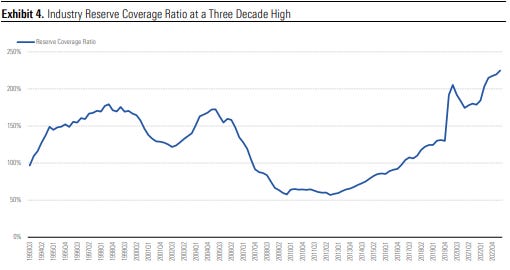

Global banks have increased their reserve coverage ratio to 225%, the highest level in three decades. The reserve coverage ratio measures a company's ability to service its debt and meet its financial obligations, such as interest payments.

Given the soaring coverage ratios among banks, this could signal that banks are preparing for credit deterioration and mounting losses should a recession hit, and from a consultative perspective, may have to forego spending in other areas such as technology implementation as a result. The high coverage ratios could also show that banks may have one eye on the tighter capital reserve requirements that are set to come into force by 2028.