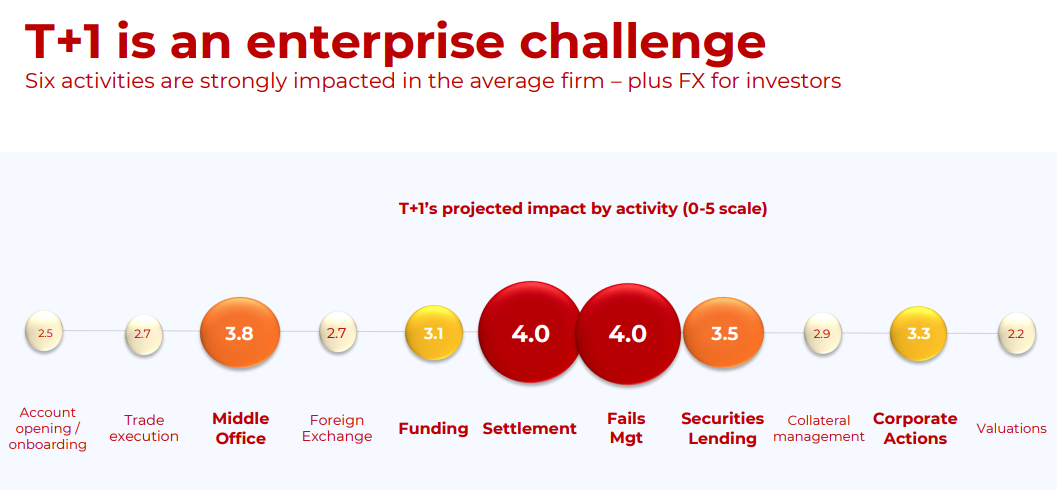

The implementation of T+1 trade settlement in the US is fast approaching, becoming effective on May 28 2024. However, there is a common misconception that changes to the trade settlement cycle will only impact post-trade settlement divisions in financial firms. However, as DTCC points out, the impact will stretch far beyond post-trade settlement divisions.

A survey from DTCC, which collected data from 287 global financial firms found that T+1 settlement in the US will strongly impact all areas of the business concerned, including the middle office, funding, foreign exchange, and trade fails management. As the diagram above highlights, fails management activity will be impacted by the same magnitude as trade settlement activity.

We’ll have more information on the impact of T+1 on financial firms very soon. Stay tuned.