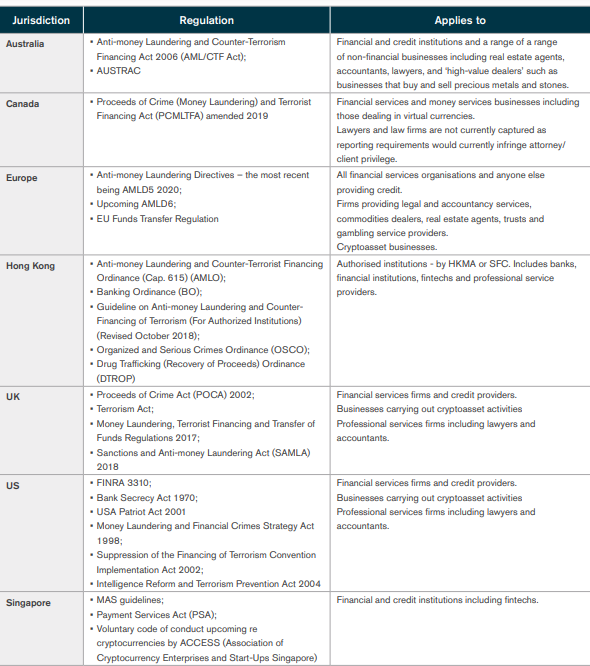

Overview of the key, global anti-money laundering (AML)/counter-terrorism financing regulations by jurisdiction

Source: GreySpark analysis

For Corporate Investment Banks (CIBs) and non-bank brokerage firms, violation of local and regional AML and counter-terrorism financing laws can lead to heavy fines, and in some cases, criminal prosecution of specific individuals or the institution.

As such, the Financial Action Task Force (FATF) - which is an intergovernmental organisation established to combat money laundering and the financing of terrorism in 39 member countries -present the de facto standards of financial crime prevention that most sellsides adhere to.

The standards include:

A Risk-based Approach – Putting mechanisms in place to monitor or mitigate AML;

Sanctions – Maintain the ability to implement institutional-level sanctions on entities that pose terrorism financing risks;

Client Due Diligence – The ability of an institution to put measures in place to prevent anonymous account opening;

Politically Exposed Persons (PEPs) – The ability of an institution to implement measures to deal with the risks that they can present;

Virtual Assets – The ability of an institution to extend its compliance with AML or counter-terrorism financing regulation to include crypto assets;

Wire Transfers – The ability of an institution to create an audit trail of domestic / cross-border wire transfer activity;

High Risk Countries – The ability of an institution to implement enhanced due diligence on all business activities originating within specific countries; and

Suspicious Transactions – The presence within a CIB of a so-called financial intelligence team to which all flagged transactions can be reported for further, internal investigation.