Hello everyone and welcome to the latest edition of GreySpark Insights.

Please do not hesitate to contact us with any questions or comments you may have. We are always happy to elaborate on the wider implications of these headlines from our unique capital markets consultative perspective. Happy reading!

One of the global financial system’s most valuable and important markets appears to be heading into a new structural era.

The repo market, in which up to $4 trillion in security-backed, repurchase agreements are traded globally every day, is seemingly shifting away from manual trading to e-manual trading. In other words, it’s less time for repo traders on the phone, and more time on the computer.

After seemingly being left behind in terms of regulatory transformation in the aftermath of the 2008 financial crisis, this gap was finally plugged with the ‘go-live’ of the EU’s Securities Financing Transactions Regulation (SFTR). The SFTR set new standards for corporate and investment banks and their repo trading clients or counterparties (namely asset managers, hedge funds and institutional investors) through its creation of new robust standards for post-trade transparency.

These new standards helped fuel the adoption of more automated workflows with upgrades to legacy technology stacks largely characterised by the introduction of application programme interfaces (APIs) and straight-through processing from the back office to front office. In the process, although still prevalent, the presence of voice-traded solutions that have historically dominated the repo trading landscape may be declining.

Voice trading, historically, tended to lead to a manual, imprecise and often disjointed process for all market participants, with little automation. Subsequently, the SFTR regulations have sought to provide new incentives for automation and e-trading to help increase market efficiency. These incentives include high reporting volumes, leaving little choice but to implement some automated practices in order to stay compliant.

As such, e-trading infrastructure has become more prevalent among repo markets. Admittedly, venues on which to trade repos electronically are nothing new; electronic dealer-to-dealer (D2D) repo trading infrastructure became commonplace from 2010. However, the prevalence of repo e-trading accelerated significantly beginning in 2018, when almost 30% of European repo trading took place on automated trading systems, which represented a steady increase over the preceding years. By 2021, ICMA estimated that repo e-trading accounted for as much as 53% to 58% of average daily volumes. This increase in activity is evident in the number of e-trading venues, with around 13 repo e-trading venues currently in operation. You can view these in GreySpark’s special report here.

From a systems and technology perspective, GreySpark observes that repo trading platforms aren’t so advanced (yet), with the majority focused on overnight general collateral (GC) trading. Brokerages that facilitate D2D trading for overnight repo trading are largely electronified, and so Tier I and Tier II-plus institutions typically use screens provided by specialist platforms (i.e. Tradeweb and MTS) to facilitate quote-driven activity. For larger institutions in particular, accessing brokerage graphical user interfaces (GUIs) is made possible through an in-house built or vendor-provided interface shared by the repo trading desk, whereas common access to these platforms among smaller regional CIB institutions is still lacking.

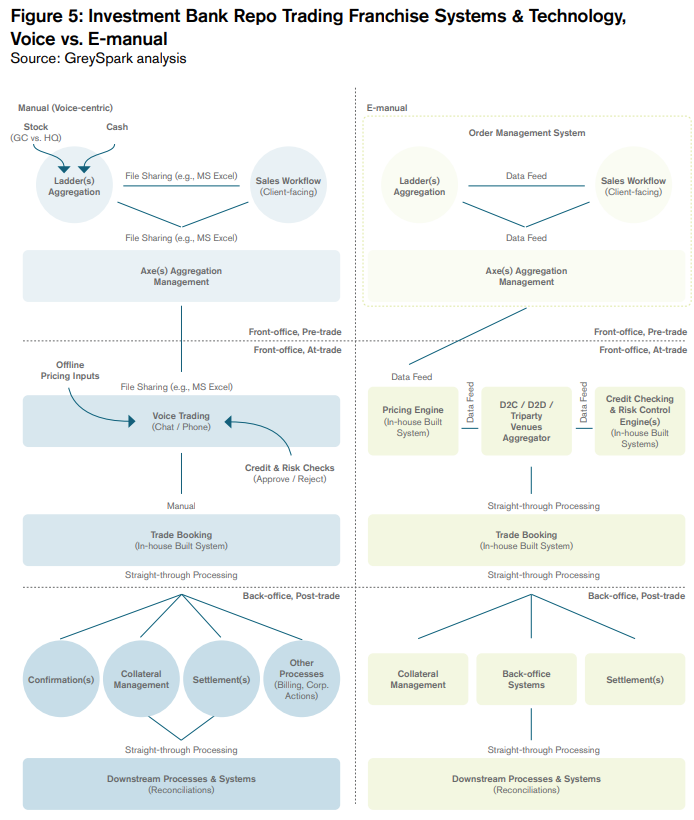

For good measure, it’s worth taking a look at the differences in the voice-trading and e-manual trading of repos.

Source: GreySpark analysis

In the voice trading setup, the trading process is largely manual and relationship-centric, although it does involve electronic communication via the use of telephones. In GreySpark’s model, this process is moved onto e-manual trading dealer-to-client (D2C) or D2D brokerage venues. This change may be as simple as utilising several trading venues via a GUI, or it may involve a system that can aggregate them into a single interface.

In the e-trading setup, an order management system replaces the previous manual information sharing between sales, trading, clients and the inventory management process. This may be as simple as a chat-based system that allows sales to communicate with clients and trading without too much dual keying, or as comprehensive as a platform that can, for example, collate client orders and inventory management and allow for negotiation between sales, traders and clients.

It is often the case that both voice and e-manual trading take place across most international and regional CIBs simultaneously.

Although the switch to automated, e-trading of repos can provide several benefits in terms of economies of scale, such as greater trade visibility, reduced order corrections, and reduced probability of fat finger trading, some challenges in transitioning to repo e-trading still remain.

For example, there currently remains a general lack of CIB and client or counterparty appetite to evolve away from a predominantly relationship-centric environment. Additionally, managing trade data that is specific to certain CIBs and counterparties across several types of non-standardised repos poses a new kind of headache for market participants. Also, the degree of automation in repo-trading is significantly lower than in other asset classes such as FX, where exchange-to-exchange-like market structures dominate, and trading businesses capable of consuming all available institution-internal and market external pricing and other directional information.

On the surface, a transition to a more electronified repo market makes sense, given the age of digitisation brought about by trends such as AI and more nuanced regulatory standards. However, a complete shift to e-trading may not actually be in the interests of a market participant due to the flaws outlined above. As a reminder, GreySpark goes into greater detail on the topic of repo trading workflows here.