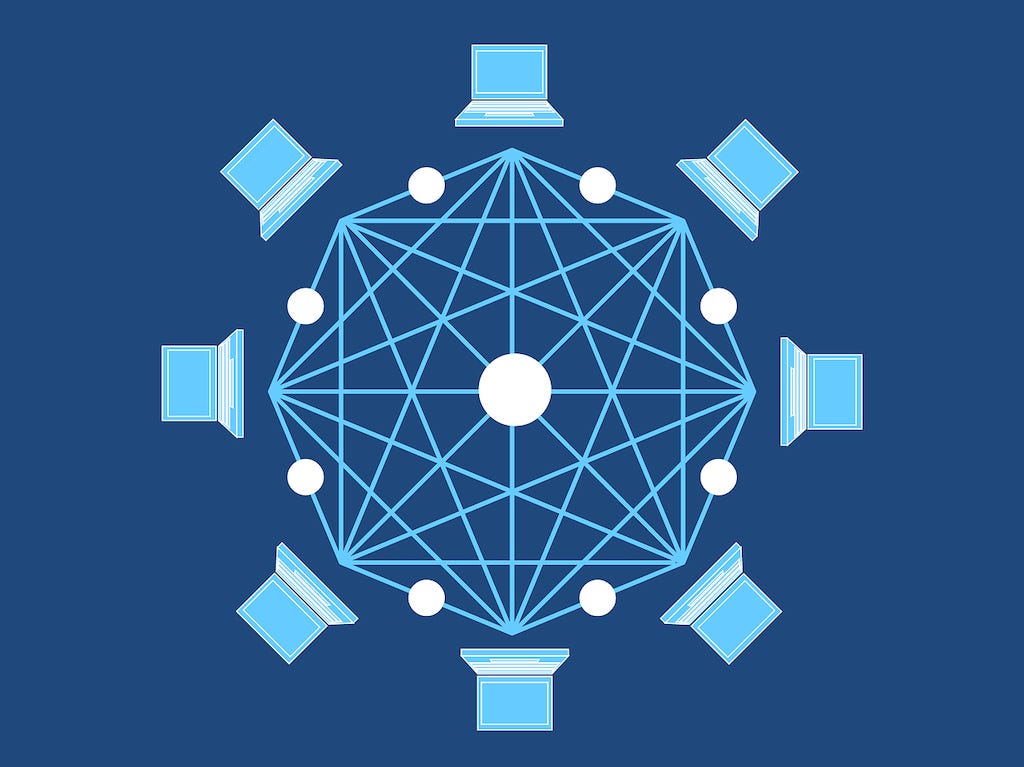

DLT is a digital system for recording the transaction data of assets, in which transaction details are recorded in multiple places at the same time, with control of the system not limited to one centralised location. In a traditional distributed database, a system administrator typically performs the key functions that are necessary to maintain consistencies across multiple copies of the ledger. An example is a supermarket chain, where a common record of transaction activity is shared across different branches situated across different jurisdictions, with a centralised system administrator maintaining the ledger and sharing with all network participants.

In contrast, digital ledgers operate on a peer-to-peer basis, without a trusted, centralised authority. In a DLT set-up, self-executing contractual clauses, known as smart contracts, can be used to confirm transactions when pre-specified criteria in the ledger are met. Designated network operators called nodes (i.e. a computer or router) then update, contribute to and enable a shared and synchronised digital database of transactions or data between themselves, without requiring permission.

The core premise of DLT is to enhance security and efficiency of transaction data. DLT uses cryptographic algorithms to secure data, meaning it is nearly impossible to tamper with or alter data records, improving the trustworthiness of the data records. In addition, DLT minimises the need for human intervention, eliminating the typically time-consuming and error-prone processes needed to reconcile data contributions to the ledger, thereby reducing costs.

There are several other key advantages that come with DLT when it is integrated into a financial institution’s (FI’s) infrastructure:

Transparency: Digital ledgers provide a shared, immutable ledger that records all transactions transparently and verifiably.

Immutable Audit Trails: Every transaction on the digital ledger is recorded and cannot be altered without leaving evidence, providing an accurate and tamper-proof, though editable, audit trail. There is still much work to be done in the area on the development of protocols and standards that will allow effective data interoperability between financial institutions.

Accelerated Settlement Times: Digital ledger technology enables near real-time cross-border transaction processing and settlement, eliminating the need for some intermediaries and reducing the time required for transactions to be completed. FIs such as banks could harness DLT to realise efficiency gains, with DLT unlikely to replace core banking capabilities but complement existing ones.

Streamlined Asset Transfers: Digital ledgers enable secure, seamless transfers of assets between parties, reducing the need for manual processes and improving overall efficiency.

However, the prospect of widespread DLT adoption in the capital markets industry currently presents several challenges. Since DLT platforms are a decentralised structure made up of multiple nodes located in several jurisdictions, there is no central entity in which a legal framework is applicable to it. As a result, the lines have become blurred in terms of how to regulate DLT, with immature local standards or standards specific to certain platforms comprising much of the current DLT regulatory landscape.

One such example is in Malta, which has become a trailblazer for the regulation of DLT, releasing its own regulatory standards in 2018. However, this lack of regulatory clarity could hinder adoption of DLT, and in many ways contribute to the fragmentation and a lack of interoperability in DLT between different jurisdictions if a unified, standardised regulatory framework is not devised. Other challenges include scalability, with DLT technology (and in particular, the smart contracts underpinning them) being more complex to programme and manage than traditional distributed databases. Another is the technicalities and nuances involved when integrating DLT with legacy infrastructures, which could be timely and costly.

Nevertheless, there are signs that interest in DLT is growing, with market participants now being more proactive towards the technology than ever before. For example, according to a recent survey from Broadridge of 500 senior global financial executives, 36 per cent foresee a reduction in the need for intermediaries (such as custodians and clearing houses) due to growing adoption of blockchain and DLT. Interestingly, DLT investment in the capital markets industry is expected to grow by 20 per cent in the next two years, trailing closely behind the artificial intelligence investment increase of 21 per cent.

In addition, this week, the European Central Bank confirmed participants for trials using DLT for central bank currency settlement. Starting on 13 May, 2024, participants including five national central banks, 10 financial institutions and six market DLT providers, will carry out simulated DLT-based payment settlements in a test environment. The use cases will mainly explore the securities settlement cycle, such as delivery-versus-payment, secondary market transactions and lifecycle management of securities. Trials will be conducted using three Eurosystem solutions – respectively developed by Deutsche Bundesbank, Banca d’Italia and Banque de France.

The trial could go a long way in uncovering what an interoperable, and regulatory-complaint DLT payment network could look like and provide the impetus for DLT integration.