Chart of the day

High inflation is continuing to squeeze pockets and is causing debt levels to soar

Bank of America survey - what are the biggest ‘tail risks’ currently in the global economy?

BofA’s monthly survey, which interviewed circa 300 global fund managers, found that the largest area of perceived risk lies in stubbornly high inflation rates. This is causing Central Banks to retain tighter monetary policy, which has a negative impact on borrowers.

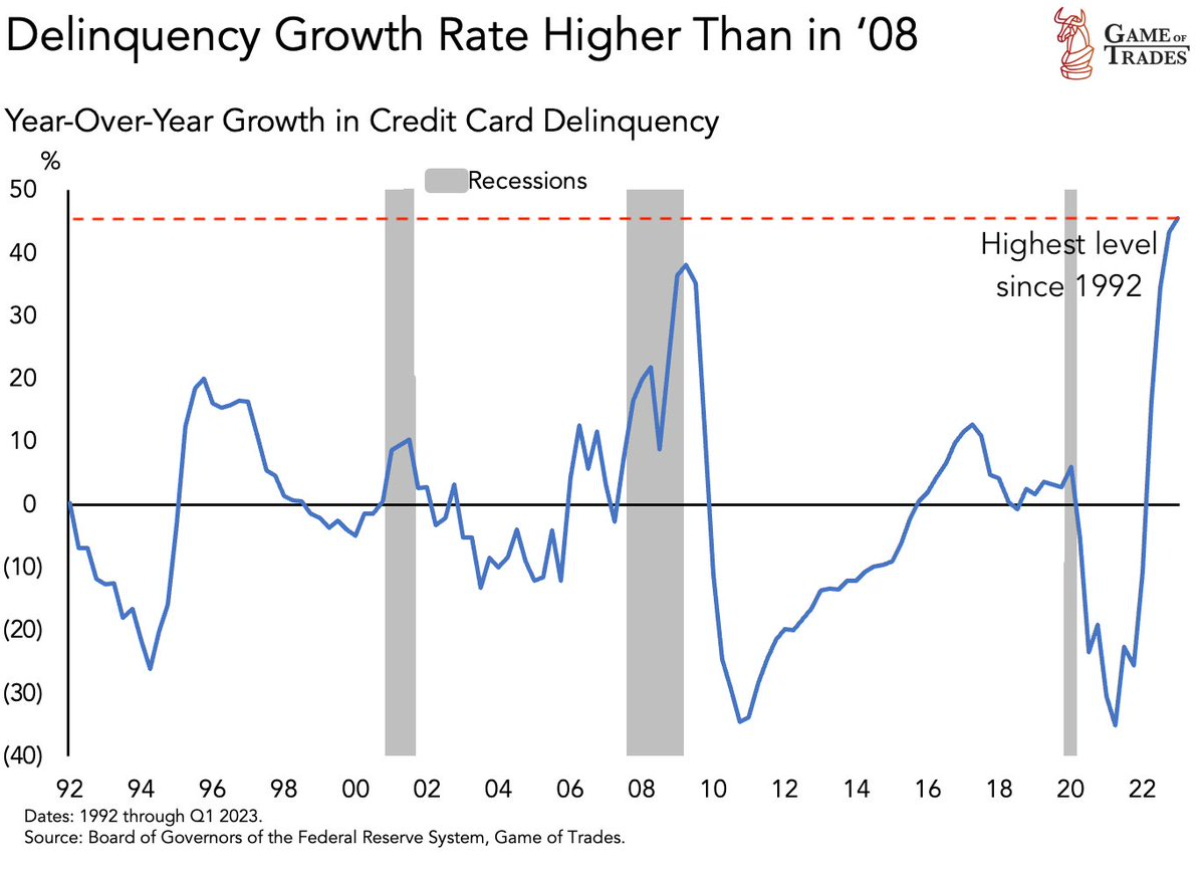

We’re already seeing repercussions of this, with high levels of inflation squeezing the pockets of consumers and contributing to the highest yearly growth rate in credit card default rates since 1992, thereby surpassing the figure from 2008 (the year of the global financial crisis).