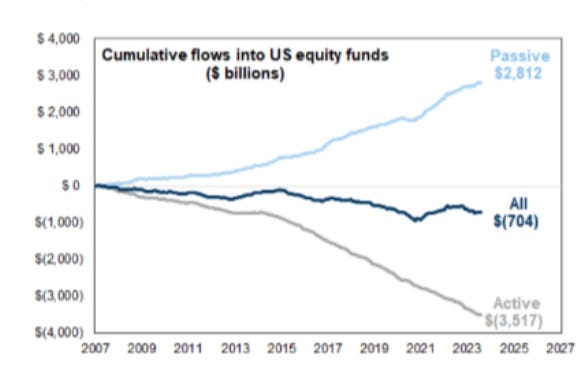

The secular shift from active fund management to passive fund management continues.

Of course, active management seeks to outperform a specific benchmark or index, whereas passive management replicates a specific benchmark or index. As such, active management generally takes on greater risks and incurs larger fees.

Given, then, the current fragile state of the global economy, with lingering inflation and a difficult business environment, a more risk-averse approach from fund managers is hardly surprising.